But as the finances of some of those same tycoons come under scrutiny — with Gautam Adani and Anil Agarwal two high-profile billionaires facing problems this year — Modi’s already-struggling campaign faces yet more hurdles. Since 2014, only one major firm has been privatized in India and several recent candidates have stalled.

That’s a problem as the world’s most populous nation looks for ways to boost public finances and weather the ripple effects of global monetary tightening and banking turmoil. The market capitalization of the seven listed companies flagged for privatization is about $25 billion, according to Bloomberg calculations.

Bloomberg

BloombergApart from the sale of IDBI Bank, which is already underway, progress has slowed for other companies, a person familiar with the privatization push said, asking not to be identified because the discussions are private. India’s national elections next year could further stall sales, the person said, especially for companies facing legal or labor issues. Market watchers are now skeptical that the government will prioritize privatization during the campaign season.

The Adani Group is a telling case study. To build up the world’s fifth-largest economy, Modi has leaned on a handful of businesses to improve India’s infrastructure and attract foreign capital away from places like China. But after a short seller in New York accused the Adani Group in January of wide-ranging fraud, the company is going slow on new investments.

That development has likely shelved Adani’s ambition to acquire businesses like Concor, the country’s leading freight rail operator, which has a market capitalization of close to $5 billion. In a February analyst call, Karan Adani, chief executive of Adani Ports, said the company’s “first order of preference” is to lower its debt before reconsidering the acquisition.

The Adani Group, which has vigorously denied wrongdoing, was a key sales candidate for Concor before Hindenburg Research’s report slashed more than $100 billion of market value from the company. Though Adani Group shares rallied this week after an Indian court panel’s report found no conclusive evidence of stock-price manipulation, Concor is unlikely to be on the company’s radar in the short-term.

The Adani Group didn’t respond to requests for comment.

Bloomberg

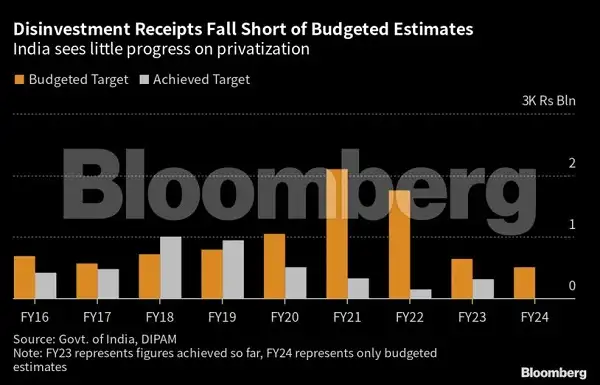

BloombergIndia’s privatization drive has faced problems from the start. Since 2014, the government has missed asset sales targets most years. Of three dozen companies originally identified for sale, officials are now left with a list of just 17 — 10 unlisted and 7 listed — largely because of legal and insolvency issues.

So far, the only major sale is the Tata Group’s 2021 acquisition of Air India for $2.2 billion. Though symbolically a success, the airline was sold after two prior attempts — despite prized landing and parking spots at key locations across the world.

“There is resistance from different sides – employees, politicians, unions, good Samaritans,” said Tuhin Kanta Pandey, the government’s disinvestment secretary. “We were in disbelief after the Air India sale. It was a burden off the chest.”

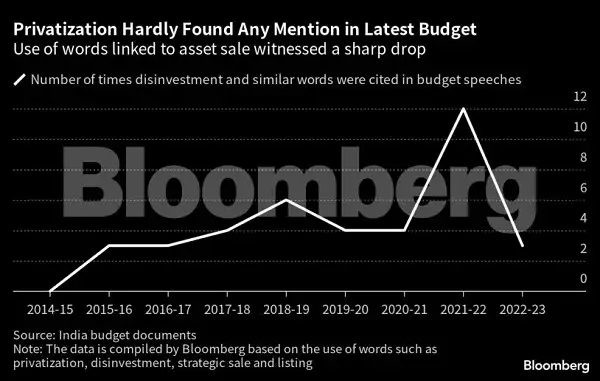

Indian officials have scaled back expectations. Disinvestment was hardly mentioned in Finance Minister Nirmala Sitharaman’s February budget speech, unlike in previous years when she announced targets or offered the names of privatization candidates.

