Payrolls are projected to have risen by about 200,000 in December, according to government data to be released Friday. While that would mark a deceleration from the prior month, that pace of job growth still points to solid hiring and an overall robust labor market.

Bloomberg

BloombergThe persistent mismatch between labor demand and supply — something that will likely be evident in the latest job openings data on Wednesday — continues to put upward pressure on wages.

Average hourly earnings are seen rising 5% in December from a year earlier in Friday’s jobs report, well above a pace that would be consistent with the Federal Reserve’s 2% inflation goal. The unemployment rate is seen holding at a historically low 3.7%.

Meantime, the record of the Fed’s December meeting, out Wednesday, could help explain the evolution of the committee’s view toward more heightened inflation risk even amid signs that it’s cooling off.

Other key US data includes the latest update on business activity at manufacturers and service providers from the Institute for Supply Management, as well as weekly figures on unemployment insurance applications.

What Bloomberg Economists say

“The labor market is loosening but only gradually, and more slowly than the Fed forecast. The big picture is that the labor market is still far from a state consistent with non-accelerating inflation.”

—Anna Wong, Eliza Winger and Niraj Shah.

Elsewhere, euro-zone inflation will probably show some slowing, and central banks in Israel and Sierra Leone may deliver the first interest-rate hikes of 2023.

Below is our wrap of what is coming up in the global economy.

Asia

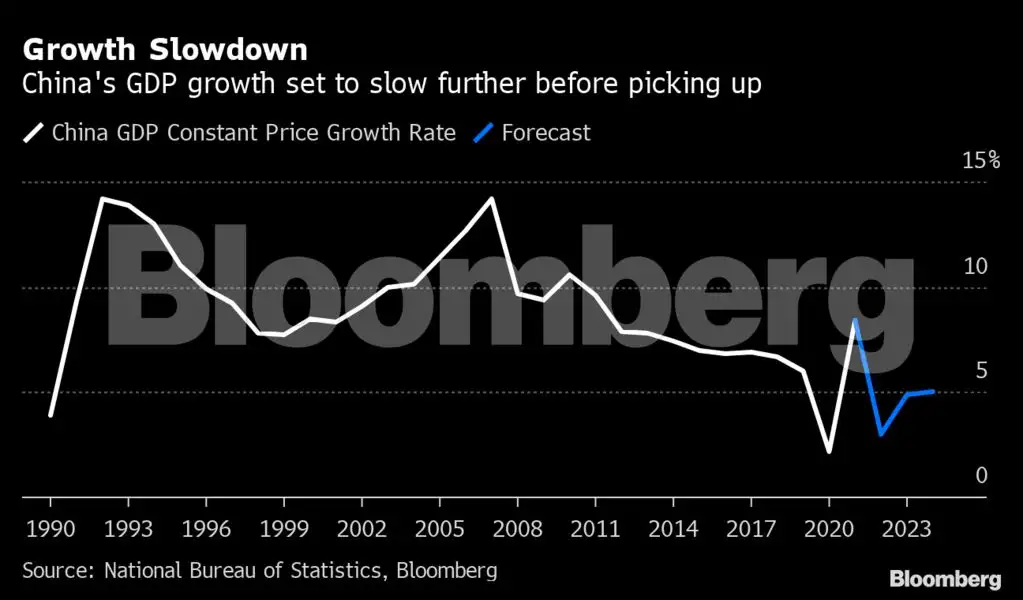

China’s purchasing managers indexes will be closely scrutinised to assess the damage to the economy from a surge in coronavirus infections in December.

The government’s official PMI on Saturday showed that China’s abrupt reversal of its Covid Zero policy pushed economic activity — its service sector in particular — to the slowest pace since February 2020.

Those data will be followed by a private industry PMI on Monday, which is expected to reveal a deeper contraction in manufacturing in the final weeks of the year.

Bloomberg

BloombergSouth Korean data Sunday showed that exports continued to decline in December in a sign of cooling global demand as higher interest rates weigh on consumption.

Meanwhile, Governor Rhee Chang-yong said in a New Year speech that the Bank of Korea should keep its policy focus on fighting inflation and be ready to help stabilise markets.

Wage figures in Japan are expected to show pay falling further behind inflation. At the end of the week, Taiwan will release its trade data, with export orders already plunging following a slump in global demand for chips.

