The finance ministry held a meeting with multilateral lenders on March 7 and sought their inputs on what it termed a “budget-plus and finance-plus” strategy, which would essentially cover the entire spectrum of project execution and go beyond just planning and financing, people aware of the details told ET. The ministry has reached out to various multilateral bodies to help mobilise other development finance institutions (DFIs) and investors, they said.

The ministry wants these MDBs – such as the World Bank and the Asian Development Bank – to also help develop strategies to reduce time and cost overruns, and enable knowledge and technology transfers, among others, they said.

The move comes amid expectations that various international entities – both public and private – could show greater alacrity in investing in Indian projects if these are backed by MDBs that enjoy top credit ratings and governance standards.

It’s also part of the broader government effort to further bolster infrastructure creation to spur economic growth and employment.

Promising Support

For their part, representatives of the MDBs have promised to support in “whatever ways we can,” expressing their confidence in the India growth story, said one of the persons cited.

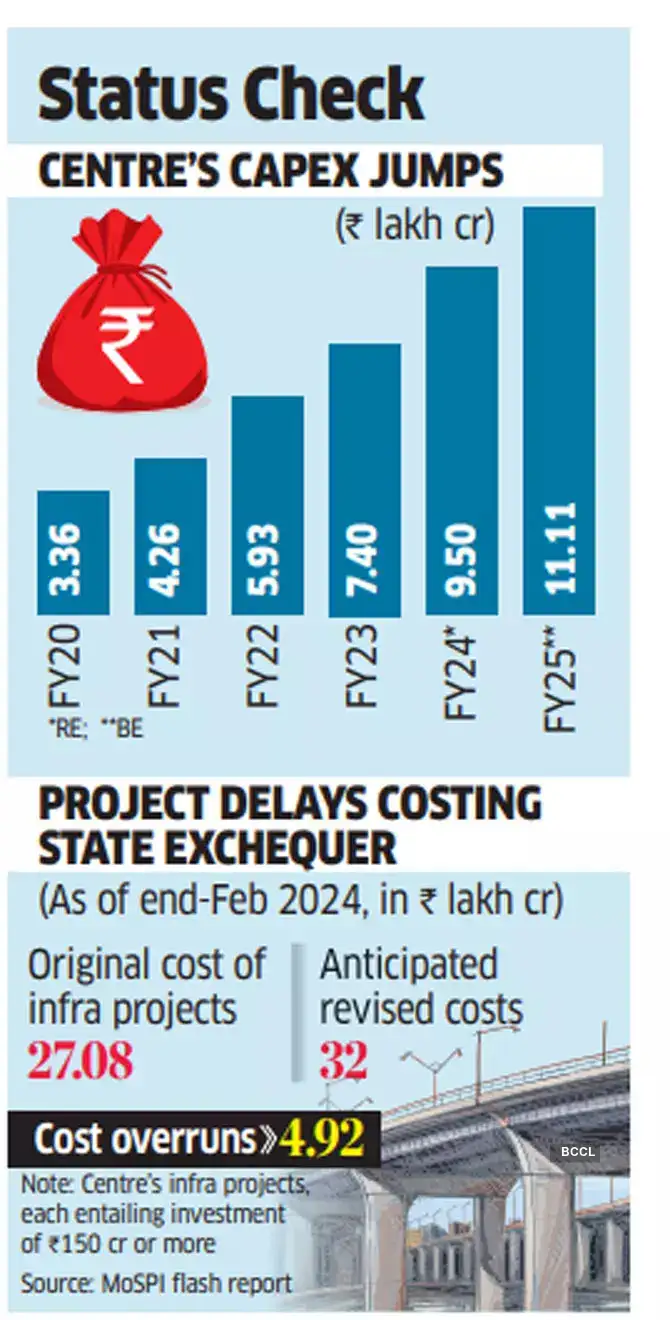

As of February, 764 of 1,902 infrastructure projects – each involving investments of Rs 150 crore or more – were delayed, according to the government’s latest flash report. This has inflated the cost of these projects by Rs 4.92 lakh crore from the original projections to Rs 32 lakh crore now. Cost overruns vis-a-vis original project costs, however, eased a tad in February to hit a three-month low of 18.2%.

The central government’s capital spending outlay for FY25 has been raised by 17% upon the revised estimate for this fiscal to a record Rs 11.11 lakh crore, exceeding the revenue expenditure hike of over 4%.