It is a system that has barely changed since the nineteenth century. But that dependence on bits of paper being flown from one party to another has become a vulnerability for companies which move and finance the world’s resources around the globe.

In one high profile case, banks including ING Groep NV discovered in 2020 that they had been given falsified bills of lading — shipping documents that designate a cargo’s details and assign ownership — in return for issuing credit to Singapore’s Agritrade Resources. In another dispute, HSBC Holdings Plc and other banks have spent three years in legal wrangling to recover around $3.5 billion from collapsed fuel trader Hin Leong, which is accused by prosecutors of using “forged or fabricated documentation,” when applying for credit.

The International Chamber of Commerce estimates that at least 1% of transactions in the global trade financing market, or around $50 billion per year, are fraudulent. Banks, traders and other parties have lost at least $9 billion through falsified documents in the commodities industry alone over the past decade, according to data compiled by Bloomberg.

“It’s the easiest type of fraud to commit,” said Neil Shonhard, chief executive officer of anti-fraud platform MonetaGo, “either falsifying a document or sending duplicates to banks ‘A’ ‘B’ and ‘C’ without them speaking to each other.”

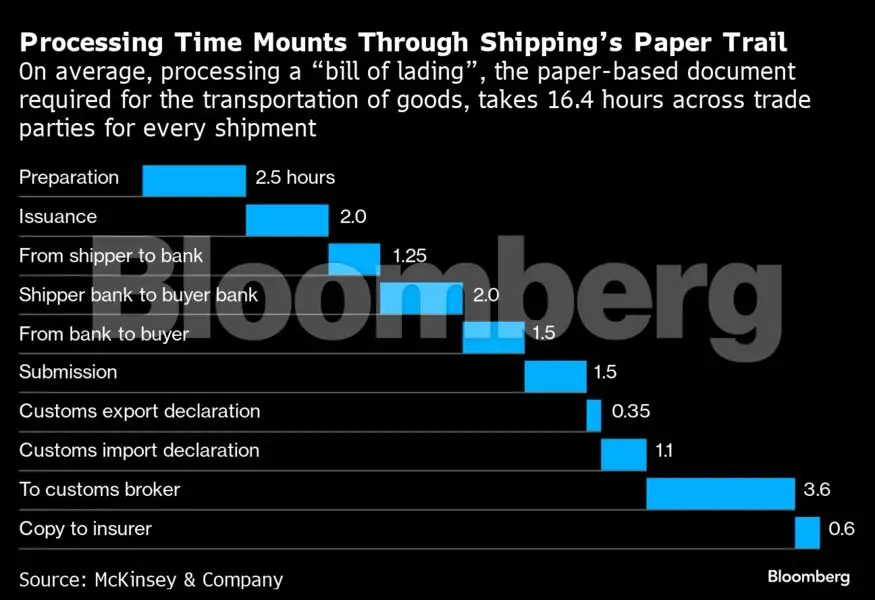

The ICC said in a 2022 report, co-authored by MonetaGo, that as much as $2.5 billion of those annual fraud costs ended up realized as losses for financiers — unearthed by commodity price shocks or other external events.Advocates say online platforms already exist that can secure, store and transfer documents, making it much less likely that banks would be presented with doctored bills of lading or other documents, such as invoices for cargoes which might not even exist or which are full of stones masquerading as valuable precious metal. Online hacking remains a risk, but one that is far more difficult to pull off than photocopying pieces of paper, they argue. Digitization also offers a potential boost for business. A McKinsey study based on industry interviews and data from carriers estimated that adopting electronic bills of lading would enable as much as $40 billion in additional global trade volume through reduced trade friction, particularly for emerging markets. The theory is that banks could in future be more amenable to finance trade for smaller, potentially riskier, counterparts if they did things digitally. The main container shipping lines, McKinsey added, could save as much as $6.5 billion a year in direct costs if they moved to full adoption of digital bills of lading.“We believe that with just a couple of small efforts everybody across this ecosystem can go out there and reap these benefits,” said David Dierker, McKinsey senior expert and co-author of the report. He argues that there is little or no downside beyond the initial investment to change processes: “Freight forwarders and shippers will need to adapt, but everyone benefits at least as much as they would have to invest. And the carriers benefit much more.”

Less than 2% of global trade is transacted via digital means, but that is set to change. Of the world’s top 10 container shipping lines, nine — which account for over 70% of global container freight — have committed to digitizing 50% of their bills of lading within five years, and 100% by 2030. Some of the world’s biggest mining companies including BHP Group Ltd., Rio Tinto Group, Vale SA and Anglo American Plc have voiced their support for a similar campaign in the bulk shipping industry.

Bloomberg

BloombergThe greatest barrier to that expansion has been legal. Banks, traders, insurers and shipping companies have had the means to go digital, but up to now a paper bill of lading has been the only document recognized by English law that gives the holder title ownership to a cargo. A bank or insurer won’t cover a deal that isn’t legally secure, and without financing, deals are unlikely to happen.

To address that, the UK passed the Electronic Trade Documents Act in July which enshrines digital documents with the same legal powers as paper ones. English law on trade documents goes back centuries. It underpins around 90% of global commodities and other trade contracts. So the UK law change represents a big step. Singapore, another center for maritime law, created a similar legal framework in 2021 conducting its first electronic bill of lading transactions in 2022. Similar legislation is expected in France later this year.

The next challenge will be getting companies to change processes that have been in place for hundreds of years. For all its faults, paper is something that everyone understands and while businesses are happy to join a critical mass of digital trade, few are keen to be the first to take steps in that direction.

“For this to work, it requires all of us to adopt the same data standards so that we can communicate more effectively to enable verification in a truly interoperable manner,” said Lynn Ng, Global Lead for Sustainable Value Chains at ING, the biggest bank in commodity finance.

