Exposure to several high-growth sectors and reasonable valuations make the index a good diversifier for long-term investors who believe in buying passive funds.

“The index represents the next leaders and gives exposure to industries not present in the Nifty 50. Given the strong GDP growth outlook for India, and the recent underperformance, it could make a good entry point for investors,” said Anil Ghelani, head of passive investments and products at DSP Mutual Fund.

Wealth managers believe the Nifty Next 50 represents the next rung of liquid securities after the Nifty 50 and recommend an allocation to this index for equity investors. The Nifty Next 50 trades at a one-year forward price-earnings ratio of 28, compared with its five-year average of 28.93, making valuations reasonable.

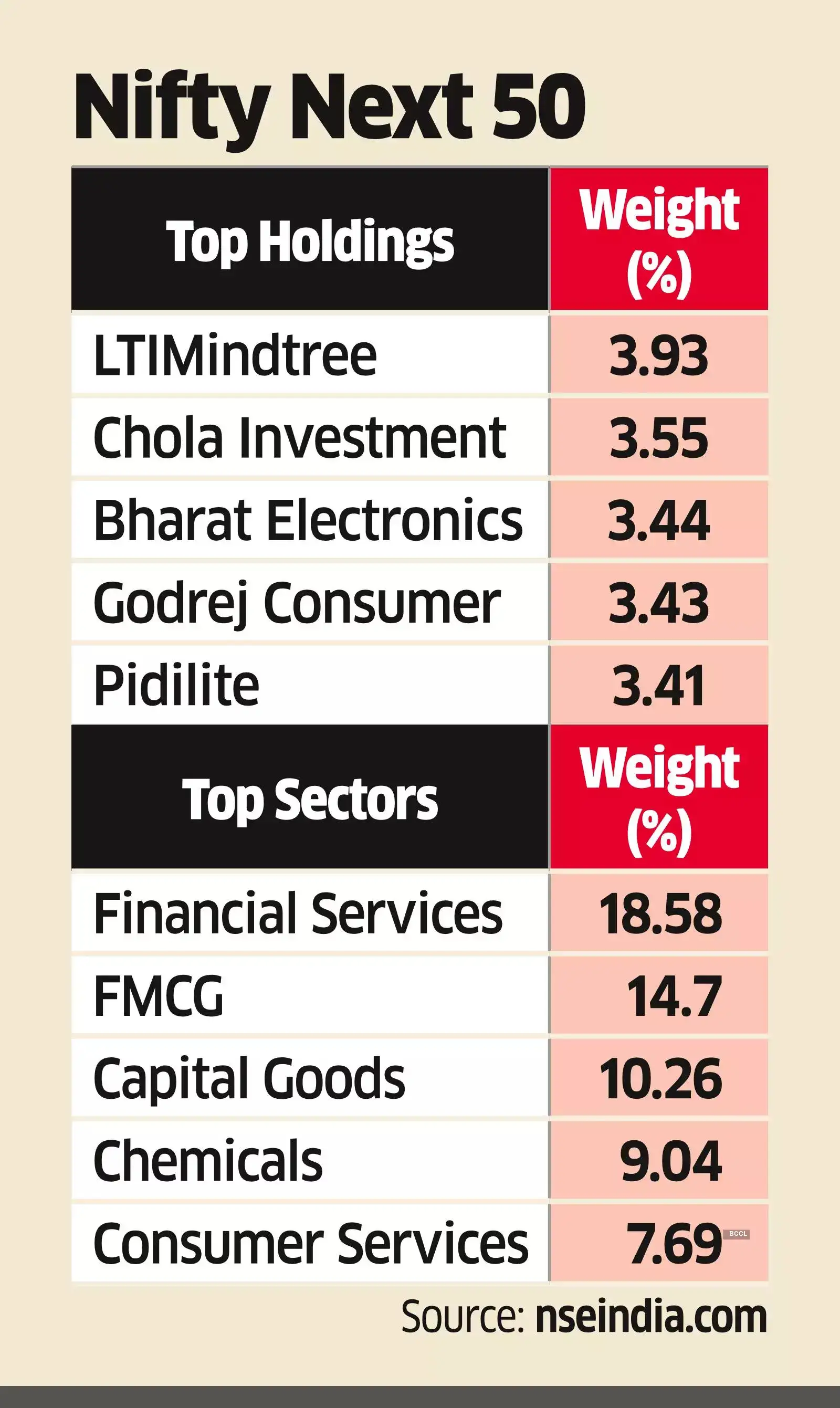

Unlike the Nifty 50 which is top-heavy with the leaders like Reliance Industries and HDFC Bank having high weights of 10.32% and 9.4%, the highest weight of a company in the Nifty Next 50 is less than 4%. While the Nifty 50 has a 37.5% weight to financials and a 14.1% weight to IT, in Nifty Next 50, the weight of these two sectors is 17.7% and 4.3%, respectively.

The Nifty Next 50 also gives exposure to sectors like capital goods at 8.3% and to Internet companies like Zomato, Paytm and Nykaa.”Nifty Next 50 consists of 50 companies some of which can be included in the Nifty in future,” said Deepak Jasani, head of retail research at HDFC Securities. Jasani believes investors with a low-risk appetite could invest up to 20% of their portfolio into the Nifty Next 50.”Investment in the Nifty Next 50 should be complementary to the Nifty50,” said Siddharth Srivastava, head of ETFs at Mirae Asset Management. Srivastava believes investors should have an allocation of 3:1 to the Nifty50 and Nifty Next 50.

The Nifty Next 50 has lagged the benchmark Nifty50 in recent times. Since September 2022, the Nifty Next 50 has lost 4%, while the Nifty50 gained 6.2%, leading to a huge divergence in returns. Over the last one year and three years, the Nifty Next 50 has returned 8.05% and 21.39%, compared with 13.05% and 26.13% by the Nifty 50.

“This was mainly due to the Adani Hindenburg issue that dragged down Adani Group companies’ values,” said Jasani of HDFC Securities, pointing out that the group has six of its companies in the Nifty Next 50.

Besides this, newly listed stocks like Nykaa and LIC saw renewed momentum on the downside, while ITC, a 6.5% weight holder in Nifty50, rose about 41% in the current calendar year, contributing to the divergence in returns, he said.

Some analysts also blame the absence of F&O trading in some stocks in the Nifty Next 50 for the underperformance, which they said made price corrections and impact on the index more severe.