The A320 Neo family consists of the A320Neo, A321Neo and A321 XLR aircraft.

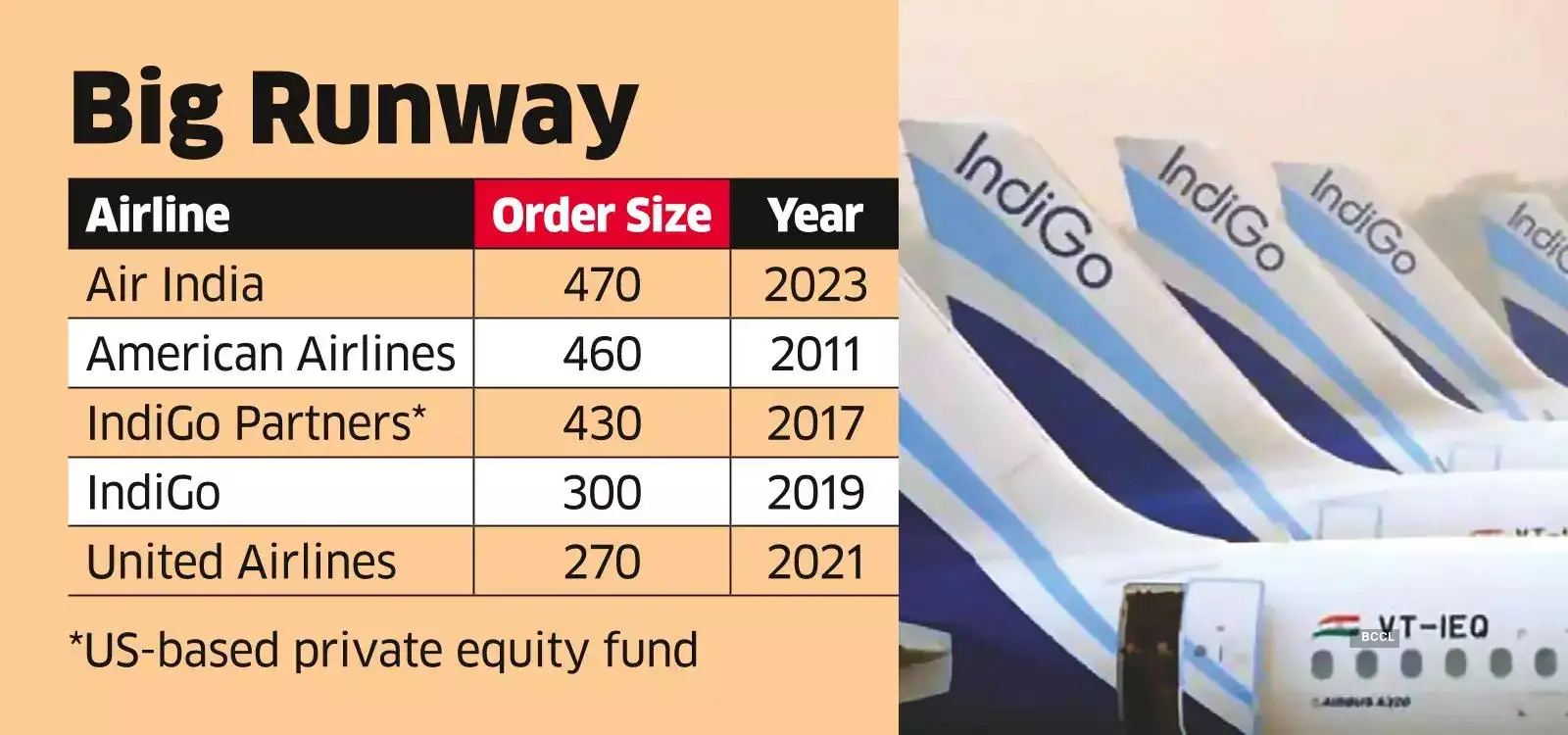

The order will be the largest in the history of aviation topping Air India’s order of 470 aircraft placed in March. IndiGo has pending delivery of 477 aircraft of the same A320 family by 2030. This order will ensure that the airline gets an uninterrupted supply of new aircraft in the next decade as it expands its fleet.

IndiGo, which has over 60% of India’s domestic market, has leveraged its expanding and large fleet to launch new flights to capture a disproportionate market share as rivals struggled.

“The airline wants to ensure delivery slots so that fleet size remains steady. It will retire around 100 aircraft by 2030 and needs fresh planes to maintain the targeted fleet size of over 700 in the coming decade,” said a person aware of the development.

IndiGo refused to comment on the order.

Airlines have placed a slew of new aircraft orders following a sharp recovery in air travel after Covid, filling up order books at Airbus and Boeing.

A global supply chain disruption has delayed the production of new aircraft resulting in carriers having to wait until the end of the decade to get delivery of A320Neo aircraft – the most popular single-aisle aircraft.

The airline is likely to order 300 longer-range A321 Neo and A321 XLR aircraft showing the company’s intention to increase international exposure. These longer-range aircraft can operate flights for up to eight hours and will be crucial for IndiGo’s plan of expansion into Europe.

The airline currently flies to 26 international destinations with 75 international city pairs. The airline plans to increase its international seat share from 23% in FY 23 to 30% in the next two years, IndiGo CEO Pieter Elbers had said earlier.

The aircraft has two engine options — Pratt & Whitney, and CFM International- a joint venture of Us and French company GE and Safran. The company will make a decision on the engine later.

People aware of the development said Boeing made a strong pitch to IndiGo for the 737 Max aircraft, but the airline is likely to go with the A320Neo which will ensure fleet commonality- a key reason why the airline maintains one of the lowest unit costs in the world.

IndiGo is now facing a resurgent Air India under the Tata group but is convinced that its superior cost-efficiency model will keep it ahead of competitors as Indian aviation undergoes consolidation.

The airline also expects an advantage in terms of lease rates as it has established its creditworthiness during Covid when it didn’t default on any lease repayments. “The growth rate in our second decade will be significantly higher than what it has been during the first decade,” Chief Financial Officer Gaurav Negi had earlier told ET.

Over the last three months, the airline’s share price has rallied over 30% to Rs 2426 a share, giving it a market value of nearly Rs 94,000 crore.