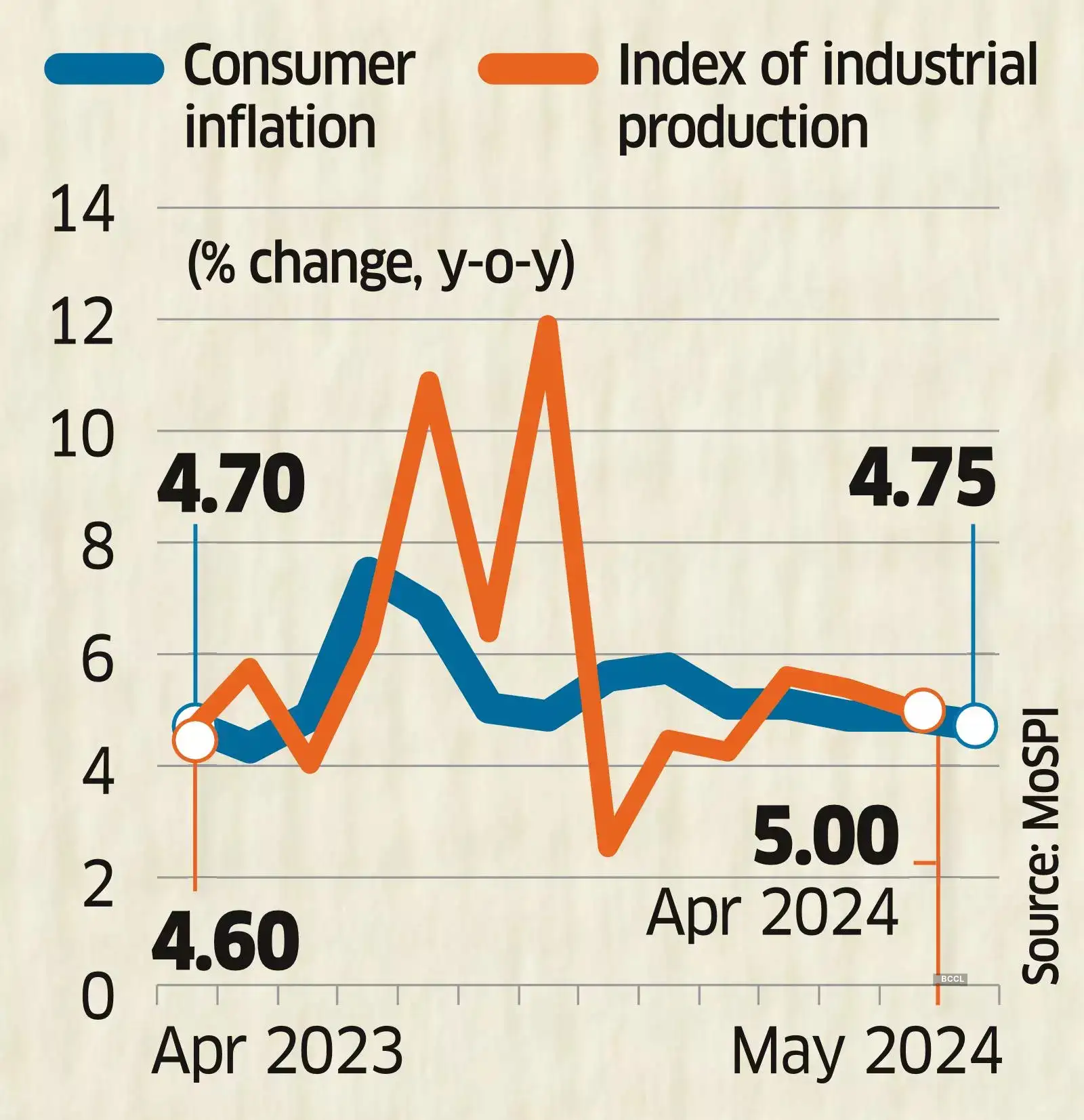

Economists contend that despite the marginal drop in consumer inflation, the Reserve Bank of India (RBI) will keep rates on hold until the second half of the year until there is clarity on food inflation risks. Retail inflation was 5% in April while food inflation printed at 8.7% in the month. Industrial production grew 5.4% in March.

“If food inflation moderates, we expect the RBI to cut the policy interest rate by a shallow 50 basis points (bps) in two tranches in the second half of the fiscal year,” said Rajani Sinha, chief economist, CareEdge.

The Monetary Policy Committee of the Reserve Bank of India kept the policy rate unchanged for the eighth consecutive time at last week’s meeting.

Food Inflation Concerns Loom

The central bank retained its inflation forecast at 4.5% for the year but raised India’s growth estimate to 7.2%. “Strong growth conditions have provided RBI policy space to remain on pause till there is further clarity on food inflation risks,” said Gaura Sengupta, chief economist, IDFC First.

The Indian economy delivered a higher-than-expected 8.2% growth in FY24. On Tuesday, the World Bank revised India’s FY25 growth estimate upward to 6.6% from the 6.4% projected earlier.

“Aside from the higher food inflation, there is an incremental risk to inflation from the increase in global commodity prices, particularly industrial metal,” said Sinha.

Sequentially, food prices rose at about the same pace as in April at 0.7%. Among food categories, vegetables continued to be high for the seventh consecutive month, coming in at 27.3% in May compared to 27.8% in March. The double-digit inflation in pulses, which has sustained for a year, gathered pace with a 17.1% rise in May. Rural inflation (5.28%) remained higher than urban inflation (4.15%) for the 11th consecutive month.

Core inflation slowed further to 3.1% in May from 3.2% in the previous month.

Economists pointed out that a favourable base effect is likely to keep headline inflation contained in the coming months.

This “is expected to lead to a sharp albeit temporary fall in the CPI (consumer price index) inflation to 2.5-3.5% in July 2024 and August 2024,” said Aditi Nayar, chief economist, Icra.

MANUFACTURING TAKES A TOLL

Softer manufacturing growth (3.9%) pulled down overall industrial output growth for the second consecutive month in April.

The growth in the other two major industries, electricity and mining, was higher at 10.2% and 6.7%, respectively, compared with 8.6% and 1.3% in March.

While the infrastructure industries (8%) continued to post stronger growth numbers, capital goods production growth more than halved to 3.1% from 6.6%.

Consumer durables production grew faster at 9.8% in April compared with 9.5% in the previous month, but non-durable production contracted 2.4% from a growth of 5.3% in March.