Europe, Middle East, Africa

The euro area starts the year larger than before as Croatia became its 20th member on Sunday. Accession to the single currency will begin a new chapter for a country that emerged from the ashes of war just three decades ago.

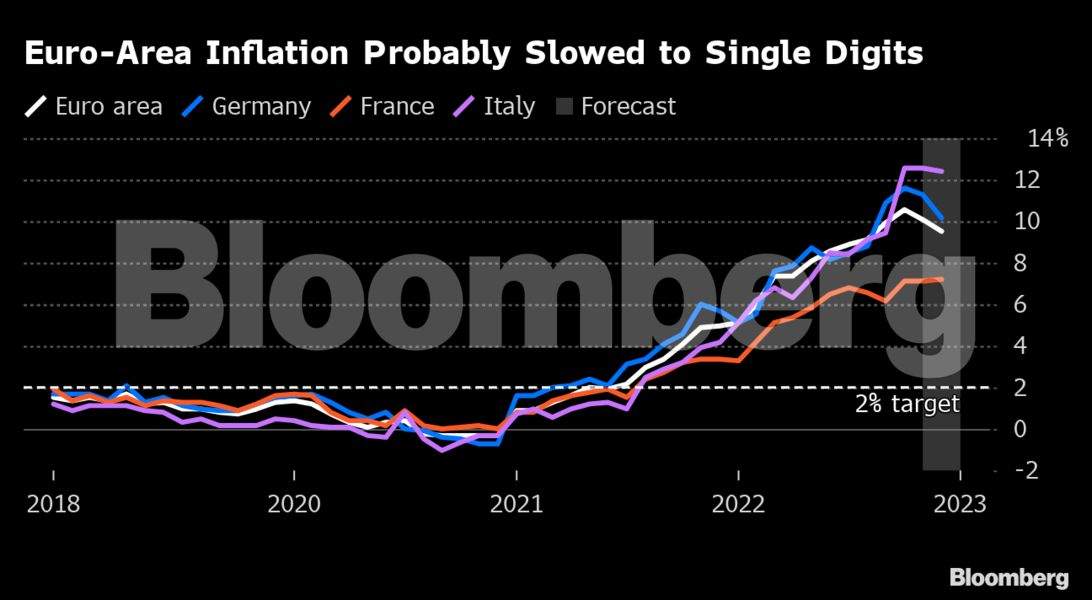

Data throughout the week will underscore challenges faced by the euro zone. Inflation on Friday is likely to have slowed below 10% in December, ending the year with some respite while still highlighting the scale of the European Central Bank’s task in bringing consumer prices under control.

National reports in the days before then are likely to show a mixed picture. Inflation probably slowed in Germany and Italy, while picking up in France.

Bloomberg

BloombergOther German data on unemployment, exports and factory orders will illustrate the health of Europe’s biggest economy just as it suffers what may be the worst recession currently affecting the region.

As with every year, only sparse public remarks by ECB officials are expected in the first week of 2023. Chief Economist Philip Lane will be among them, addressing the American Economic Association on Friday.

Bank of England Chief Economist Huw Pill and policymaker Catherine Mann will speak to the same conference next weekend, the only engagements currently foreseen for British central bank officials. UK mortgage approval data on Wednesday will be among the few key numbers due there.

Away from western Europe, the most significant reports due elsewhere will be Turkey’s inflation on Tuesday. That’s likely to show slowing to about 67% in December from 84% in November, reflecting strong base effects.

On Monday, Israel is expected to deliver one of the world’s first rate moves of 2023, extending its longest cycle of monetary tightening in decades. The Bank of Israel will probably hike to 3.75%, the highest since 2008, according to a Bloomberg survey.

The same day, the Bank of Sierra Leone will also likely raise rates to stem a slide in what was one of the world’s worst-performing currencies in the last quarter of 2022. Meanwhile, Poland’s Monetary Policy Council is expected to keep its benchmark rate at 6.75% on Wednesday.

Latin America

The survey of market expectations from Brazil’s central bank gets the week under way, followed by Mexico’s November remittances report and full-year trade data from Latin America’s biggest economy, which is likely to show that exports and imports hit records in 2022.

