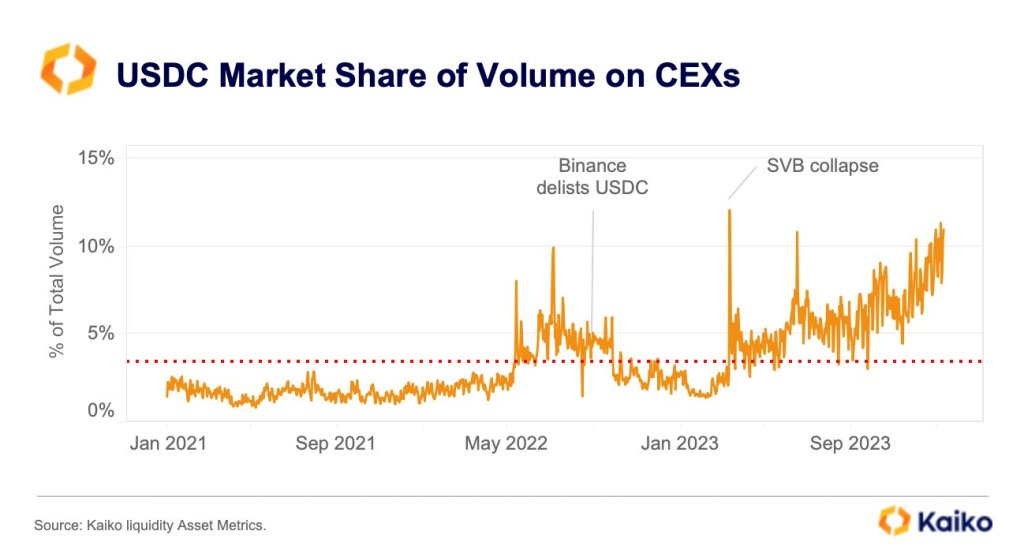

The crypto market is witnessing a remarkable resurgence of USDC, the second-largest stablecoin by market capitalization. According to Kaiko market data, USDC’s CEX volume market share has more than doubled since January 2022.

USDC CEX Market Share Rises 2X

This development is noteworthy considering the depressed USDC activity in the first half of 2023 following the continuation of the crypto bear market. The recovery also follows fundamental changes in Binance, the world’s largest crypto exchange, that saw the platform delist USDC in their bid to concentrate liquidity and increase market share for the now-delisted BUSD.

While the decision to end support for USDC on Binance saw USDT’s market share skyrocket, Jeremy Allaire, at that time, said the move by Binance was bullish for USDC. The Circle CEO said the delisting from Binance would also “likely lead to more USDC flowing to Binance.”

Less than a year later, in late 2023, Binance reinstated the stablecoin on its platform. The relisting and Binance’s extensive user base and liquidity have significantly boosted USDC’s market share in CEXes, looking at trends in the past few trading months.

From Kaiko’s data, USDC trading activity, gauging by volume, picked momentum from late Q3 2023. Notably, this coincided with market recovery as leading crypto assets, mainly Bitcoin, Ethereum, and Solana, began their move up. Swelling USDC and stablecoin activity also coincides with decentralized finance (DeFi) activity recovery, whose trading volume now exceeds $56 billion, according to DeFiLlama data.

Solana Adoption Driving Growth?

Beyond Binance’s relisting, USDC’s growth is also fueled by its increasing adoption of Solana, a high-performance blockchain network.

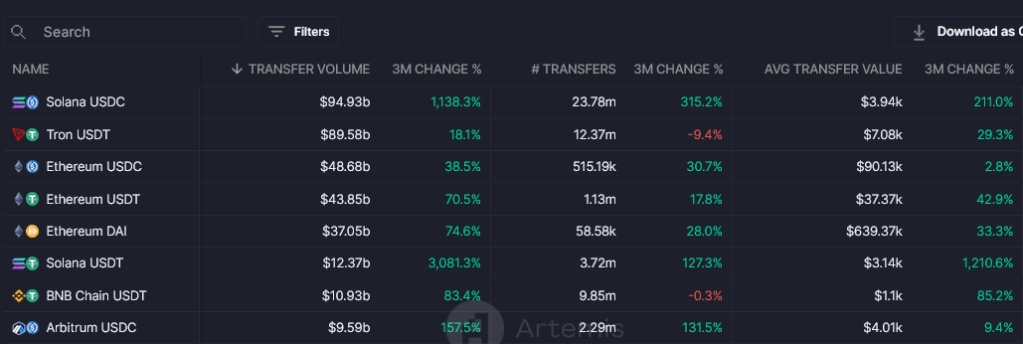

In early January 2024, Artemis data revealed that Solana-based USDC transaction volume surpassed USDT’s on Tron. This move represented a seismic shift in the stablecoin landscape.

More importantly, this is considering that Tron, the low-fee and high-throughput platform, is primarily stablecoin-driven, powering a considerable percentage of USDT transfers.

USDT and USDC dominate stablecoin trading, looking at trading volume across CEX and decentralized exchanges (DEXes) like Uniswap. While USDT and the algorithmic stablecoin, DAI, may command a significant market share in Ethereum-based protocols, USDC is the preferred stablecoin in Solana.

Referencing Artemis data, there has been more on-chain activity related to USDC over the past three months, especially on Solana. This heightened activity has seen USDC flip USDT as trading volume is up more than 11X in the past three months alone. While USDT activity in Tron comes second, there is also a spike in USDC trading in Ethereum.

Feature image from Canva, chart from TradingView