Justin Paget | Digitalvision | Getty Images

If you were fully remote or a hybrid worker in 2023, you may be curious about the home office deduction for your tax return.

While fully remote work is now less common, hybrid positions represented 13.1% of U.S. job postings in December, and nearly 20% of all applicants went to those roles, according to LinkedIn.

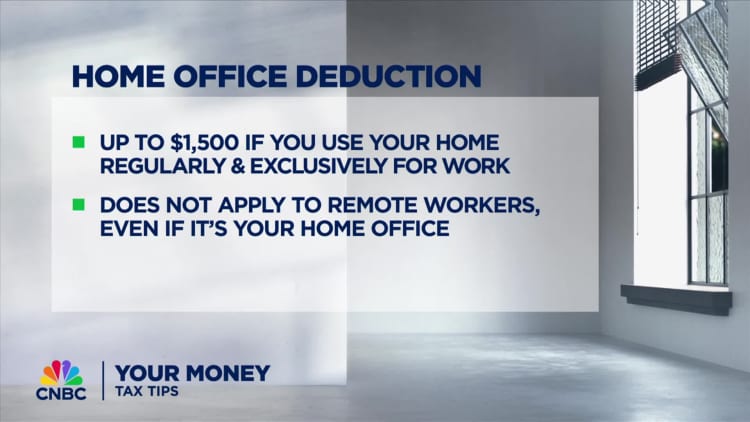

But if you’re a W-2 worker — meaning your employer withholds taxes from your paychecks — you can’t take the home office deduction for 2023 on expenses related to that work, according to certified financial planner Eric Bronnenkant, head of tax at Betterment, a digital investment advisor.

Since the Republican’s 2017 tax overhaul, there’s been no miscellaneous itemized deductions, which were subject to a 2% adjusted gross income limitation. That tax break allowed some W-2 workers to claim a deduction for unreimbursed home office expenses, explained Bronnenkant, who is also a certified public accountant.

However, you may qualify for the home office deduction for 2023 as a self-employed or contract worker, with earnings reported on Form 1099-NEC, he said.

Your office needs exclusive and regular use

Your home office must meet specific guidelines to qualify for the deduction, said CFP Sean Lovison, founder of Philadelphia-area Purpose Built Financial Services. He is also a certified public accountant.

The office needs exclusive and regular use, and must be your “principal place of business,” according to the IRS, such as a separate room in your home.

Separate structures may also qualify. “This could be a studio, garage, or barn, as long as it’s exclusively and regularly used,” for business, Lovison said.

How the home office deduction works

If you qualify for the home office deduction, there are two ways to calculate the tax break, according to the IRS.

The “simplified option” uses $5 per square foot of the portion of the home used, up to 300 square feet, for a maximum tax break of $1,500.

“It can simplify your life in a lot of ways” but it may not provide the biggest tax break, Lovison said.

By comparison, the “regular method” uses the percentage of your home used for business and deducts actual expenses, such as part of your mortgage interest, insurance, utilities, repairs and depreciation.

Regardless of the method, it’s critical to maintain detailed records of your home office expenses and use, because thorough documentation could “substantiate your deduction claim” in the event of an audit, Lovison said.