The Sensex ended at 59,910.75, down 520.25 points or 0.86%, from Thursday’s close. The Nifty declined 121.15 points or 0.68% to end at 17,706.85. Both indices had fallen as much as 1.4% earlier in the day.

Among Asian indices, shares in Hong Kong and mainland China advanced more than 1%, while Japanese indices ended in positive territory. The pan-Europe index Stoxx 600 ended flat, giving up early gains. The Wall Street indices – Nasdaq Composite, S&P 500 and Dow Jones Industrial Average – were trading flat at the time of going to press.

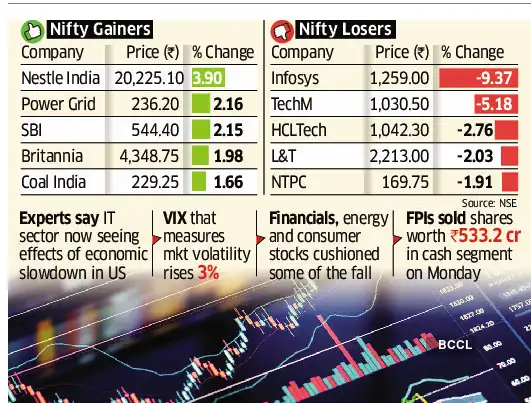

Infosys shares tanked 10%, hitting the lower circuit before extending declines. The negative sentiment rubbed off on other Indian tech stocks too and the Nifty IT index fell to its lowest in nearly two years. LTIMindtree (-6.8%) and Tech Mahindra (-5.3%) were among the top five losers in the NSE 500 universe on Monday.

“There will be more hiccups along the way, not just for India, but for globally before things get better again,” said Andrew Holland, CEO, Avendus Capital Alternate Strategies.

FPIs Sold Shares Worth Rs 533.2 crore

“The IT sector has had a good run for the last few years, but it is seeing the effects of economic slowdown in the US. That will lead to more downgrades in the IT sector in the near term,” said Holland.

Financials, energy and consumer stocks also cushioned some of the fall. The Bank Nifty – carrying the highest sectoral weightage on the benchmark indices – closed at 42,262.55, up 130 points or 0.31% from the previous close.

The Sensex and Nifty touched their two-month highs last week. Indian markets were closed on Friday for Ambedkar Jayanti.

The broader markets closed in the green on Monday. The NSE Midcap 150 index advanced 0.4% and the NSE Smallcap 250 index ended up 0.2%.

India’s Volatility Index – a measure of the market’s expectation of volatility over the near term – rose 3% to 12.26%.

On Monday, foreign portfolio investors (FPIs) were net sellers in the cash segment, ending their buying spree for the previous 10 days. Overseas funds net sold shares in the cash segment worth Rs 533.20 crore while domestic institutions were net sellers to the tune of Rs 269.65 crore, according to provisional stock exchange data.

Brokers expect the Sensex and Nifty to continue swinging in a tight band in the foreseeable future.

“Indian equities are witnessing time-correction with some modest price correction also,” said Pratik Gupta, CEO and co-head, institutional equities, Kotak Securities. “The magnitude of the slowdown in the US and the impact of the Indian monsoon season, on agricultural output and therefore inflation, will give direction to our markets.”

Gupta said Indian equities are cheap when compared with other emerging markets (EMs), with their own historical valuations, or even the bond yields. “Premium valuations coupled with the risk of some more earnings downgrades in the near term reduces the scope for a market rally in the near term,” said Gupta.

The Sensex and Nifty trade around 21-22 times their price-to-earnings (PE), a premium to their historical average of 16-17 times, as per Bloomberg data.