India is the sixth-largest producer of chemicals globally. However, the country ranks 14th in chemical exports, excluding pharmaceuticals, contributing merely 2.5% to global chemical sales.

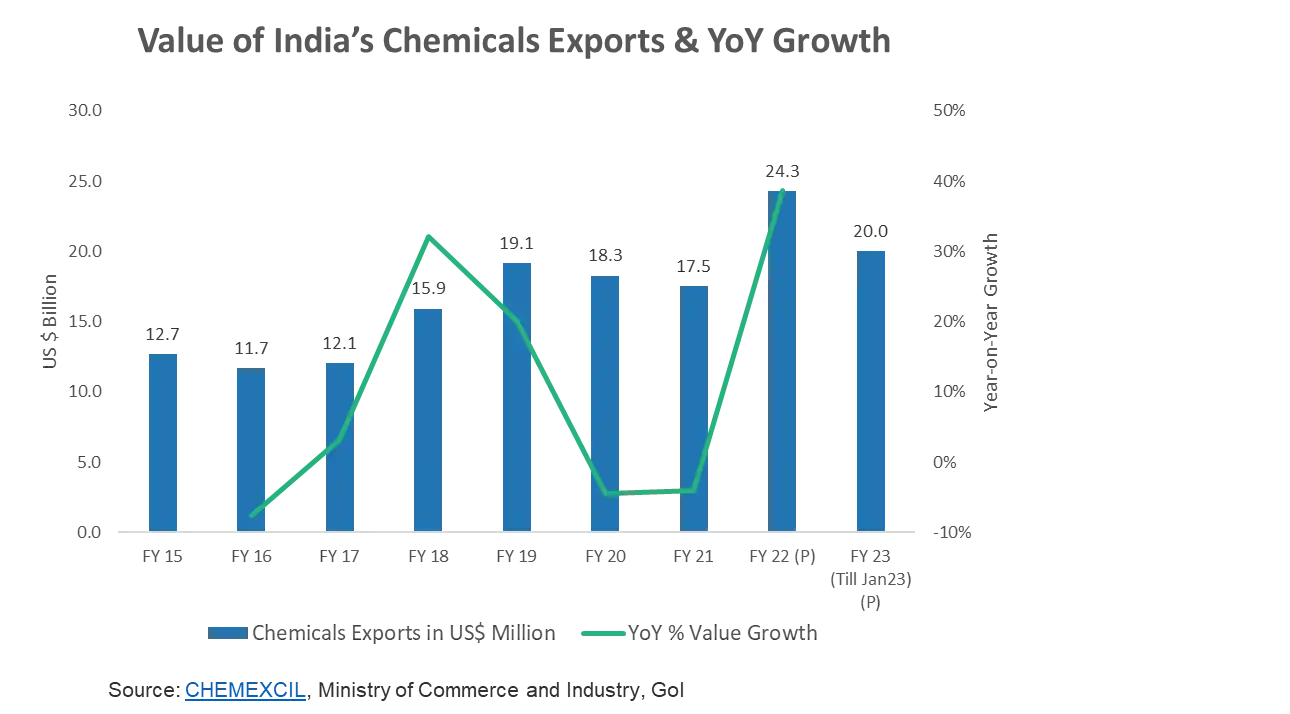

Fortunately, the picture appears to be changing. In FY22, India clocked $24.3Bn in chemical exports, the highest since FY15, and witnessed 39% Y-o-Y growth in value and a 14% Y-o-Y growth in volume.

Drip Capital‘s analysis pegs this rise to several government initiatives and the increased demand for inorganic chemicals, agrochemicals, speciality chemicals like dyes and pigments, lubricants, food flavourings, cosmetic additives, etc.

Even though the current macro situation has limited consumers’ discretionary spending, India’s chemicals market is expected to reach $850-1,000Bn by 2040, comprising a 10-12% share of the global market. This makes it crucial for exporters to stay updated on the latest industry trends and opportunities.

Increasing India’s share in the global specialty chemicals market:

Recent studies suggest the global specialty chemicals market is expected to witness a CAGR of 5.1% from 2023 to 2030, with the Indian exports of specialty chemicals likely to scale 10 times.

The growth may be attributed to the increasing popularity of processed food/beverages and the desire of people to experiment with different flavours. Exporters can bank on this emerging trend to innovate and develop flavouring agents tailormade for their consumers’ preferences and pallets. Additionally, the rising demand for detergents, crop protection chemicals, cleaning agents, and cosmetic chemicals will further open up opportunities for exporters across various industries. While the China +1 sentiment being adopted by countries worldwide will continue to work in favour of India as a hub for chemical investments and manufacturing, exports need to gain momentum.

Diversifying to other regions besides the current dominant market- Asia Pacific, is a step in the right direction. Cosmetic additives exporters, for e.g., can also expand to new geographies in the Middle East, like the UAE, Kuwait, and Saudi Arabia. These nations have a young and dynamic population with high purchasing power, making them suitable markets for the personal care industry.

Growing demand for sustainable chemicals:

The EU has lately been at the forefront of sustainability efforts and has devised the ‘Chemicals Strategy for Sustainability,’ which includes a long-term vision for the EU’s chemicals policy. Such regulatory initiatives and consumers becoming increasingly environmentally conscious have prompted companies in the key end-use sectors to innovate and develop sustainable chemical solutions.

The chemical industry directly interacts with other sectors and has the power to influence them by encouraging companies to develop a greener product portfolio and adopt eco-friendly practices. Using natural ingredients, energy conservation techniques, low-carbon products, and investing massively in R&D can go a long way to make Indian goods competitive in the international market. Businesses can also restrategize their branding and marketing efforts to highlight the sustainability aspect of their goods to buyers and fetch premium returns.

Capturing Europe’s declining market share:

Europe is the second largest producer of chemicals globally, but today its industry is undergoing an existential crisis. Besides the geopolitical and macro situation, costly labour/ raw materials, and skyrocketing prices of natural gas — the primary feedstock for the industry, the newly laid sustainability norms/regulations have rendered Europe’s domestic chemical industry incompetent.

This opens new opportunities for Indian exporters to cater to Europe’s top buyers like the US, UK, and China. Understanding the needs of the local end-user and then customising suitable products will help exporters gain a competitive advantage in the continent.

Government’s focus on agrochemicals:

A Crisil report says India’s agrochemical industry’s revenues are estimated to grow at 15-17% in FY23, and 10-12% in FY24, with exports contributing over 50% of the revenue. However, limited feedstock/land availability, low investments in R&D, delayed environmental clearances, etc., are a few challenges obstructing this target.

Fortunately, the government has already started working on creating a readily available scientific database and launching educational programs for farmers on the benefits of using agrochemicals. The government is also working towards rationalising customs duty, developing PLI schemes, reducing the time required to grant environmental clearances, and setting up chemical parks to attract more investments into this sector.

The writer is CEO/Co-Founder of Drip Capital.