Of all Britain’s grocers, the group most in need of a revamp is Bradford-based Morrisons. Sold to private equity kingpins Clayton, Dubilier & Rice for £7 billion (£9.95 billion including debt) in 2021 it has had a torrid time. Market share has been lost to rivals and it trails behind German upstart Aldi amid intense price competition.

No one ought to be more capable of recognising the Morrisons dilemma than chairman and Tesco innovator Sir Terry Leahy. He judged that when David Potts stepped down in 2023, after nine years at the helm, something different was required.

Owner CD&R has expertise in spades. It has hauled in another former Tesco boss, Dave Lewis, with a record of transformation, to add muscle to the private equity firm’s consumer focus.

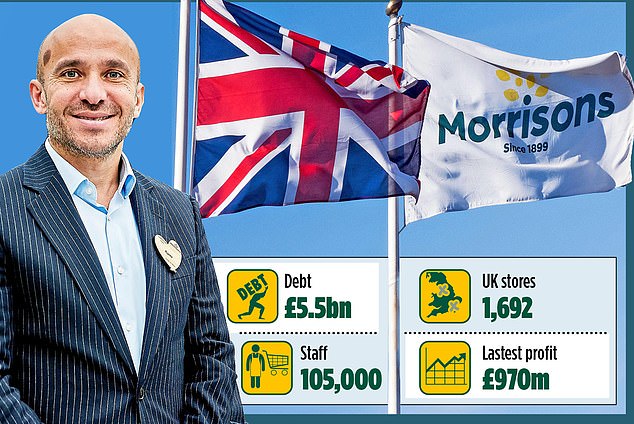

As significantly, Leahy, thinking outside the box, settled on French-Lebanese Carrefour veteran Rami Baitiéh as Potts’ successor. Wiry and bubbly, Baitiéh has made the long journey from elegant Paris to vibrant Leeds.

The new boss is leaving the owners to worry about the £6 billion-plus debt mountain – much of it taken when CD&R won a bidding war. He is laser focused on transformation.

Figurehead: Rami Baitiéh is enormously enthusiastic about the idiosyncratic Morrisons model

Last week, Morrisons revealed it will be selling its 337 petrol forecourts to Motor Fuel Group as part of a £2.5 billion deal. The supermarket chain will continue to supply fresh food and groceries across the forecourts and Morrisons’ branding will remain in place.

The tie-up provides an insight into the ambition of the refreshed leadership.

Similarly, the group is racing to convert and bring its home-based produce into more than 1,100 McColl’s newsagents, bought out of administration in May 2022.

In the manner of other overseas-born executives seeking to effect turnarounds at household name UK businesses, Baitiéh is enormously enthusiastic about the idiosyncratic Morrisons model. It is refreshing to see his dogged determination to be an agent of change and revive the spirit of the late Ken Morrison, who built the supermarket into a national presence with the takeover of Safeway two decades ago.

Baitiéh is a reminder of another agent of change from the Middle East, Tufan Erginbilgic, who, in a short space of time changed the perception and share price of aero-engine builder Rolls-Royce.

Back at Morrisons the focus is all about the customer. Baitiéh says: ‘I don’t run any business meetings without inviting the customer. We will not make decisions according to our own values or our own thoughts without asking the customer. We rely a lot on our DNA coming from Ken Morrison himself – making good food affordable to everyone.’

There has been real concern since the private equity swoop on Morrisons that as the owners sought to rid themselves of debt, in an era when borrowing costs soared, the company would ditch its unusual vertical model of controlling production from farm to table.

Soon after taking the helm – following extensive discussions with Leahy – Baitiéh decided market share and price matching were not the only things that counted. Morrisons’ unique selling point is its control over the supply chain and an ability to deliver the freshest food. Other chains such as Sainsbury’s, in a cost cutting exercise, have decided that deli counters are an expensive encumbrance.

But Baitiéh extols the virtues of Morrisons’ Market Street and Market Kitchen which bring the atmosphere of open-air stalls into the store. Other grocers are dependent on external suppliers. Baitiéh believes that through ownership of the production chain he has the answer to food price inflation.

At the start of the food chain Morrisons has been affected by inflation because it has to buy its own raw materials. But because it controls manufacture and the logistics there are fewer middlemen to take their share of the profits and whack up prices.

AT times this newcomer to the UK, with 28 years of experience in retail across the globe, sounds more patriotic than most British chief executives. ‘We are the first direct buyer with the British farmers in the UK. We know where the cow comes from, we know the sheep and we know where the chicken came from.’ This, he believes, allows Morrisons to guarantee quality.

Translating the vision into sales, better margins, profits and paying down debt is his challenge. In spite of the debt overhang and the beady eyes of Leahy and Lewis, the two former Tesco gurus in the rear mirror, he is full of self-confidence that Morrisons can be fit for purpose again.

Morrisons’ heavy indebtedness drained profits and has been seen as a huge disadvantage in the post-pandemic era. Baitiéh has been given assurances there would be no restrictions on the way he runs the company. He views chairman Leahy as acting as a coach on the UK market rather than imposing financial targets.

The ultimate goal is clearly to restore the profitability and dividends for the company’s private sector investors. Forecourts, city centre convenience stores and acting as wholesaler operators of smaller stores is part of the plan. But the ultimate goal must be to fatten up Morrisons for an eventual return to listed markets.

There is no timetable for that. All the focus is on polishing the group’s production and trading capabilities. There also needs to be an awareness that retailers such as Debenhams, emerging from private equity ownership, have a very mixed record.

Baitiéh thinks the Morrisons model, properly exploited, offers an opportunity to buck the trend.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.