Some venture capitalists are nurturing small upstarts amid the ongoing crypto winter.

Zoom in: Rarely as of late is the venture capitalist making it rain on the crypto sector. Rather, investments are small and are going to smaller operations whose missions are pointed at boning up the crypto ecosystem, VCs tell Axios.

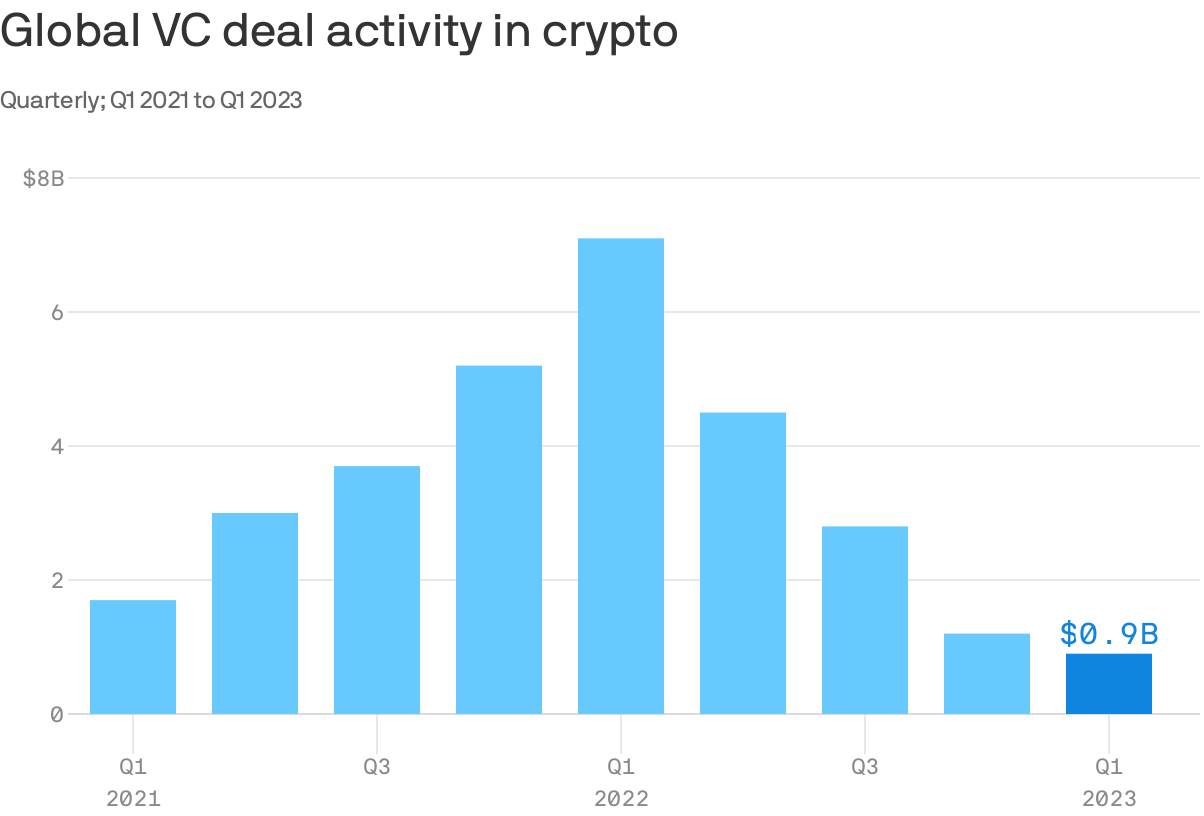

- Crypto investing in dollar terms has fallen significantly since peaks reached only last year, but it’s not zero.

What they’re saying: “There has definitely been a shift to earlier [investment] stages, and it seems like the most activity has been at the seed stage,” Spencer Bogart, general partner at Blockchain Capital, tells Axios.

- “This is a notable departure from 18 months ago when we saw a lot of high-profile activity in the mid- to late-stage of the market,” Bogart says.

- “Later-stage growth capital is much harder to come by these days as companies need to meet a higher bar in terms of real traction and growth,” Shan Aggarwal, head of corporate development and Coinbase Ventures, tells Axios.

Of note: Andreessen Horowitz, which led the most crypto fundraising rounds in 2022, resurrected its “startup school,” an accelerator program amid a decline in deal activity.

The strategy isn’t new for Coinbase Ventures, though.

- “We’ve been dedicated to investing at the earliest stages since 2018, and our strategy is largely unchanged,” Aggarwal said.

Between the lines: Regulatory risk is putting the shine in other categories and other jurisdictions.

- There’s less activity in historically heavily financed categories like DeFi and Layer-1 blockchains, in part, because they pose a regulatory risk, per Bogart.

- “From a geographic standpoint, we’re seeing more and more interesting opportunities outside of the U.S. due to the lack of regulatory clarity domestically,” Aggarwal said. “[We] are excited about investing in emerging crypto markets, [with] our portfolio companies span[ning] over 40 countries.”

What we’re watching: Certain categories are catching interest, including decentralized infrastructure, wallets, and gaming, according to Bogart.

- Others include infrastructure that addresses scalability or privacy; developer tooling that make it easier to build crypto-based apps, and decentralized finance, Aggarwal said.

Details: Among Blockchain Capital’s biggest investments in the past quarter is EigenLayer, which wants to effectively become a platform for launching networks via what they call restaking.

- Coinbase Ventures also participated. Plus, they funded former FTX exec Brett Harrison’s crypto trading infrastructure startup Architect as well as decentralized protocol Affine this past quarter.

- Azra Games, which is developing an NFT game called Legions & Legends, raised more money led by a16z this past quarter; other investors included NFX, Coinbase Ventures, Play Ventures, and Franklin Templeton.

The bottom line: The seedlings that make it past the myriad avenues of death this crypto winter would make for a healthy crop for the next bull market.

- Synthetix founder Kain Warwick recently said that, in the next cycle, the key metric is going to be actual revenue.