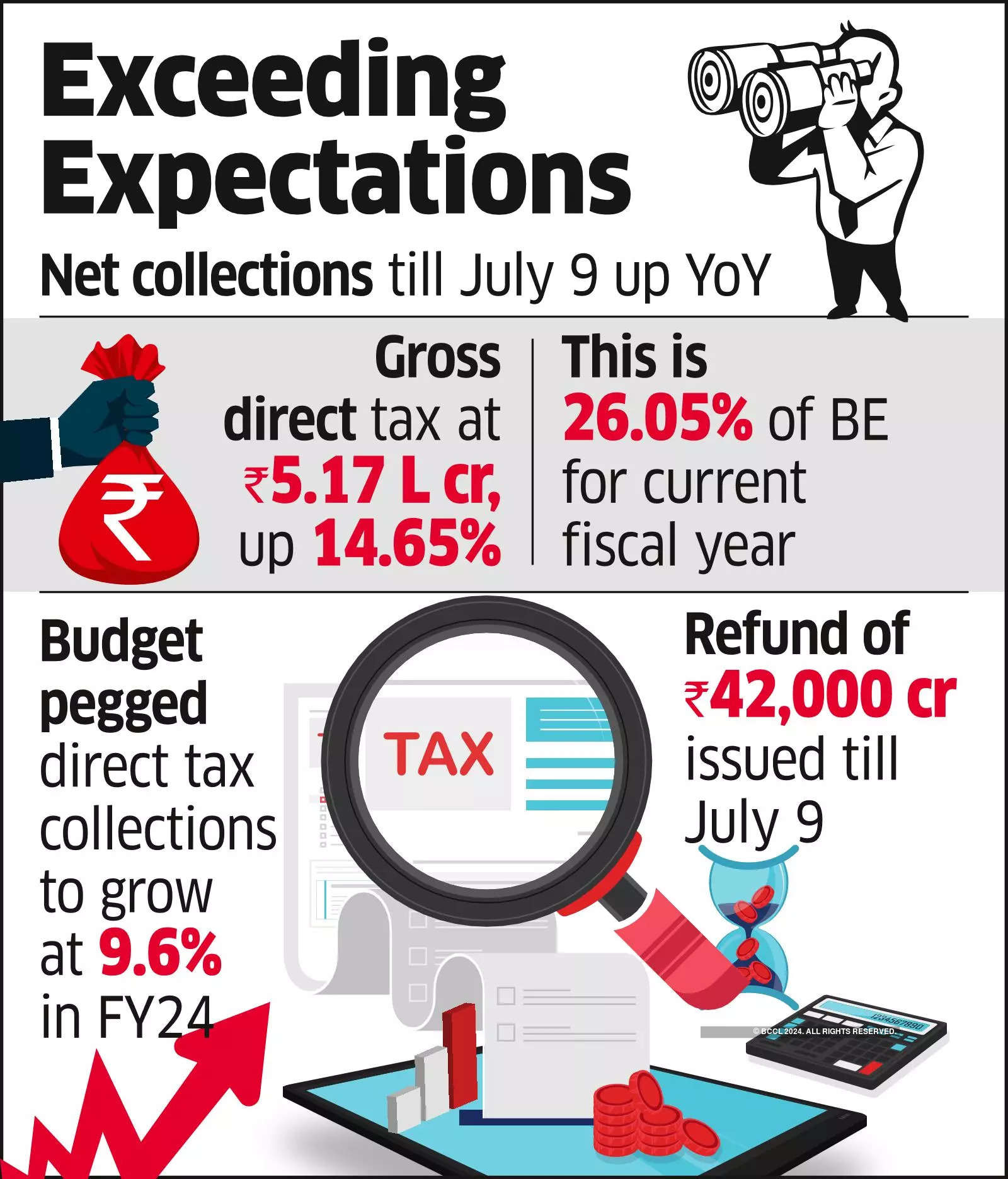

The Central Board of Direct Taxes, the apex direct taxes body, said in a statement the collections touched 26.05% of FY24 budget estimate for direct taxes pegged at ₹18.23 lakh crore.

Collections are in line with other data that point to sustained recovery despite global headwinds including goods and services tax collections and automobile sales. GST mopup rose 12% in June to ₹1.61 lakh crore from the year earlier and automobile companies reported a sixth straight month of sales of 300,000-plus units.

According to the data, gross direct tax collections stood at ₹5.17 lakh crore, 14.65% higher than last year.

Tax experts say administrative reforms and digitisation had begun to have an impact.

“The trend yet again underlines enduring benefits of significant administrative reforms and digital adoption seen over the past couple of years,” Sumit Singhania, partner, Deloitte India, said.

The CBDT said refunds of ₹42,000 crore were issued during April 1, 2023 to July 9, 2023, which are 2.55% higher than refunds issued during the year-ago period.

The Centre has projected a growth of 9.6% for direct taxes in FY24.

“The big data environment will continue to enhance the quality of tax audits and reduce the time involved in such audits, both key to incentivising voluntary compliances amongst taxpayers,” Singhania added.

The government had budgeted for direct tax revenues at ₹14.2 lakh crore. The projection was raised to ₹16.5 lakh crore when the revised estimates were presented, but the actual collection exceeded it marginally at ₹16.61 lakh crore.