The Bank of England held the base rate again at 5.25 per cent last week, sticking at the level it has been at since August last year.

But while the Bank’s benchmark rate hasn’t budged, savings and mortgage rates have dropped substantially in recent months as markets anticipate base rate cuts later this year.

This is good news for borrowers, with the best five-year fixed mortgage rates now below 4 per cent – compared with about 5.5 per cent at their peak last summer.

But it’s bad news for savers, who have also seen fixed rates tumble from their highs – the best one-year fixed rate deal is now 5.16 per cent, a far cry from NS&I’s blockbuster 6.2 per cent offer in early September.

The big question for both borrowers and savers is whether now is a good time to fix.

Stick or twist: Andrew Bailey and the Bank of England’s Monetary Policy Committee set the base rate – but what should you do with your mortgage and savings

For those who need a mortgage, it’s about whether rates are attractive enough to lock in, how long to do so for – and whether they’d save money by waiting.

For savers, it’s a question of whether they should take the chance to bag rates above 5 per cent now, before they are all gone.

Muddying the waters is the fact that both mortgage and savings rates are also dependent on money market sentiment – and this means they could move up or down independently of what the Bank of England decides.

In a shining example of that, even as the Bank of England held rates and opened the door to cuts coming this year, Britain’s biggest building society announced it was hiking mortgage costs.

So, what should you do with your mortgage and savings? In our definitive guide on whether to fix, we look at the forecasts for interest rates, savings and mortgages and ask our panel of savings and mortgage experts what they would do.

What has happened to savings rates?

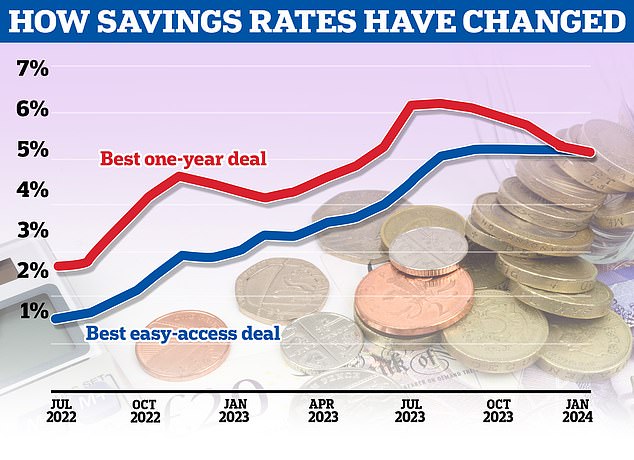

After years in the doldrums, savers have started to get much better rates since the Bank of England stared raising the base rate.

As with mortgages, savers have seen a couple of points where savings rates have rapidly accelerated. Most notably, this occurred over summer last year, when almost every day brought a flurry of rate rises from banks and building societies.

The biggest battle ground was shorter term fixed rate savings deals, particularly one and two-year fixed rate bonds.

The high water mark came with NS&I’s 6.2 per cent one-year fixed rate Guaranteed Growth Bond. This was launched at the end of August last year and lasted just over a month before it was pulled at the start of October.

The top one-year fixes now pay just under 5.2 per cent.

Easy access savings deals lagged fixed rates as they accelerated over the summer, but as the latter have been cut back, they are now at a similar level to fixes and broadly similar to where they were in September.

Savings rates peaked above 6 per cent but have come down sharply since autumn

Will fixed rate savings keep falling?

The big concern for savers is that fixed rates will continue their downward trajectory and This is Money and the Mail’s Savings Guru, Sylvia Morris warns that not only is this likely to happen but easy access rates will probably follow them down too.

She says: ‘Rates on these accounts are aligned with the Bank of England base rate rather than the money markets.

‘As soon as the Bank cuts its base rate, providers will be quick off the mark in culling the rates on their easy-access accounts.

‘They could even cut them earlier if providers think a future cut looks inevitable.’

The decline in fixed savings rates has come despite the Bank of England holding base rate steady since August. The answer to why lies in the fact that fixed-rate savings are priced based on money market rates, which reflect what markets think will happen to base rate in future.

This means fixed savings rates can often run ahead of what the Bank of England does, hence the substantial cuts in recent months.

A potential silver lining for savers is that markets may have overcooked their expectations for how soon and how swiftly the base rate will fall, this could stem the tide of cuts and even see a few rises.

What are the best savings rates now?

The top one-year fixed rate in This is Money’s independent best buy savings tables is now Smartsave’s 5.16 per cent account.

The top two-year fixed rate is Close Brothers’ 4.95 per cent deal and the top five-year fixed rate pays even less, with Smartsave offering 4.36 per cent.

The top deal in This is Money’s easy access savings tables is Coventry Building Society’s Triple Access Saver at 5.15 per cent.

The best one-year fixed rate in This is Money’s cash Isa tables is Shawbrook Bank’s 4.98 per cent account, while the best easy access cash Isa is Zopa’s 5.08 per cent account.

