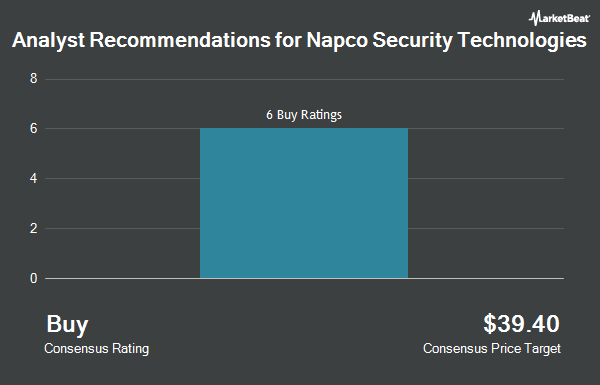

A number of research analysts recently commented on the company. 22nd Century Group reissued a “reiterates” rating on shares of Napco Security Technologies in a report on Thursday, May 18th. William Blair initiated coverage on shares of Napco Security Technologies in a research note on Wednesday, March 8th. They issued an “outperform” rating for the company. B. Riley increased their price objective on shares of Napco Security Technologies from $34.00 to $38.00 and gave the stock a “buy” rating in a report on Wednesday, February 8th. StockNews.com initiated coverage on Napco Security Technologies in a report on Thursday, May 18th. They set a “hold” rating on the stock. Finally, Lake Street Capital upped their price objective on Napco Security Technologies from $32.00 to $40.00 in a research note on Tuesday, February 7th.

Hedge Funds Weigh In On Napco Security Technologies

Large investors have recently modified their holdings of the stock. Arizona State Retirement System raised its holdings in Napco Security Technologies by 3.8% in the 4th quarter. Arizona State Retirement System now owns 8,810 shares of the industrial products company’s stock valued at $242,000 after acquiring an additional 325 shares during the period. Isthmus Partners LLC increased its stake in shares of Napco Security Technologies by 0.4% during the first quarter. Isthmus Partners LLC now owns 89,963 shares of the industrial products company’s stock worth $3,381,000 after purchasing an additional 352 shares during the period. HighTower Advisors LLC increased its stake in shares of Napco Security Technologies by 0.3% during the fourth quarter. HighTower Advisors LLC now owns 130,187 shares of the industrial products company’s stock worth $3,576,000 after purchasing an additional 434 shares during the period. Ameritas Investment Partners Inc. lifted its holdings in Napco Security Technologies by 21.0% during the 1st quarter. Ameritas Investment Partners Inc. now owns 2,529 shares of the industrial products company’s stock worth $95,000 after purchasing an additional 439 shares during the last quarter. Finally, Jane Street Group LLC boosted its stake in Napco Security Technologies by 4.0% in the 4th quarter. Jane Street Group LLC now owns 11,926 shares of the industrial products company’s stock valued at $328,000 after purchasing an additional 458 shares during the period. 84.49% of the stock is owned by institutional investors.

Napco Security Technologies Price Performance

NSSC stock opened at $37.78 on Monday. The business’s 50-day moving average is $34.31 and its two-hundred day moving average is $30.96. The firm has a market capitalization of $1.39 billion, a P/E ratio of 42.45 and a beta of 1.15. Napco Security Technologies has a 1 year low of $18.64 and a 1 year high of $39.22.

Napco Security Technologies (NASDAQ:NSSC – Get Rating) last issued its earnings results on Monday, May 8th. The industrial products company reported $0.29 earnings per share for the quarter, beating the consensus estimate of $0.19 by $0.10. Napco Security Technologies had a net margin of 19.71% and a return on equity of 26.33%. The firm had revenue of $43.53 million for the quarter, compared to analysts’ expectations of $42.16 million. During the same quarter last year, the company earned $0.08 earnings per share. On average, analysts expect that Napco Security Technologies will post 0.95 EPS for the current year.

Napco Security Technologies Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, June 12th. Shareholders of record on Monday, May 22nd will be given a dividend of $0.0625 per share. The ex-dividend date of this dividend is Friday, May 19th. This represents a $0.25 dividend on an annualized basis and a yield of 0.66%. Napco Security Technologies’s dividend payout ratio (DPR) is 6.74%.

Napco Security Technologies Company Profile

Napco Security Technologies, Inc engages in the development, manufacture, and distribution of security products. Its products include access control systems, door security products, intrusion and fire alarm systems, video surveillance products, and cellular communications services. The company was founded in 1969 and is headquartered in Amityville, NY.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Napco Security Technologies, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Napco Security Technologies wasn’t on the list.

While Napco Security Technologies currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.