A Volvo C40 Recharge electric SUV is on display during the Volvo “A New Era of Volvo Cars” press conference at The Shilla Seoul on March 14, 2023 in Seoul, South Korea.

Han Myung-gu | Wireimage | Getty Images

Volvo Cars shares surged more than 20% on Thursday after the Swedish automaker announced that it will stop funding subsidiary Polestar Automotive.

The group announced that it may hand stewardship of ailing luxury car brand Polestar over to majority Volvo shareholder, China’s Geely Holding, which has a 78.65% stake in the company, according to LSEG data.

In its full-year report, Volvo said Polestar is “entering the next exciting phase of its journey with a strengthened business plan and cost actions,” but that the parent company’s focus is on developing Volvo Cars and concentrating its resources accordingly.

“We are therefore evaluating a potential adjustment to Volvo Cars’ shareholding in Polestar, including a distribution of shares to Volvo Cars’ shareholders. This may result in Geely Sweden Holdings becoming a significant new shareholder,” the company added.

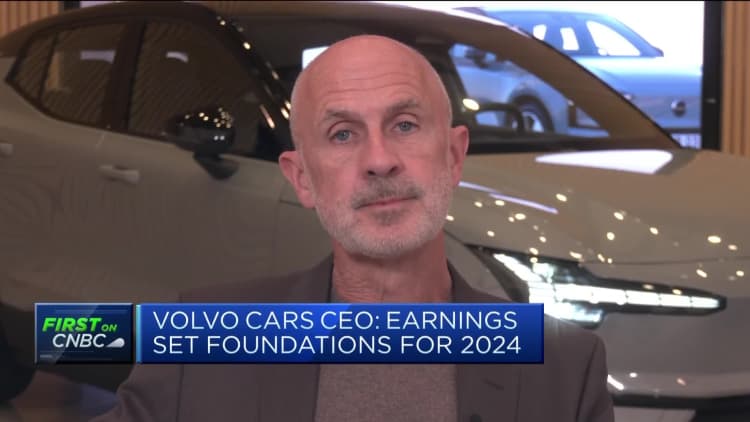

Volvo Cars CEO Jim Rowan told CNBC’s Silvia Amaro on Thursday that this was a “natural evolution” in the relationship between the two carmakers.

“Obviously, we spun out Polestar as a separate company a long time ago, and since then we’ve been incubating and working with Polestar for a number of years,” Rowan said.

“Now, Polestar … they’ve have got a very exciting future ahead of them, they’ve moved from being a one-car company to a three-car company, they’ve got two brand-new cars coming out very shortly, in fact in the first half of this year, and that’s going to take them to a new growth trajectory.”

Volvo Cars holds around a 44% stake in Polestar, according to LSEG data, having acquired the company in 2015. The compatriot luxury electric vehicle brand has struggled since going public in June 2022, and analysts were wary that it had become a drag on Volvo’s resources.

Rowan said this felt like the right time for Volvo Cars to begin reducing its shareholding of Polestar and for the company to “look for funding outside of Volvo.”

“That allows us and Volvo as well to fully focus on our growth journey, especially some of the technology investments that we need to make in the next two-three years.”

In a statement Thursday, Polestar said it “welcomes Geely Sweden Holding as a potential direct new shareholder,” and that Volvo Cars will “remain a strategic partner in areas across R&D, manufacturing, after sales and commercial.”

“With our growing line-up of exclusive, performance cars, Polestar is in one of the most promising phases of its development,” Polestar CEO Thomas Ingenlath said.

“We look forward to continued cooperation with Volvo Cars as well as benefiting from even greater synergies with Geely on future orientated technologies.”

Volvo Cars on Thursday reported a sharper-than-expected rise in fourth-quarter operating income (excluding joint ventures and associates), which hit 6.7 billion Swedish krona ($643.83 million) compared to 3.9 billion krona for the same period in 2022. Fourth-quarter revenue was 109.4 billion krona versus 105.2 billion a year ago.

For 2023 as a whole, operating income climbed to 25.6 billion krona from 17.9 billion in 2022, while revenues rose to 399.3 billion krona from 330.1 billion the previous year.

Correction: This article has been updated with the correct earnings figures for Volvo Cars.