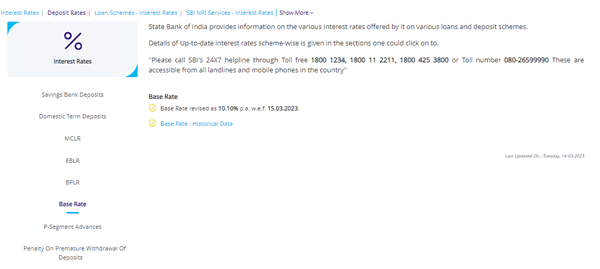

SBI base rate

SBI base rate has been hiked to 10.10% from 9.40%, an increase of 70 basis points.

SBI BPLR

SBI benchmark prime lending rate has been hiked to 14.85% from 14.15%.

Also read:6 ways existing home loan borrowers can reduce EMI amount

SBI MCLR

SBI marginal cost of lending rates remain unchanged. The overnight MCLR rate is 7.90%, while that of one month tenure is 8.10%. The three-month MCLR is 8.10% Among others, the six-month MCLR stands at 8.40% and 8.50% on one-year tenure. For tenure of two years and three years MCLR is 8.60% and 8.70%, respectively.

SBI EBLR/RLLR

SBI external benchmark lending rates (EBLR) remain unchanged at 9.15%+CRP+BSP and RLLR at 8.75%+CRP.

What is BPLR

According to Kotak Mahindra Bank, “An internal benchmark rate, it was used to set the interest rate for home loans. BPLR was calculated based on the average cost of funds. However, BPLR lacked transparency as lenders could lend below it to some privileged customers. So, in 2010, the Reserve Bank of India introduced the Base Rate system, which replaced the BPLR system

What is Base Rate

“The Base Rate was the minimum interest rate at which Indian banks could lend. They were not permitted to resort to any lending below this rate The base rate was determined significantly on the average cost of funds. As per RBI policies, lenders were required to review their base rate at least once every quarter. MCLR was introduced in April 2016 by RBI in place of base rate,” as per Kotak Mahindra Bank website.

What is MCLR

The Marginal Cost Lending rate is the lowest interest rate at which banks cannot lend. It is a floating loan internal rate set by individual banks. The MCLR is more sensitive to changes in policy rates.