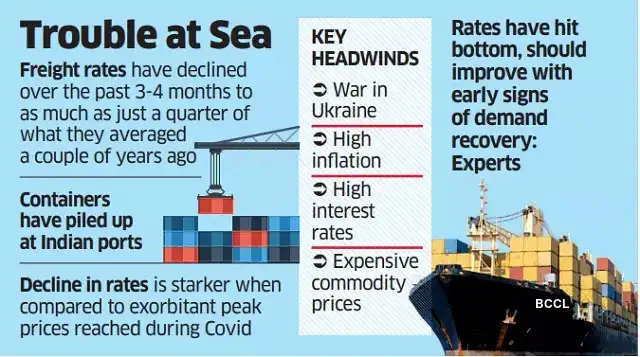

As things stand, freight rates in key transit routes have declined over the past three-four months to as much as just a quarter of what they averaged a couple of years ago due to lower consumption in western markets due global economic headwinds.

With that, containers have piled up at Indian ports, resulting in a reversal of the situation from just a year ago, when shippers were running pillar to pole to get their hands on empty containers.

“During the pandemic there was unprecedented demand and with that, the freight rates shot up. In the last three-four months demand has softened, mainly in North America and Europe,” said Bhavik Mota, Director for Ocean Shipping in the IMEA region at Maersk.

The decline in freight rates is starker when compared to the exorbitant peak prices reached during the peak of the pandemic when there was a global logistic logjam .

For instance, rates for shipping a standard 20-foot container from the Mundra port to the UK went as high as $6,500. These have corrected to around $750 now. For the Port of Jebel Ali in Dubai, rates have declined to as low as $100 from the highs of $1,400.

Meanwhile, the accumulation of containers has also led to a few instances of shipping lines charging extremely low prices to incentivise desired movement of cargo. For instance, one global shipping line reportedly charged just $1 for a 20-foot container shipment to the Port of Durban, while another charged as low as $25 for moving cargo to the Port of Jebel Ali, said one person in the know.

“This is, in many ways, a perfect storm. This is almost like the 2008 crisis. While that was a financial crisis, this is a masala of many crises,” said Shashi Kiran Shetty, founder of AllCargo group whose overseas subsidiary, ECU Worldwide, a non-vessel operating common carrier, is directly impacted by the softening.

The factors affecting freight rates include the war in Ukraine, inflation, high interest rates, expensive commodity prices – which are putting a pressure on consumption, inventory build-up and geopolitical issues, Shetty explained.

The decline in outbound trade is apparent from the level of activity at ports, industry sources say.

“Take the Kandla port for instance. Four-Five months ago there would be on an average 30-35 vessels waiting to get berths. Currently, the ships get the berth on arrival,” said Raajesh Bhojwani, managing director at RBB Ship Chartering Pte Ltd Singapore.

The lower outward movement of cargo from India has resulted in an accumulation of empty containers at domestic ports. Industry insiders remarked at the stark reversal of the situation compared to the last two years when there was a container shortage in India while the metal boxes piled up at Western ports.

“The pandemic significantly disrupted global container networks and capacities as a result of extreme, uncoordinated lockdowns and resulting labour shortages,” explains Prahlad Tanwar, global head of logistics at KPMG. China’s persistent zero-Covid policy and the growing pile-up of laden containers across ports in Europe and the United States dragged the disruption well into 2022, with shipping lines registering dismal 30% schedule reliability levels, he said.

However, the spike in freight rates ensured that despite recording the lowest operating performance levels in history, shipping companies abruptly registered record profits emerging from an extreme 12-year downturn, Tanwar said.

“However, if current rates are an indicator, the party for the shipping industry is seemingly over. As global container flows normalise, the industry has encountered pre-pandemic supply-demand realities layered by softening global demand, especially from Europe,” he said.

With rates on key corridors down as much as 70% compared to prevailing tariff levels during the pandemic, the industry could likely be entering another down cycle that will persist over the next 2-3 quarters, he said.

Ravi Jadhav, Allcargo’s chief strategy officer, feels it will take another five-six months for the industry to come to a steady flow of volumes.

However, some experts are more optimistic and believe that the rates have hit the bottom and should improve going forward with early signs of demand recovery.

“There are early signs of recovery. Our simulations show that the demand will pick up in the next quarter as customers start to replenish their inventory,” said Maersk’s Mota.