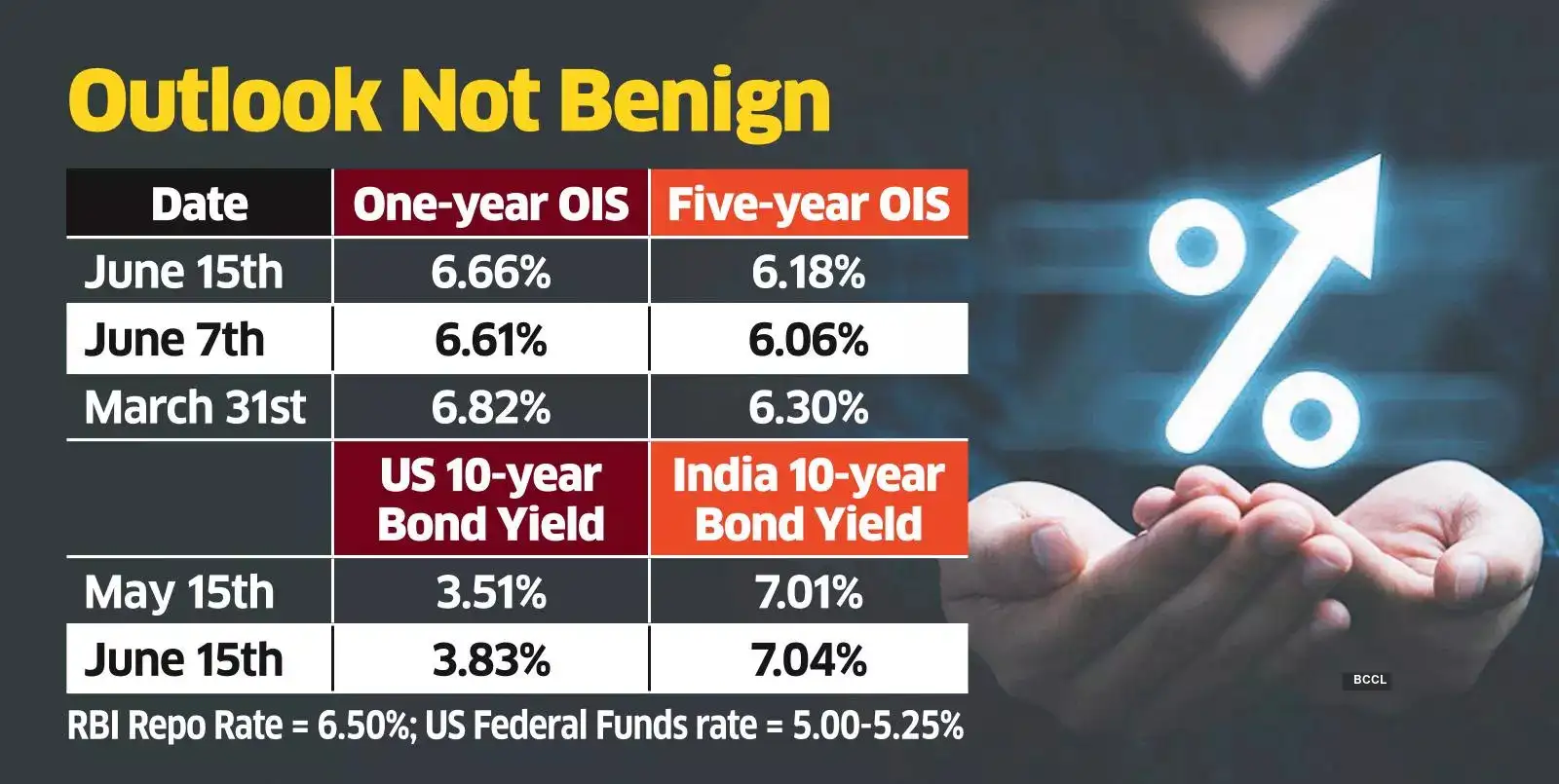

Overnight Indexed Swap (OIS) rates, an indicator of how the Reserve Bank of India (RBI) may act on policy rates, have climbed over the past eight days, reversing earlier optimism that rates were likely to head lower in the last quarter of calendar 2023.

The two events that have led to the reset in domestic interest rate expectations are the policy statements by the RBI and the US Federal Reserve on June 8 and June 14, respectively. Both central banks flagged persistent inflation concerns.

Since June 8, rates on the one-year and five-year OIS – two of the most liquid contracts – have risen 5-12 basis points. At current levels, OIS rates indicate a shallow cut in the repo rate from its current level of 6.50% by April 2024, traders said.

“The new theme is one of rates staying high for longer. US yields and consequently, domestic OIS rates are reflecting that. The bets on rate cuts in October-December are off now,” said Naveen Singh, head of trading at ICICI Securities Primary Dealership. “The earlier expectation was that the Fed will over-tighten and then compensate by cutting rates swiftly as growth suffers. But growth is resilient both in India and the US, and inflation is coming down slowly,” he said.

Prolonged Pause?

The RBI acted in line with expectations by holding off on rate hikes for the second consecutive policy meeting. However, the central bank’s repeated stress on bringing inflation back to its 4% target and the need to see a sustained fall in core inflation have left traders all but convinced that rates are likely to remain at their current levels through the current year.

This is more so as the central bank itself is projecting Consumer Price Index inflation at 5.1% in FY24.

“In the June 8 policy meeting, the RBI’s comments came across a shade hawkish, and appropriate, at a time of high global uncertainty. We do not expect any change in India’s policy repo rate in 2023,” HSBC’s economists Pranjul Bhandari and Aayushi Chaudhary wrote in a June 13 note.

The signals emanating from the world’s largest economy are similar. The US Fed may have this week refrained from raising rates for the first time in 10 policy meetings, but its economic projections suggest rates being raised further later in the year.

“Markets have been complacent, predicting rate cuts. There could be significant corrections, given that expectations must be reversed from cuts to hikes,” said Sandeep Bagla, CEO of Trust Mutual Fund.

Continued tightening by the Fed could further narrow the interest rate differential between India and the US, posing complications for the RBI when it comes to rate cuts. A shrinking rate differential holds risks for the rupee’s exchange rate.