Bloomberg

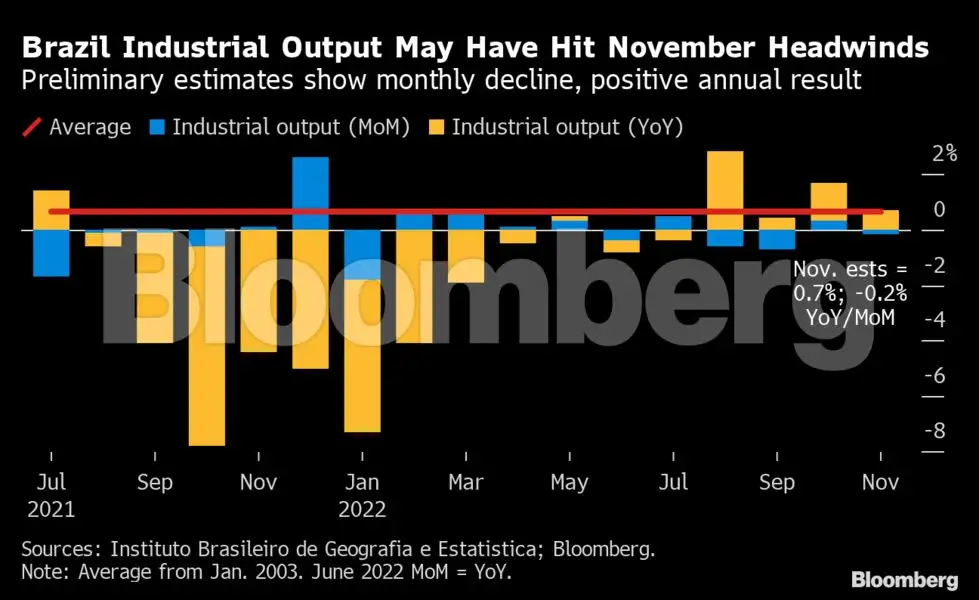

BloombergLeading off a busy Thursday, analysts expect Brazil’s November industrial production data to have weakened after an uptick in October.

The minutes of Banxico’s Dec. 15 meeting should underscore policymakers’ guidance that the current 10.50% is not the terminal rate. Given that he’s consistently been the board’s most dovish member, Mexico watchers are also keenly awaiting news of who will be named to replace deputy Governor Gerardo Esquivel.

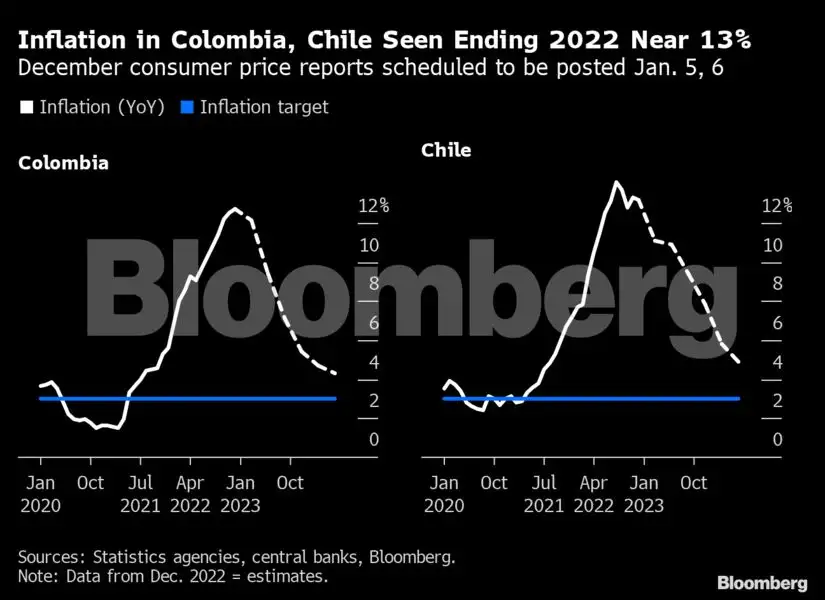

Unrelenting demand in the region’s fastest-growing economy is expected to have pushed Colombian inflation up from November’s 12.53% year-on-year rate. Annual inflation more than doubled in 2022 and is more than four times the 3% target.

Bloomberg

BloombergClosing out the week, data posted Friday may show headline inflation in Chile cooled modestly from November’s 13.3%. Banco Central de Chile President Rosanna Costa and her board have said that the key rate will stay at 11.25% until they’re certain inflation is heading back toward their 3% target.