Should you fix your savings?

Right now, you can earn the same rate of around 5 per cent whether you leave your money in an easy-access account or tie it up for a year or two.

It’s unusual to get the same rate. Normally you are paid extra for agreeing not to touch your money for a year or more.

The parity has come about because fixed rate bonds have already priced in the fact that interest rates are expected to fall in the coming months while easy-access rates haven’t.

Fixed-rate bonds already dropped from a high of 6 per cent plus for one year in the autumn to just over 5 per cent at best now, even though the base rate has stayed steady at 5.25 per cent since last August.

The verdict: Savers might be tempted into a state of inertia by thinking they have already missed the best rates and there’s no point bothering now. But fixed rate deals above 5 per cent beat inflation and look great value compared to what banks offered a few years ago.

Don’t tie up money in fixed rate savings that you may need for a rainy day – this should go into an easy access account, where you can get it quickly – but our experts say that savers with larger pots should lock some of it in to good rates.

Shorter term fixed rate savings look most attractive and give an extra degree of flexibility over five-year deals. Those willing to tie up savings for five years, should potentially consider whether they should be investing it instead.

Whatever they do, savers should preferably do it through a cash Isa. Rising rates have dragged more people into paying savings tax, as their interest rises through the personal savings allowance that is set at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers.

What has happened to mortgage rates?

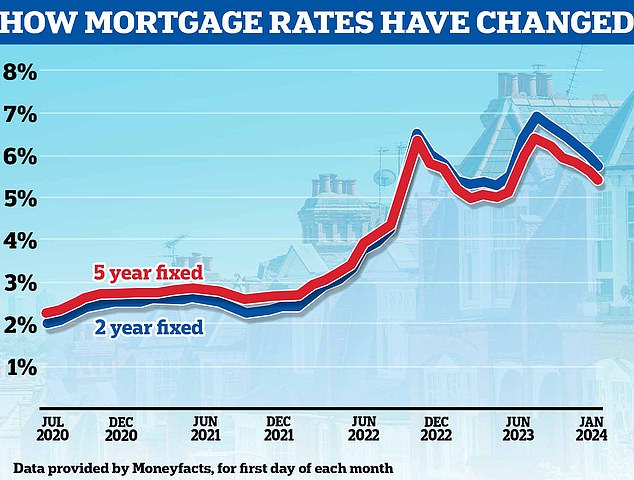

Since the base rate started going up in 2021, mortgage rates have soared – adding hundreds of pounds to monthly payments for those who have had to remortgage.

An estimated 1.6 million mortgage borrowers will come to the end of two or five-year fixed rate mortgages this year, on which they are likely to have been paying 2 per cent interest or less and now face rates at about 5 per cent.

On a £200,000 mortgage over a term of 25 years, this would mean monthly payments rising from £885 to £1,235 – an increase of £350 per month.

This prospective payment shock means the mortgage market over the past 18 months has been a nerve-racking rollercoaster ride for homeowners. With ups and downs along the way, most notably the post-Liz Truss mini-Budget spike and then a sudden inflation-driven mortgage shock over summer.

The average two-year fixed mortgage rate is now 5.56 per cent, according to Moneyfacts, and the average five-year fix is 5.18 per cent.

Heading down: Mortgage rates have been falling over the past few months, with markets now forecasting the Bank of England base rate will begin being cut later this year

These rates are much higher than many borrowers had become used to over the past decade, but they have come down substantially from their peak last summer – a trend that accelerated in recent weeks.

As recently as mid-December, those averages were 5.99 per cent and 5.59 per cent. In summer 2023, they were even higher at 6.86 per cent and 6.37 per cent.

The best fixed mortgage rates are considerably lower than average rates, with NatWest offering a five-year fix at 3.89 per cent.

‘The good news is that rates are much better for both two and five-year fixes than they were last summer when they spiked,’ says David Hollingworth, mortgage expert at broker L&C and This is Money’s mortgage columnist.

‘However, they will still be higher than the ultra-low fixed rates that may be coming to an end now, so many will be facing a jump in payments.’

Will fixed rate mortgages keep getting cheaper?

There was a rush of rate reductions in early January, but the pace of these has slowed and further dramatic cuts seem unlikely.

Instead, experts suggest home loan cuts have run ahead of the Bank of England predict mortgage rates will gradually move down as we get closer to the first base rate cuts. These are currently forecast for May or June.

Nicholas Mendes, mortgage technical manager at broker John Charcol, says: ‘Depending on inflation data and the wider economic and political landscape, we could see five-year fixed rates go below 3.5 per cent in the second half of this year. Similarly, two-year fixed rates could break the 4 per cent benchmark.

We are certainly not out of the woods yet

Nicholas Mendes, mortgage broker at John Charcol

‘But nothing can be taken for granted when it comes to market sentiment. With a general election around the corner, global instability, and core inflation remaining at 5.1 per cent, we are certainly not out of the woods yet.’

