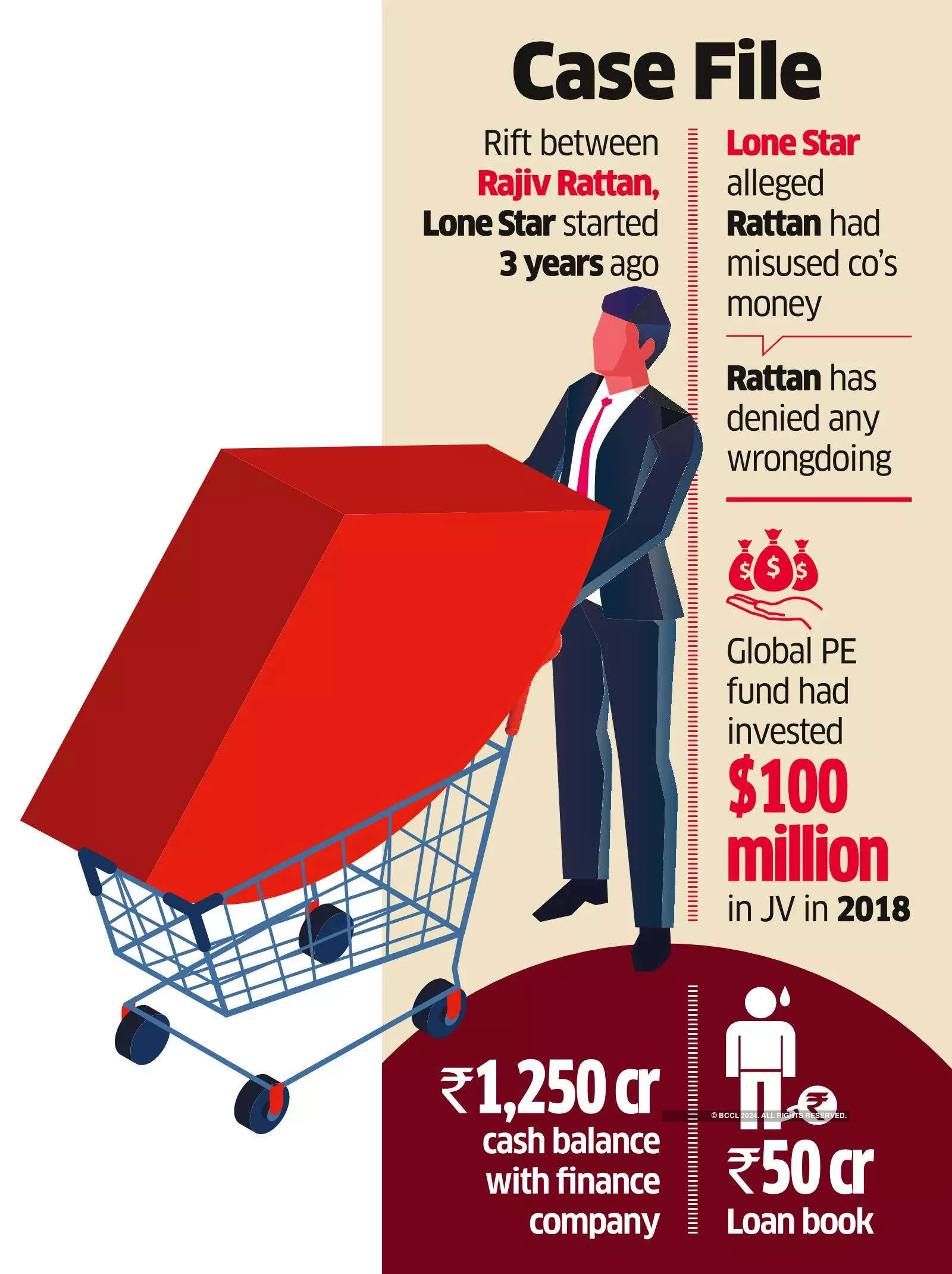

The rift between the two was triggered three years ago after Lone Star alleged that Rajiv Rattan had misused money belonging to the company.

Rattan, also the promoter of RattanIndia Power, has denied any wrongdoing.

In May 2021, the global private equity fund firm approached the Delhi bench of the National Company Law Tribunal (NCLT) against RattanIndia Finance, alleging irregularities and mismanagement in the company. Countering this, Rajiv Rattan, the chairman of the non-bank entity, argued that the foreign investors had filed the case to negotiate an exit as they were no longer keen to continue the 50-50 JV.

A joint statement issued by both partners on Thursday stated, “As part of the settlement, Rajiv Rattan and RattanIndia Finance shall provide a full exit to Rose Investments (affiliate of Lone Star Funds) for an agreed consideration and the parties shall approach the relevant authorities to approve the same.”

The joint statement did not mention the settlement amount. RattanIndia Finance transferred Rs 611 crore early this week in an escrow account with Kotak Mahindra Bank, one of the persons cited above said.

For Lone Star Funds, the transaction will imply a haircut on its investments in the JV. The global private equity fund invested $100 million in the JV in 2018 and received $73 million in 2023. The finance company had not declared any dividend during its operations.

Both partners will make a joint application with the tribunal to withdraw the case following which they will seek approval from the Reserve Bank of India, the same person said.

The company had Rs 1,250 crore cash balance and a loan book of ₹50 crore. It will dip into this cash balance to pay Lone Star.

Differences between the partners began sometime in 2020, but by the first quarter of 2021, they decided to part ways, the people cited above said. Rajiv Rattan offered $40 million for Lone Star’s 50% and later improved it to $60 million. The PE demanded $70 million. In September 2021, Rajiv Rattan offered $65 million on the condition that Lone Star withdraws all the legal cases filed against him and his company.