“Given the high market volatility over the past three years, it makes sense to invest in companies which are not only profitable but also provide dividends to shareholders,” said Harshvardhan Roongta, CFP, Roongta Securities. He added that such companies are safe havens as they protect the downfall of the portfolio value to a certain extent.

In terms of taxation, it is profitable to invest in dividend yield funds rather than directly buying the stocks of dividend paying companies. Rupesh Bhansali, head of mutual funds at GEPL Capital, noted that dividends in the hands of investors are taxed at the marginal tax rate, which is 30%, at the higher end of the tax slab and may also incur a surcharge while the tax structure for mutual funds is more favourable. “The long-term capital gains tax on mutual funds is 10%, which makes investment in dividend yield funds more tax efficient,” Bhansali added.

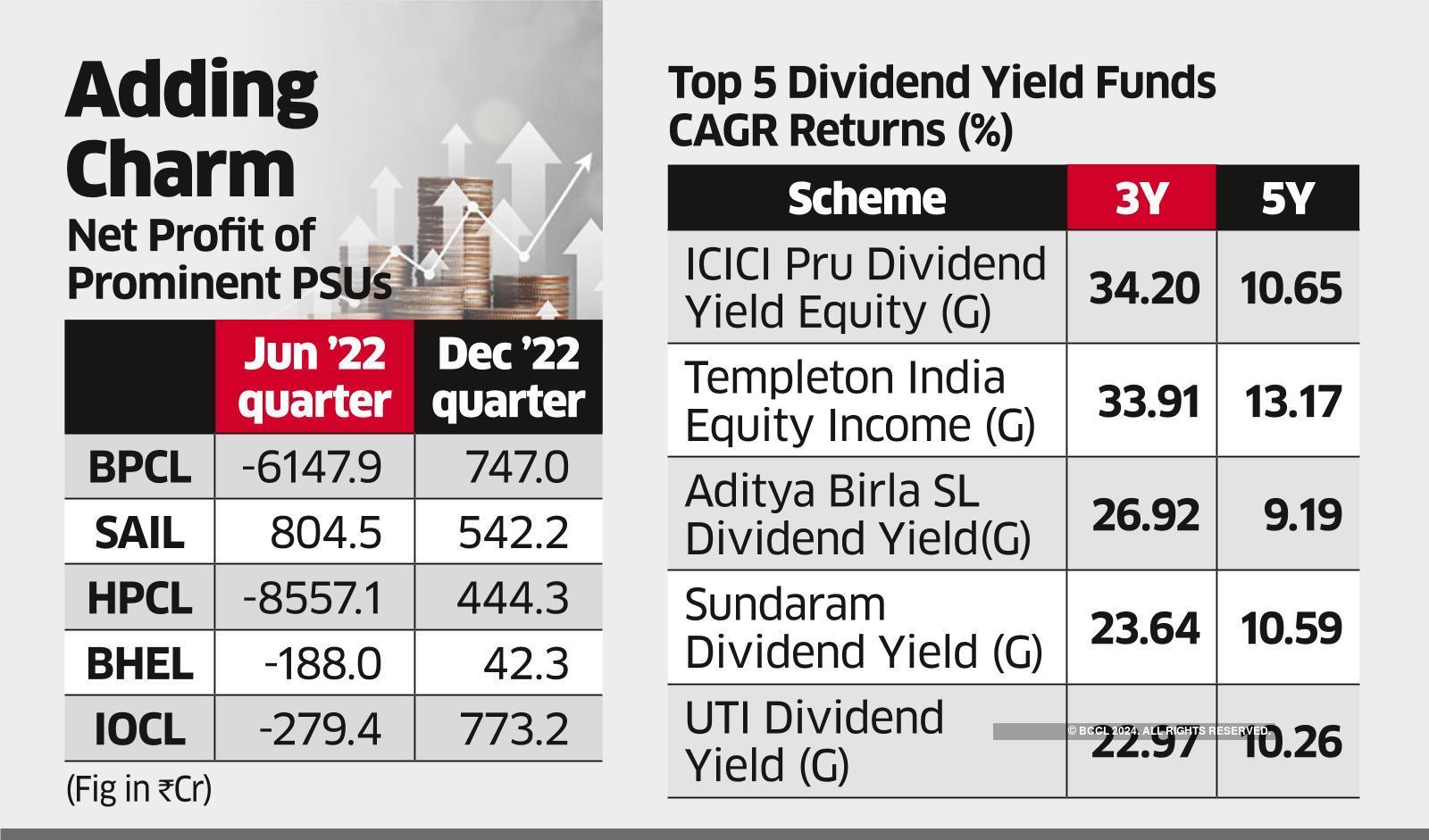

Another reason for the rising popularity of dividend yield funds is improving profitability of the public sector undertakings (PSUs), which form a large part of dividend yield funds.

PSUs such as BPCL, SAIL, BHEL, REC, Power Finance Corporation, Hindustan Aeronautics, Engineers India and Coal India have either turned profitable or recorded stable or increasing profits. This has added to the attractiveness of these funds.