For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, ‘Long shots almost never pay off.’ Loss making companies can act like a sponge for capital – so investors should be cautious that they’re not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Dayang Enterprise Holdings Bhd (KLSE:DAYANG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Dayang Enterprise Holdings Bhd

How Fast Is Dayang Enterprise Holdings Bhd Growing?

If you believe that markets are even vaguely efficient, then over the long term you’d expect a company’s share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Dayang Enterprise Holdings Bhd has achieved impressive annual EPS growth of 53%, compound, over the last three years. While that sort of growth rate isn’t sustainable for long, it certainly catches the eye of prospective investors.

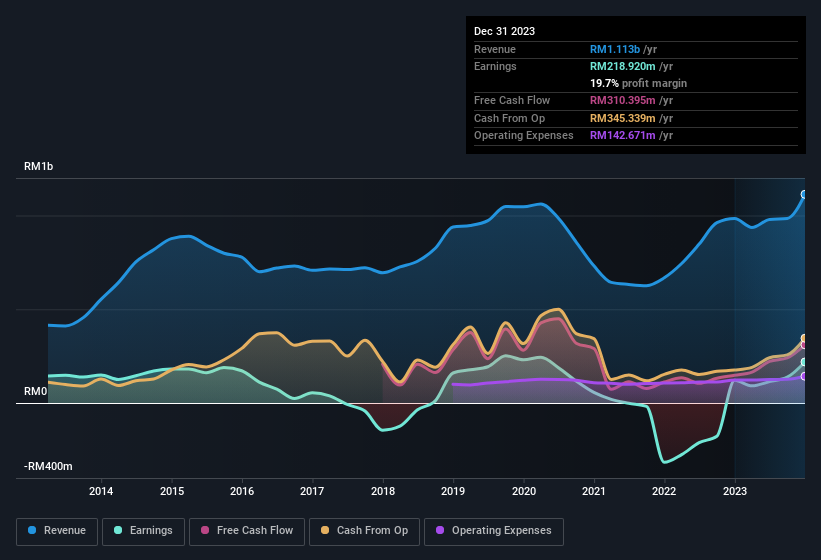

It’s often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company’s growth. The good news is that Dayang Enterprise Holdings Bhd is growing revenues, and EBIT margins improved by 8.7 percentage points to 30%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company’s bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we’ve got access to analyst forecasts of Dayang Enterprise Holdings Bhd’s future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Dayang Enterprise Holdings Bhd Insiders Aligned With All Shareholders?

It’s pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Dayang Enterprise Holdings Bhd insiders have a significant amount of capital invested in the stock. Holding RM438m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. Amounting to 16% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

It’s good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between RM955m and RM3.8b, like Dayang Enterprise Holdings Bhd, the median CEO pay is around RM959k.

Dayang Enterprise Holdings Bhd’s CEO took home a total compensation package of RM385k in the year prior to December 2022. That’s clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn’t be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Dayang Enterprise Holdings Bhd Deserve A Spot On Your Watchlist?

Dayang Enterprise Holdings Bhd’s earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The strong EPS improvement suggests the businesses is humming along. Dayang Enterprise Holdings Bhd certainly ticks a few boxes, so we think it’s probably well worth further consideration. You should always think about risks though. Case in point, we’ve spotted 1 warning sign for Dayang Enterprise Holdings Bhd you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in MY with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.