Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

With commercial real estate in the doldrums, there is one sector that just about everyone seems to think could give London property a new lease of life.

Lab space for life sciences companies is seen by landlords as a source of demand that could fill gaps left as office occupiers cut back. Take Canary Wharf, in London’s Docklands. Vacancy rates in its outcrop of skyscrapers are expected to approach 20 per cent this year, thinks Green Street. Owners Brookfield and the Qatar Investment Authority hope that courting life sciences, with specialist lab space, will help take up some slack. It is far from the only property developer betting on this sector.

London, which forms one corner of the UK’s so-called golden triangle with Oxford and Cambridge, does not have much specialist lab space. The capital may seem an odd place to put higher-cost labs. But it is where the country’s tech talent — increasingly in demand from biotechs — is most abundant.

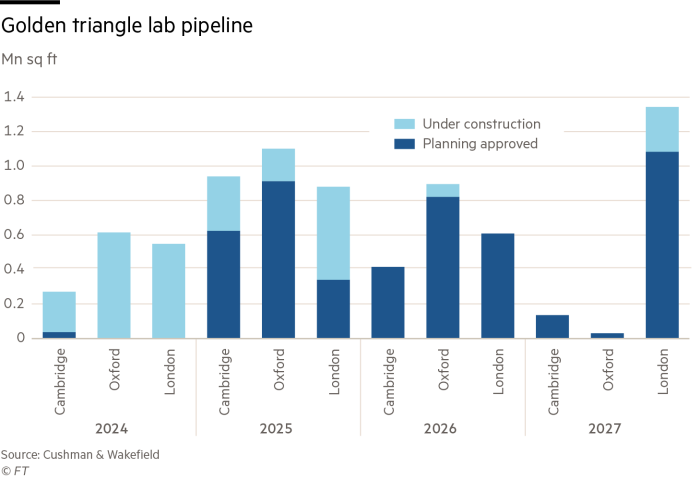

In total, the city has about 700,000 sq ft of lab space, according to Cushman & Wakefield, or about 15 per cent of Cambridge’s stock of space. Take-up for labs across the three cities was about 925,000 sq ft last year, just 92,000 sq ft of which was in London. Vacancy rates are in the low single digits.

Canary Wharf plans to create a life sciences hub in Docklands: One North Quay, with 800,000 sq ft of dedicated life sciences buildings, will include Europe’s largest with about 300,000 sq ft of lab space. It has planning permission and could be completed by 2027.

The trouble is that competitors are already building into this perceived opportunity. British Land has a head start on a new lab quarter. Its Regent’s Place campus is located on the doorstep of Imperial College, UCL and the Francis Crick Institute.

In fact, there is about 1mn sq ft of lab space under construction in London, due for delivery this year and next — with only about a third already under offer. There is twice that amount with planning permission. Lab space is costly to build. But the appeal may be London rents that at present reach £130 per sq ft, well above prime offices at £100 per sq ft, and about twice what labs cost in Oxford and Cambridge.

Given London’s tiny market to date, developers seem to be betting that those rents will hold firm as more space hits the market, adopting a “build it and they will come” approach to this nascent sector. Not everyone will be right.