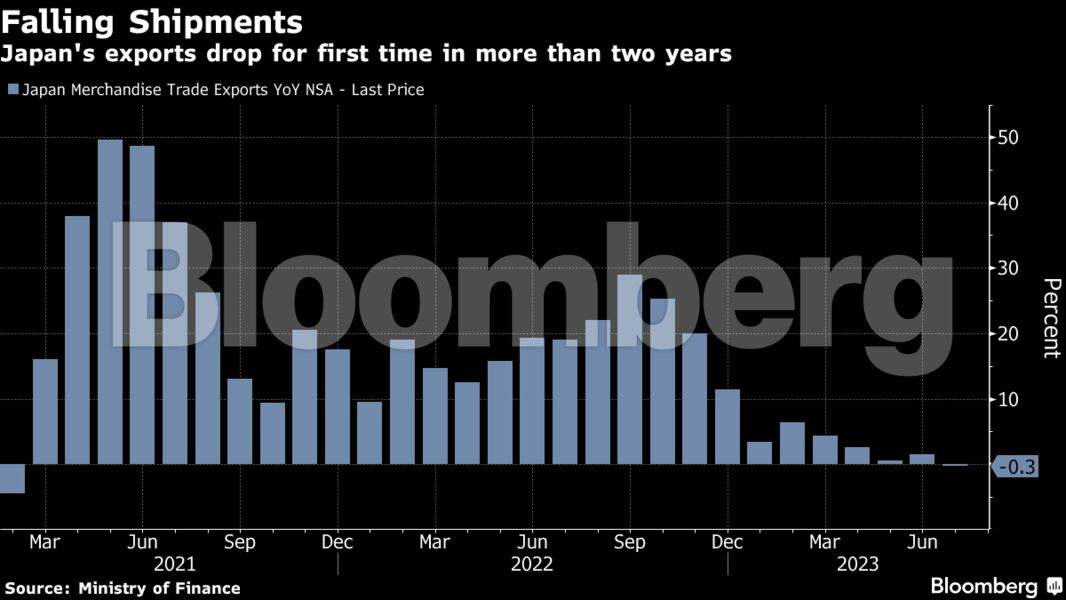

The value of exports fell 0.3% in July from a year earlier, retreating for the first time since February 2021 as sharp falls in shipments of chip-making gear and parts outweighed a jump in demand for cars, the finance ministry reported Thursday. Economists had forecast a 0.2% decline.

Imports fell for a fourth month, sliding 13.5% from the previous year, the steepest decline since September 2020 as commodity prices ease. Economists had estimated they would fall by 15.2%.

Bloomberg

BloombergThe trade balance slipped back into the red, with a deficit of 78.7 billion yen ($538 million) after a 43 billion yen surplus in the previous month. Economists had expected the surplus to widen to 47.9 billion yen.

The figures come days after data showing the economy grew at a 6% annualised pace in the second quarter, with much of that expansion powered by external demand. Combined with signs of sluggish domestic demand — household spending fell for a fourth straight month in June — the data add to the case for Bank of Japan Governor Kazuo Ueda and his board to retain their ultra-easy policy as authorities wait to see if recent gains in wages become a trend.

What Bloomberg Economics Says…

“Japan’s export engine — which powered a surprisingly strong pickup in growth in the second quarter — entered 3Q23 sputtering, with outbound shipments falling in July. The adjusted trade deficit widened slightly, suggesting net exports could drag on the economy.”— Taro Kimura, economistExports data continued to highlight uneven economic conditions overseas. Shipments to the US rose by 13.5% from a year ago, a slightly faster pace than in the previous month, and those to Europe increased by 12.4%. Meanwhile, exports to China, Japan’s biggest trading partner, slid by 13.4%, the largest drop since January, with shipments of cars and chips and chip components dipping at double-digit clips.

Shipments to China fell for an eighth consecutive month, a trend that may persist as economic activity cools. The world’s second largest economy saw slower-than-expected growth in the second quarter, prompting economists to slash their forecasts for 2023 growth.

Exports to the US were powered by shipments of cars, which rose 34% as supply-chain glitches were ironed out. Japan also shipped more cars to Europe.

It’s unclear if that demand will be sustained. Leading economic indicators in the US and Europe have shown signs of slowing, partly due to continued interest rate hikes.

“The automobile industry has been recovering, but this trend will soon run its course,” said Makoto Ishikawa, senior research associate at Itochu Research Institute. Once it runs its course, “Japan’s exports to Europe and US will weaken.”

In its latest Outlook report, the BOJ noted that external demand may flag in the months ahead, saying, “Exports and production are projected to be affected by the slowdown in the pace of recovery in overseas economies.”

By product, exports of mineral fuel fell by 60%, the biggest drag, while shipments of chips and chip manufacturing equipment declined by 27%.

“Deteriorating semiconductor market conditions pushed down prices, putting downward pressure on overall exports,” said Ishikawa.

The decline in imports comes as commodities prices have declined. Brent averaged about $80 a barrel in July, down from around $105 a barrel in the same period last year. That drop signals that commodity-driven inflation is easing in line with the BOJ’s view.

The yen’s retreat to the weakest since November is offsetting some of that impact by pushing up the costs of imported goods. For Thursday’s trade data, the average exchange rate was 142.32 yen against the dollar, as Japan’s currency weakened by 4.6% compared with a year earlier.

The deterioration in the trade balance comes even as inbound tourism helps bring money into the country. The number of foreign visitors to Japan topped 2 million for a second consecutive month in July, recovering to about 78% of pre-pandemic levels.

That effect could build in coming months after China last week ended a ban on group tours to Japan. Daiwa Institute of Research estimates that Chinese tour groups will boost inbound spending by about 200 billion yen to roughly 4.1 trillion yen ($28.2 billion) this year.

The weak yen is fuelling the strong interest among tourists in visiting Japan. It should also help boost the profits of exporters, but it also puts upward pressure on import bills.

“Continued yen depreciation will increase the amount paid overseas,” said Shuji Tonouchi, senior economist at Mitsubishi UFJ Morgan Stanley. “In the short term it’s a negative, deteriorating factor for the trade balance.”