Then lots of things happened: Governments from Buenos Aires to Mexico City did a 180 on a half-century of statist, inward-looking economic policy. They slashed budgets and sold off public enterprises; opened up to trade and foreign capital. Mexico hitched its economy to the United States through Nafta. Brazil and Argentina tied the knot (sort of) via Mercosur. China swooped in to buy the region’s commodities.

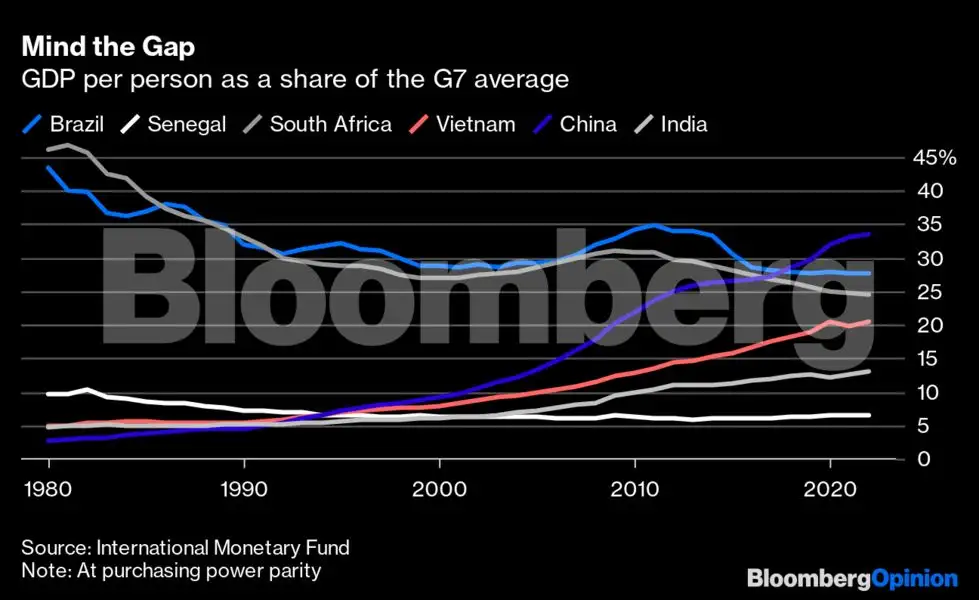

And last year, Latin America’s domestic product per person amounted to 29% of that of the G7 nations.

But before you blame Latin American incompetence, consider this: The economic output of the average citizen of Africa declined from 17% to 10% of that of the average citizen of the rich world over those 42 years, measured at purchasing power parity; the average GDP per capita in the Middle East plummeted from 114% to 41% of the G7’s.

Bloomberg

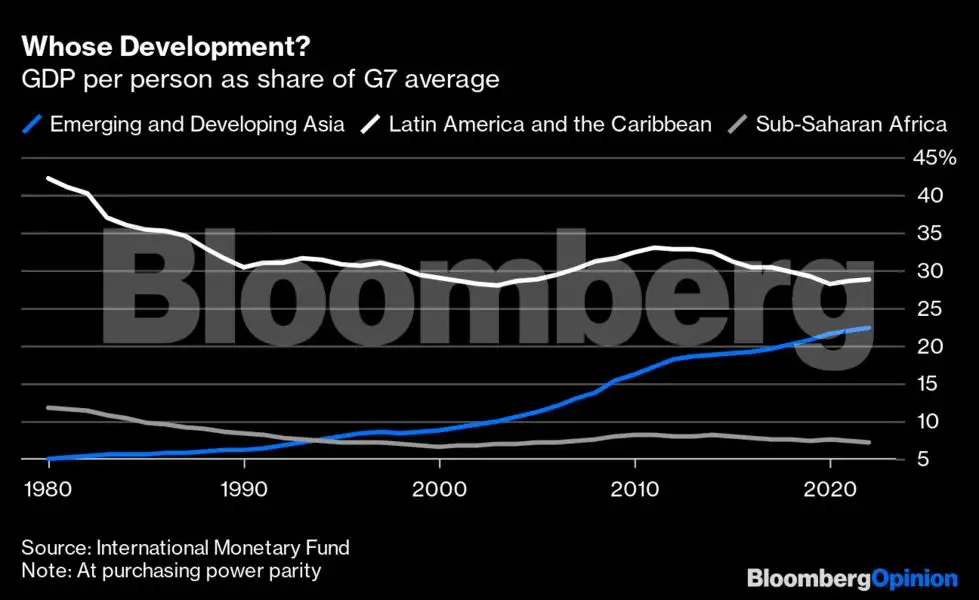

BloombergIn fact, outside of South Asia and East Asia, development over the last generation has gone backward in most of the countries that are not yet rich. The economic convergence that economists used to envision as the inevitable fruit of the encounter between the rich world’s capital and the poor world’s cheap labor has failed to materialize in too many places for its absence to be considered a fluke.