The UK’s legal push is based on a model law put forward by the United Nations. Such transnational bodies have been important in putting together statutes that have to be acceptable and usable by the whole world. It has been broadly welcomed by the industry: “We believe this is one of the solutions which would help in reducing documentary fraud,” said the trading house Trafigura Group.

“It’s not a panacea for the electronic bill of lading and we’ve got a way to go, but I’m massively energized by this change and I think it will make a significant difference to how the industry views these digital instruments, said Marina Comninos, co-head of the paperless trade management company, ICE Digital Trade. “We’re still at such a nascent point in international trade, with only a small fraction of global trade being digitized — we need oxygen and this is oxygen.”

As a newly qualified lawyer working in the Singapore office of Holman Fenwick Willan in the late 2000s, Michael Buisset remembers flying 5,000 kilometers to Hong Kong and back in a day, briefcase in hand, to get a last-minute bill of lading signed off by a client.

“My rate was much cheaper than it is now, but it’s just a testament to the waste of time and money that paper documents can create,” Buisset, now head of the firm’s office in the commodities trading hub of Geneva, said. “And of course there was the risk of it getting lost.”

Such trips still happen, even though that transfer of documents could feasibly be executed in minutes via an online platform. The full documentation process on a 2022 deal to ship nickel in containers from miner BHP Group Ltd. in Australia to Chinese buyer Jinchuan, financed by banks from each country, took under 48 hours over the ICE Digital Trade platform, the company said.

For now, when a cargo of coffee is shipped from Brazil to a roaster like Illycaffe SpA in Europe it sets off a flurry of printing. Three identical bills of lading need to be produced and gradually make their way between sellers, banks and buyers, stopping off at law firms and consultants in order to guarantee the rights to the cargo across its 20 day journey. There are also paper invoices, certificates of analysis, and additional documents to measure weight, origin, packing, and moisture content if it is ores that are being shipped.

It is impossible to accurately calculate how many documents are printed for a given trade route but Brazil exports over 900,000 tons of coffee to the European Union every year. And that represents a lot of paper — McKinsey estimated that at least 28,000 trees a year could be saved by reduced friction in the container trade.

As well as providing details of the cargo, its destination and origin, the documents give the holder ownership rights over whatever is being shipped, crucial for holding transport companies accountable for any damages or loss that might occur, or indeed to give banks and insurers some security when providing hundreds of millions of dollars to finance a single shipment. The biggest vessels that transport oil, known as Very Large Crude Carriers, are moving cargoes valued at over $170 million at current prices.

The multi-step process begins when an agent prepares the bill of lading and receives sign-off that all the details are correct from the seller, ship owner, trader and end-buyer. The ship is then loaded and original bills of lading are issued by the vessel’s owner and signed by its captain. The three original bills of lading are then released to the seller — in the Brazilian example, the coffee producer — which passes them on to its financing bank along with additional documents to receive payment. The coffee company’s bank will endorse the bill of lading by writing on the back of it.

In many cases a carrier will need to set sail before this process is complete, so the vessel’s captain will provide a shipping agent with a letter of authority to complete the documents on their behalf.

The next leg of the journey for the bill of lading is from the coffee company’s bank to the trading group’s equivalent via DHL Worldwide Express or FedEx Corp. The trader’s bank then makes the payment to the producer’s bank against the receipt of those documents. Assuming everything is okay at this stage the bank working for the trader endorses the bill of lading, signs, stamps, dates and delivers it to its counterpart representing the buyer of the cargo, which in turn pays the trader’s bank for the goods and hands the bill of lading to the master at the destination port to obtain the release of goods.

This pass-the-parcel style approach to the bureaucracy is happening in parallel with the physical goods being loaded, shipped around the world and delivered. Sometimes the documents may only need to move between a small cluster of offices in Geneva or Singapore — where companies across the supply and finance chain have set up offices to be close to one another. But often they are far more tortuous.

The news section of the website of the Grain and Feed Trade Association, GAFTA, is often dedicated to bills of lading feared lost or stolen, where companies publicly state their ownership of a cargo to dissuade other parties at the arrival port from stealing their wheat or soybeans potentially worth hundreds of thousands of dollars. Although rare, many cargo owners believe the risk to be sufficient to issue the public hands-off warnings.

“Practically everybody I know who works in the industry has at some point encountered bills of lading getting lost,” said Richard Watts, a Geneva-based specialist in maritime trade and a board adviser to electronic document platform Secro. “It doesn’t happen often but given the pure number of documents that we’re sending around the world at any one time — even if 0.001% of them get lost — that’s still a very expensive and complex problem, often with a ship waiting to discharge.”

Digital startups like Vakt and ICE Digital Trade offer the opportunity to transfer trade and other financial documents electronically. Bolero has been doing it since the 1990s. Oil majors, such as BP Plc and Shell Plc, traders like Gunvor Group and banks including Société Générale SA have stakes in Vakt, while Intercontinental Exchange bought essDOCS last year for an undisclosed sum, betting that the move online will accelerate.

But the lack of public examples highlights the uphill battle to full adoption of electronic bills of lading. Trafigura used essDOCS for an Australian iron ore shipment back in 2014. Taiwanese shipping line Wan Hai used Bolero’s electronic bill of lading for a polyester filament trade to China in 2018.

This low take-up is largely due to the continued lack of legal recognition in many jurisdictions and banks — which finance the cargoes in transit — but will not accept a digital bill of lading as collateral in most cases. Advocates say the UK law reform should change that.

“We’re still living in the Dark Ages in terms of global trade,” said Secro’s Watts, “after this call I’ve got to go down to pick up some bills of lading for a fertilizer shipment from a bank and send them via courier to Argentina, it’s all just a bit silly.”