And it’s even possible that mortgage rates could rise from here. Following the January round of aggressive cuts, some mortgage lenders have put costs up in recent weeks, most notably Nationwide and Santander.

However, experts say some banks were merely correcting their rates as they had been slightly over-confident with New Year price cuts, and that this does not necessarily indicate further rate rises to come.

At some points, lenders offered mortgage rates cheaper than swap rates – the forward-looking indicators which predict where base rate will be two or five years in the future.

‘[Pricing based on swap rates] means lenders can be over-reactive or over-confident at times,’ Mendes explains. ‘They typically price their products a fortnight in advance, which means they can be caught out if the market moves quickly.’

Direction of travel: Mortgage rates are heading down, and there could be a five-year fix at 3.5 per cent by the end of the year according to some experts

What are the best mortgage deals now?

The cheapest five-year fix available is with NatWest and has a rate of 3.89 per cent, charging fees pf £1,544. This is for those who have a 40 per cent deposit or equity.

On a two-year fix the cheapest rate is 4.17 per cent with Halifax, again for someone with a 40 per cent deposit and charging a £1,099 fee.

Someone with a 25 per cent deposit or equity could get a 4.04 per cent rate with Nationwide, also charging a fee of £999.

On a five-year fix, they could get a two-year fix with Nationwide at 4.25 per cent, charging a £999 fee.

With a 10 per cent deposit, the best five-year rate is with Virgin Money. It has a rate of 4.40 per cent and a £1,009 fee.

For a two-year fix, Nationwide offers a 4.86 per cent rate with a £999 fee.

These figures are based on a mortgage on a £250,000 home, taken on a 25-year term.

You can find the best mortgages for your home value and loan size using This is Money’s mortgage search tool.

It is also important to remember that the lowest rate may not be the best deal – especially if it comes with a large fee. You can calculate the overall cost of a mortgage, including any fees, using our calculator.

Should you fix your mortgage and how long for?

Most mortgage borrowers still prefer the security of a fixed rate.

But many people are now opting for two-year fixes instead of five, even though these are more expensive. This is because they think mortgage rates will have fallen by the time their deals end in 2026, and they can switch on to a cheaper deal at that point.

Mark Harris, chief executive of broker SPF Private Clients, says: ‘While five-year fixes have fallen below 4 per cent in some instances, some clients are opting for shorter, two-year fixes in the hope that by the time they come to remortgage again, rates will be more palatable and they will be fixing for longer at a lower rate.’

Two-year preference: Mark Harris, chief executive of mortgage broker SPF Private Clients, says shorter fixes are in favour

While most forecasts currently predict cheaper mortgage rates in two years’ time, it is impossible to be certain.

If they find a five-year fix that they can comfortably afford, some borrowers may prefer to have the security of knowing what their monthly payments will be for a longer term. They will also be on a slightly cheaper rate for at least the first two years.

‘There’s no guarantee rates will fall in two years, and five-year fixes currently offer lower rates, so it’s a tough call,’ says Hollingworth.

For those who are willing to put up with some volatility in exchange for potentially getting a cheaper rate sooner, another option is to take a tracker mortgage following the base rate for now, and then jump on to a fix once rates fall to a level they are comfortable with.

Trackers usually follow the base rate, plus a certain percentage. For example, one of today’s cheapest trackers is from Skipton Building Society, offering a rate of base plus 0.79 per cent, which currently means the borrower would pay 6.04 per cent, as well as a £995 fee.

To do this, they will need to make sure they can afford the initial repayments – which will probably be higher than on a fixed rate – and choose one with no charges if they exit early.

Skipton’s deal, for example, tracks for two years but there are no early repayment charges.

Verdict: If you need to remortgage at a certain point, experts say don’t hang around paying a lender’s expensive standard variable rate while you wait to act.

Instead, make the decision on whether to fix and how long for – or if you want to take a punt on rates falling, get a base rate tracker deal.

The message from our panel of experts is that most people should fix but they need to decide how long for.

Fixing for two years is popular and markets believe interest rates will be lower when those deals end but there is no guarantee of that and mortgage rates have already come down substantially form their highs. A two-year fix also means paying a higher rate for at least the first 24 months and a fresh set of fees to remortgage in 2026.

A five-year fix gives security of payments and starts cheaper and if you have a big deposit rates look far more attractive than they once were.

The advantage mortgage borrowers have over savers is that they can speak to brokers, who will give them regulated advice on what to do and search the market for the best deal for them. Some brokers, such as This is Money’s partner L&C are fee-free and only earn their money through commission from the lender (others charge a fee and take commission).

You can lock into a fix with many mortgage lenders up to six months in advance with no commitment to take it – if rates fall between now and then you could swap to a cheaper deal. So if your mortgage is up for renewal before summer, act now, seriously consider fixing and speak to a broker.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.