In recent weeks, Sitharaman placed some blame for the slow progress on the pandemic, global economic turmoil and geopolitical tensions after Russia’s invasion of Ukraine. In an interview with Bloomberg News last month, she said that privatization is challenging in India because of the volume of stakeholders involved.

“Bids come in after a certain level of certainty,” Sitharaman said in the Bloomberg interview, noting that the upcoming national elections could also introduce volatility.

A spokesperson for India’s finance ministry didn’t respond to calls or messages seeking comment.

| Privatization candidates (listed companies) | Status | Interested parties* |

| Bharat Petroleum Corporation Limited | Process called off in May | Vedanta |

| Container Corporation of India Ltd (Concor) | Expression of interest yet to be invited | Adani, Vedanta, Allcargo Logistics, PSA International |

| NMDC Steel Ltd. | Financial bids yet to be invited | Vedanta, Safe Sea Services, JM Baxi, Megha Engineering |

| IDBI Bank | Financial bids yet to be invited | Kotak Mahindra Bank, Emirates NBD, CSB Bank |

| BEML | Financial bids yet to be invited | Ashok Leyland, Bharat Forge, Tata Motors |

| Units of ITDC | Expression of interest yet to be invited | ITC, Indian Hotels |

| *Source is local media reports |

Others point to the government’s poor track record as a reason for the shift in priorities. In 2020, Modi’s administration announced its biggest-ever asset sales plan of 2.1 trillion rupees ($25.5 billion). By the end of the year, India had raised just 16% of its target.

Since 2014, the government’s total disinvestment proceeds stand at 4.7 trillion rupees — or about a 10th of its proposed spending budget for 2023. And at current market valuations, India would only fetch about $13 billion from selling the seven listed companies, according to Bloomberg calculations.

Last year, the finance ministry called off the planned sale of Bharat Petroleum Corporation Ltd., which would have marked India’s largest deal. Most bidders walked out of the process because of the pandemic, energy transition issues and disruptions to the oil and gas industry — leaving only Vedanta Resources, the mining conglomerate, in the fray.

Nandini Gupta, associate professor of finance at Indiana University‘s Kelley School of Business, said government firms are tying up scarce capital in unproductive concerns, which has “a high opportunity cost in a developing country such as India.”

The financial challenges of Indian businessmen with the funds to bid on assets haven’t instilled confidence. Consider Anil Agarwal, the founder of Vedanta, who’s in the mix for bidding on several public sector companies, including Concor and NMDC Steel Ltd.

Vedanta, one of the world’s largest mining conglomerates, is now struggling to settle about $2 billion of bonds due in 2024. That’s put Agarwal at loggerheads with the Indian government: One strategy for Vedanta to raise capital involves offloading around $3 billion of assets to stepdown subsidiary Hindustan Zinc Ltd., which is partially owned by the government.

Officials have threatened legal action if the transaction goes through. New Delhi is worried that Agarwal’s zinc deal may impact valuations for the government’s own plan to sell its stake. Vedanta didn’t return requests for comment.

These sort of tricky political equations mean finding the right buyer is only one piece of the puzzle. To land more sales, the federal government must clear legal hurdles facing bidders, improve its technical expertise and urge states to take a proactive stance in privatizing their assets, according to Poonam Gupta, an economic adviser to Modi.

“There is firm acceptance, in principle, of the need for more private ownership,” she said. “Yet the execution of privatization is often a complex task.”

–With assistance from Abhishek Vishnoi and Adrija Chatterjee