Bloomberg

BloombergThe periods of euphoria — like the decade in which China seemed to buy all the iron, copper, soybeans and steak that South America could produce — largely ended in a thud. The slam-dunk arguments — like let’s hitch the Mexican economy to the richest, biggest consumer market in the world — also failed to build broad prosperity.

Even some of the more positive stories feel a bit, well, meh. India’s GDP per head rose from 5% of the G7’s to 13%, Vietnam’s from 5% to 21%. GDP per person in China, the poster-child for recent export based economic success, rose from 3% to 33% of the G7 average. That’s progress. But it didn’t quite make China rich.

The depressing track record of so many shots at “development” raises questions that economists should try to answer honestly, instead of hemming and hawing: Is there a feasible path to development for the world of the poor? What does it look like? And what do we do if we can’t find it?And let’s not do the McKinsey thing. The consultancy shtick about “investing in human capital is essential to become more productive and join global value chains” won’t help countries that can’t afford sending all their kids to high school, let alone college. As Donald Rumsfeld might put it, poor countries need development strategies for the workers they have, not for the ones consulting companies might prefer.

The problem for economists pussyfooting around the issue — tossing up exhortations about “free trade” and “better governance” — is that the track record of development and the playbooks deployed over the last couple of decades offer few precedents that might prove helpful in the new world that is unfolding.

You might ask, What about manufacturing? Think of Japan and Korea, of the East Asian tigers and China, of postwar Germany: For the better part of a century, manufacturing for export provided pretty much the only successful strategy to bring broad-based prosperity to the poor countries of the world.

That’s not a coincidence. Manufacturing has a unique ability to lift productivity. To raise the productivity of even the least educated farmworkers, one only needs to erect a factory making t-shirts or plastic toys in the middle of a field. Exports help leapfrog the small domestic consumer market. And the income from these businesses can pay for the investment in human capital and other inputs to move up the value chain.

Yet even the most successful strategies of the past look doomed to failure. The reason is straightforward: automation. The industrial economy no longer has as much need for labor, especially of the cheap unskilled kind.

It’s not just happening in the US, where President Joe Biden is pulling out the stops to bolster manufacturing jobs. Manufacturing’s employment footprint is shrinking globally. In South Africa, for instance, manufacturing jobs fell to 9% of total employment in 2018, before Covid struck, from 14% in 1990; in Nigeria, they declined to 7% from 12%.

Bloomberg

BloombergFor all the promise of Nafta, in 2018 only 17% of Mexican workers toiled in manufacturing, down from 20% in 1990. Even in China, manufacturing’s share of employment fell from a peak of 22% in 1995 to 19.5% in 2018.

Unfortunately, what developing countries have to offer is mostly cheap, less skilled labor. And if the rewards of the last 40 years for this resource look mediocre, new generations of labor-saving technology based on artificial intelligence are going to make the next 40 years much more difficult.

Forget, also, about agriculture. For all the faith Brazil has placed in soy and beef, increasing productivity in agriculture pushes people out of the fields to look for jobs in the urban economy. Economies built around raw materials cannot do the trick — a lesson Latin American countries never tire of relearning. They employ few people and offer few linkages to other sectors of the economy. They may spur exports and benefit a few, but most workers, especially the least educated, will be left behind.

Although policymakers from Africa to Latin America may hold high hopes that the battle against climate change will open new development paths, the cry of “why export the lithium if we can export the lithium-ion batteries” will run not only into the old roadblocks of lack of capital and know-how that gave us dependency theory in the 1960s, but also into new ones raised up by automation.

Indeed, the rich world’s push for decarbonization is more likely to undercut development options for the poor world — limiting their access to cheap energy and restricting developed markets’ imports from what they may consider “dirty” sources.

Add to the mix “Buy American,” “nearshoring” and other US attempts to step back from the globalized economy, and workers in the developing world are left in a bit of a fix.

Dani Rodrik at Harvard has pondered this nexus of problems more than most. He has written about what he calls premature deindustrialisation, explored the growth spurts in some African countries, which failed to generate many highly productive jobs, and assessed how global supply chains have shown little use for their plentiful cheap labor.

His conclusion, after examining the alternatives, is not particularly optimistic: Developing countries must figure out how to build development around their domestic service businesses, which employ most of their workers. Because little else is out there. As he put it: “It’s the only possible answer to the question you can come up with.”

The path is not obvious: Policies are needed to increase the productivity of a relatively unproductive sector that has few incentives to improve. These businesses are generally small, and often informal — retailers, restaurants, maybe clinics and hotels — constrained by a poor domestic consumer base and limited investment, foreign or domestic.

Governments in the poor world must essentially develop industrial policies, but for services. If enough of these microenterprises find the wherewithal to enter the formal economy and grow, boosting employment, they could anchor a domestic middle class that would, in turn, provide a bigger domestic market for their services.

As shots go, this one looks very long. “It doesn’t make growth and development impossible,” Rodrik said. “What is impossible is the very rapid growth miracles we have seen.” What hits home, however, is his warning: “If you don’t do that, it’s going to be even worse.” How would the world cope with poverty as inescapable destiny?