The capex of 118 companies (top 150 by revenue, excluding financial firms) crossed $80 billion in FY23.

Taking advantage of de-levered balance sheets

A record, this was nearly four times the past five-year average, shows data compiled by Bernstein Research, displaying industry’s confidence in long-term growth.

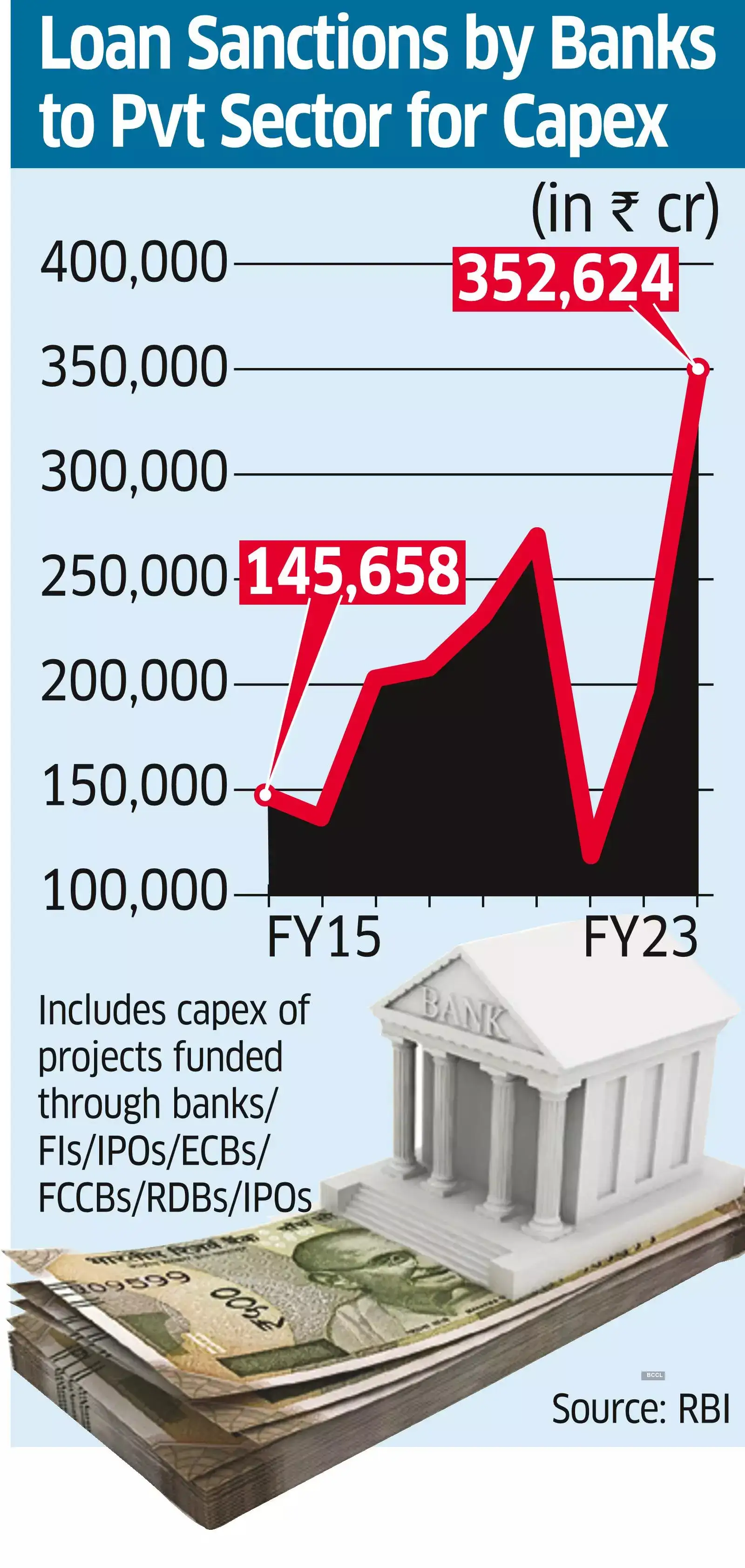

The capex tracker index of institutional research firm Avendus Spark shows a reading of 342 in June 2023 – the highest in more than 12 years. The index has been consistently rising since December 2020 – when it hit a low of 147. The index assigns weights to private capex announcement (35%), aggregate new order (15%), import of capital goods (10%), and central government capex and state capex (20% each). In order to remove the impact of seasonality, it is computed based on a four-quarter moving average. Further, loan sanctions by banks to the private sector for capex rose 80% YoY to ₹3.5 lakh crore in FY23 – a 12-year high, shows RBI data.

Private sector capex announcements stood at ₹6.2 lakh crore in the first half of FY24, as per Avendus, 40% higher than the last ten years’ average in the same period.

The propensity of India Inc to invest is upbeat, says R. Shankar Raman, Whole-Time Director & CFO, L&T. “Pre-bid consultations by potential project sponsors and RFPs (request for proposal) floated for some specific opportunities are indicators of the private sector’s appetite for capex. These opportunities are across some specific sectors like steel, cement and other construction materials, commercial and residential real estate, data centres, automobiles, airports, healthcare, infra projects sponsored by private sector concessionaires,” he said.According to L&T, orders from the private sector constituted 25% of the order book at the end of September 2023. India Inc’s FY23 capex was driven by a rising capacity utilisation rate and demand buoyancy backed by the government’s capital expenditure, the latter being a record.

Bharat Puri, MD of Pidilite, says the company has invested over ₹1,000 crore into 14 new manufacturing facilities over the last three years. “What is better than preparing for the next round of growth? Our investment plans are not based on a few quarters of challenging business scenarios, and we had in fact even invested during Covid. Businesses are all about taking a medium-term view and we are betting on long-term growth,” he said.

Meher Pudumjee, chairperson of Thermax, said, “Our capital expenditure is accelerating. Much of this is driven by a push to enhance our energy transition capabilities. The single-biggest capex is in expanding our green solutions related to the Build Own Operate model.”

With sentiment improving around the growth potential of the Indian economy, the private sector is better prepared to take advantage of their de-levered balance sheets while banks have improved their capital adequacy. The credit markets and the capital markets are supportive to financing growth opportunities available to companies in select sectors. Domestic markets continue to remain promising while inflation, slower growth in the global economies and geopolitical escalations are the current headwinds.