The demand has been so high that last year, L&T Technology Services (LTTS), which provides engineering research and development services, set up a delivery centre in Krakow, Poland, to meet the requirements of a leading US-based auto OEM. The Krakow centre will be the hub of LTTS’ activities in Eastern Europe and could help provide more value to its global customers. Over the past three years, LTTS has spent $9-10 million to develop R&D infrastructure for its EACV (electric, autonomous and connected vehicles) practices alone.

“We have an EV lab at our Bengaluru facility to test solutions faster, and an electrification and prototyping centre for next-gen solutions in Peoria in Illinois, US,” says Amit Chadha, CEO, LTTS.

The urgency among auto OEMs to move towards EACV is pushing them to work with services providers to hasten product development cycles and eventual rollout in the market. Digital technology systems, including advanced driver assistance systems, and software defined vehicles (SDVs) are helping drive this journey, say experts.

ER&D services companies provide support to auto OEMs and tier-1 component suppliers in vehicle product design and development of electric motors, car infotainment systems and algorithms for autonomous driving.

“The savviest services providers which have a strong client base are investing in and chasing critical trends to drive opportunities for growth. India has moved to a leadership position in terms of being a go-to source for digital engineering and an established, trusted location,” says Frances Karamouzis, group chief of research, Gartner. Leading services providers such as LTTS, KPIT Technologies, Tata Elxsi and Cyrient are betting big on EACV and investing in digital engineering, talent building and upskilling.

KPIT has started investing in all domains of automotive software. “OEMs need a strong partner for software just like they need one for semiconductors or cloud. This is now the focus of KPIT. Billions of dollars are being invested by vehicle makers that will determine their future business and technology roadmap,” says Kishor Patil, CEO & MD, KPIT Technologies, which has made acquisitions worth $150 million in the last few years in this area. KPIT, which offers embedded software and product engineering services to automotive companies, has developed multiple centres in North America, Europe and Asia.

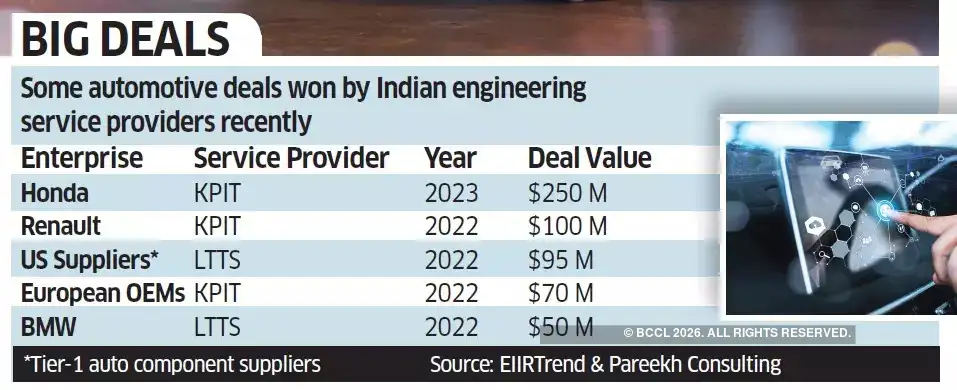

“More than 80% of our work revolves around cutting-edge SDV programmes. We are playing a key role globally in six out of nine SDV programmes,” says Patil. KPIT has tied up with Renault and Honda as its software integration partners.

Auto enterprises are partnering with IT services providers for exploring new technology applications. Recently KPIT and ZF, the Germany-headquartered company that supplies systems for passenger cars and commercial vehicles, entered into a partnership to create solutions for automotive systems. Capgemini and Audi have launched a joint venture, XL2, which provides digital technology in the fields of SAP and cloud services.

Tata Elxsi has won multiple deals in the EACV space over the past two years and counts Jaguar Land Rover its biggest customer in this area. Its EBITDA margin in this vertical is 30%, which is significantly higher than its peers due to new product development work and high offshore mix, according to Auto ER&D Services Primer by JP Morgan Equity Research, released in April.

NO SLOWDOWN IN ER&D SPENDS

The uncertain macro conditions have not slowed down auto ER&D spends. One of the growth drivers is EACV, and services providers are winning multi-year deals in this space. This could lead to India’s share in ER&D offshoring rising to 33% by FY32 from 25% in FY22, according to the JP Morgan report. These tailwinds will benefit auto ER&D services companies.

“Automotive industry forms a good proportion of total engineering spend (20%), a high proportion of outsourced ER&D spend (30%) and an even higher proportion of ER&D large deals (40%),” says Pareekh Jain, CEO, EIIRTrend & Pareekh Consulting.

Recent projection by industry bodies indicate that the ER&D spend patterns will remain resolute in the face of potentially adverse macro headwinds –– growing at a 6% CAGR by 2025 to reach a total of $2 trillion.

The renewed focus on newage technologies has had a positive impact on ER&D offshoring, especially in high-potential regions like India. The Indian ER&D sector is projected to be worth over $63 billion by 2025, according to NASSCOM, and most of these services providers stands to benefit. LTTS aspires to hit $1.5 billion revenue in FY25.

DEMAND FOR TALENT

Services providers are attracting talent from multiple areas and upskilling them in different operating systems. KPIT Technologies, which added 3,800 employees to its workforce last fiscal, says it is bringing in people from banking, semiconductor and technology companies.

“We say the automotive industry is the coolest industry right now,” says Patil of KPIT Technologies.

Demand for digital engineering talent continues to outstrip supply. This is a key factor in driving offshoring, especially in developed economies. However, there is also a strong trend in favour of developing local talent to address the shortfall. Companies like LTTS are expanding their footprint across Poland, France, Canada and the US. “We have plans to add over 1,000 local engineering talent across global centres and in India. In the first quarter of FY24, we are likely to add around 500 engineers,” says Chadha of LTTS.

“The ebb and flow of talent supply and demand certainly impacts pricing of deals,” says Karamouzis at Gartner.

“India is in a sweet spot because in no other geography can enterprises get digital talent at scale and cost-effective price points,” says Jain.

Indian engineering services providers have been developing automotive talent both in house and in collaboration with the academia. With Indian OEMs and startups starting and scaling up EV programmes, the requirement and sources of automotive talent have gone up.

Patil, an executive council member of NASSCOM and chair of its ER&D council, says building a strong talent pipeline and equipping Indian companies to maximise engineering opportunity is a focus area.

There is a lack of digital engineering talent in client geographies, which is leading to more work coming to Indian ER&D companies that are better placed in that area, thanks to the abundance of engineers in the country.

As technologies evolve, particularly in the field of AI and connectivity, reskilling of engineering talent will be crucial. LTTS, with its Global Engineering Academy, is onboarding freshers across locations, and conducted over 444 training sessions in the last fiscal. It has enhanced the skillsets of over 4,500 engineers, including at its Krakow centre.

“At LTTS, we have unlocked capabilities with the adoption of digital technologies, which are also driving new investments,” says Chadha.