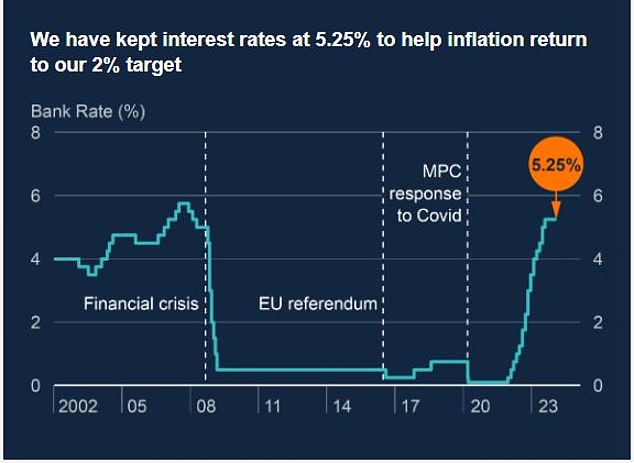

The Bank of England held base rate at 5.25 per cent on Thursday as hawkish sentiment derailed hopes of a cut in March.

Its Monetary Policy Committee voted to keep base rate on hold by a margin of six-to-three with two members voting for another 25 basis point hike to 5.5 per cent, as recent data failed to quell concerns about wage growth and services inflation.

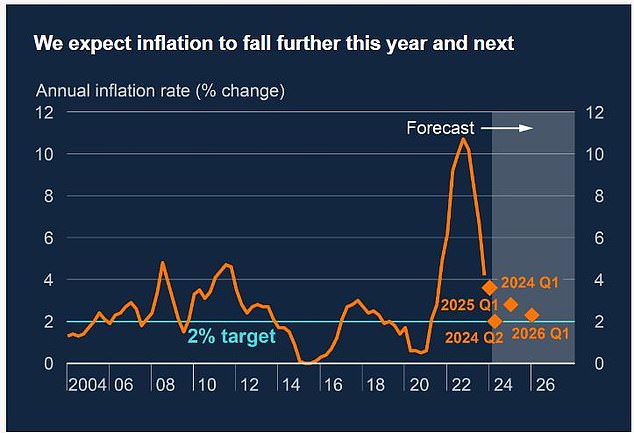

The BoE still thinks consumer price inflation will ‘temporarily’ fall back to 2 per cent by April, as the impact of previous hikes take effect.

But CPI, which fell to 4 per cent in December, is forecast to rise back to 2.75 per cent by year-end and remain above the bank’s target of 2 per cent until 2027.

MPC votes 6-3 for another pause with two members voting for a 25bps hike

‘This reflects the persistence of domestic inflationary pressures, despite an increasing degree of slack in the economy,’ the bank said.

Governor Andrew Bailey added the BoE needs to see ‘more evidence that inflation will fall further and stay low’ before the bank can ‘declare victory’ and begin cutting rates.

The bank has repeatedly warned that investors expecting an imminent base rate cut were being overly ambitious, and the hawkish tone from MPC forced a rethink on market pricing.

BoE holds base rate at 5.25%

Markets had been expecting as much as 125bps of cuts by year-end, which would have taken base rate to 4 per cent.

Following the MPC meeting, however, pricing suggested closer to 100bps of cuts – leaving base rate at 4.25 per cent in by the end of 2024.

However, Bailey left room for optimism, telling reporters the MPC was now actively considering when rate cuts should come.

He said: ‘For me, the key question has moved from ‘how restrictive do we need to be?’ to ‘how long do we need to maintain this position for?’.’

Inflation heads back to bank’s target of 2% before ticking higher

Inflation forecast

The BoE thinks CPI will jump from 2 per cent in April to as high as 3.6 per cent by the first quarter of next year.

It doesn’t expect the figure to start the year below target until at least 2027, when it expects CPI of 1.9 per cent.

While both wage inflation and services inflation have fallen significantly from their peak, the BoE is concerned that each measure remains ‘significantly elevated’.

Annual wage growth excluding bonuses hit 7.3 per cent in the third quarter of 2023, down from a record 7.8 per cent in the previous three months.

Services inflation has also been particularly sticky, with prices 6 per cent higher year-on-year in December, unchanged from the previous month.

The BoE will be watching these readings closely when fresh Office for National Statistics data is published this month.

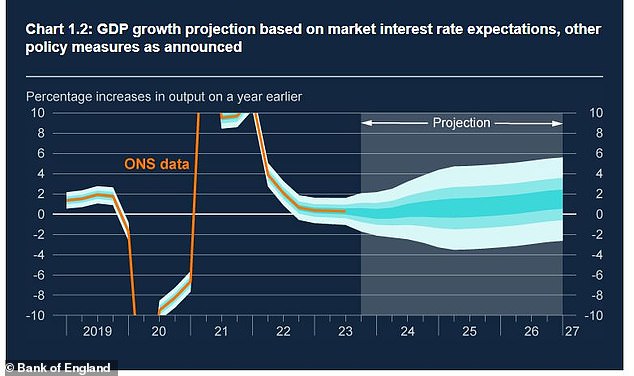

GDP growth is expected to tick gradually higher in the coming three years

It pointed to a survey of firms suggesting that the average pay settlement in 2024 would be for a rise only slightly lower than in 2023, at 5.4 per cent.

According to the minutes form the MPC’s latest meeting: ‘Although services price inflation and wage growth had fallen by somewhat more than had been expected, key indicators of inflation persistence remained elevated.

‘There were questions, on which further evidence would be required, about how entrenched this persistence would be, and therefore about how long the current level of Bank Rate would need to be maintained.’

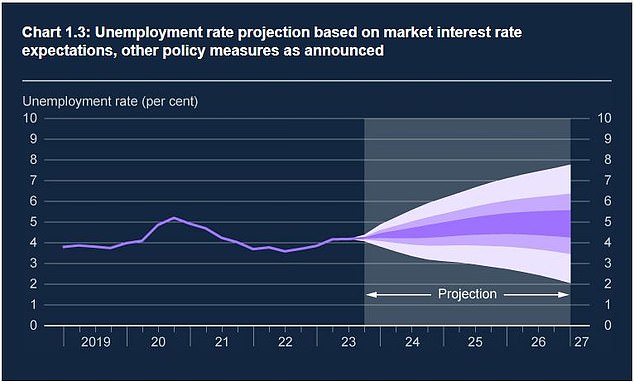

The unemployment rate is also expected to tick higher

Economic growth outlook

While the BoE’s main priority is getting a handle on the CPI rate, the bank will be keeping a close eye on weakness in the British economy as it weighs the timing of its first rate cut.

UK gross domestic product is estimated to have contracted by 0.1 per cent between July and September, according to the most recently available ONS data, revised downward from previous estimates of flat growth.

The UK is not alone is suffering from sluggish growth, with the US economy a rare outlier among comparable markets as the Eurozone continues to tread water.

But, the BoE said: ‘Following recent weakness, GDP growth is expected to pick up gradually during the forecast period, in large part reflecting a waning drag on the rate of growth from past increases in Bank Rate.

‘Business surveys are consistent with an improving outlook for activity in the near term.’

However, GDP is forecast to expand by just 0.2 per cent in 2024, 0.75 per cent in 2025 and 1 per cent in 2026, with lacklustre growth trailing Britain’s global peers.

The unemployment rate is also expected to rise ‘gradually’ from its current level of 4.2 per cent to 4.4 per cent in 2024, and to 4.7 and 4.9 per cent in the following two years.

Forecasts in full

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.