As of December 15, core liquidity, which accounts for government cash balances that periodically flow in and out of the banking system, is at around 1.1% of net demand and time liabilities (NDTL) – a broad measure of bank deposits.

In its Report on Currency and Finance for 2021-22 published in April last year, the RBI had said that every percentage point increase in surplus liquidity above 1.5% of NDTL leads to average inflation rising by 60 basis points in a year.

“RBI has talked about 1.5% of NDTL as the threshold for liquidity being classified as inflationary or non-inflationary. As of December 15, we are at 1.1% of NDTL in terms of core liquidity so we are below that threshold,” said Vivek Kumar, economist, Quanteco Research.

“They have not clearly defined whether they are talking about headline liquidity or core liquidity, but my sense is that it pertains more to core liquidity because the headline liquidity is extremely volatile. Whenever you are fixing some kind of a threshold, you would ideally want it to be on a relatively stable benchmark,” he said.

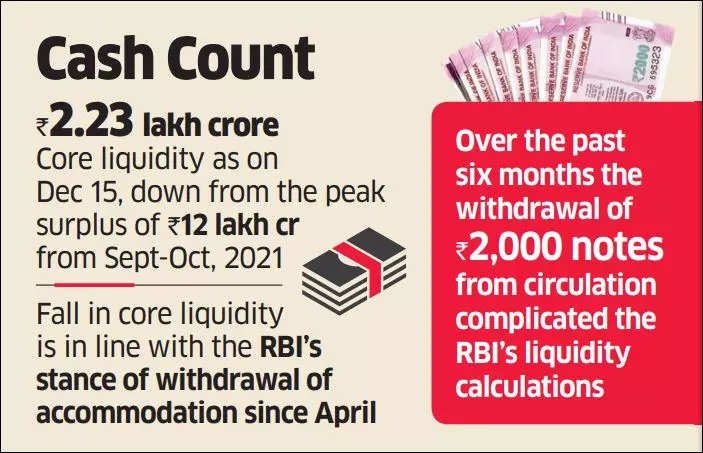

At ₹2.23 lakh crore as on December 15, the core liquidity has declined sharply from the peak surplus of ₹12 lakh crore from September to October of 2021 during the post-Covid phase in which the RBI had infused large amounts of funds into the banking system to ensure flow of credit to productive sectors during the crisis, analysts said.

RATE TRAJECTORY

The decline in core liquidity could prompt the RBI to let overnight money market rates drift towards the repo rate of 6.50% instead of their current levels of 6.75%, thus bringing down banks’ cost of funds. The timing of this phenomenon – which is equivalent to a rate cut – hinges crucially on the inflation trajectory.

If inflation eases in line with the RBI’s projections, the central bank could undertake regular short-term liquidity infusions through variable rate repo auctions and let the overnight rates fall to the repo rate in the next three to four months, analysts said.

“Government spending pick up in Q4 and lead to system liquidity improving then that could see overnight rates falling back towards repo rate. As long as that process is coterminous with a fall in durable liquidity, RBI should allow the reset in overnight rates to play out,” ICICI Securities Primary Dealership’s economists wrote recently.

The fall in core liquidity is in line with the RBI’s stance of withdrawal of accommodation since April 2022, with foreign exchange market interventions, sales of government bonds by the central bank and currency leakages from the banking system playing a part in whittling down surplus funds.

Over the past six months what had complicated the RBI’s liquidity calculations was the withdrawal of ₹2,000 notes from circulation, which led to funds with banks abruptly ballooning.

Since August, the RBI has announced steps to drain out that excess liquidity, while broadly ensuring that money market rates stay near the Marginal Standing Facility, which is 25 bps higher than the prevailing repo rate of 6.50%.