What do Bitcoin (CRYPTO: BTC), Solana, Dogecoin (CRYPTO: DOGE), and other cryptocurrencies have in common with penny stocks and sports gambling? If you guessed “they’re all places where excess capital migrates for the purpose of financial speculation,” you’re thinking along the right lines.

But why would investors prefer these risky bets when there are safer investments like real estate available? As it turns out, the situation in the real estate market is actually one of the factors driving money toward crypto — at least, it has been recently.

A cocktail of issues is freezing investors out of homeownership

As you’ve probably heard, the housing market is exceptionally difficult for buyers right now. But understanding why is key to appreciating the market’s impact on cryptocurrencies.

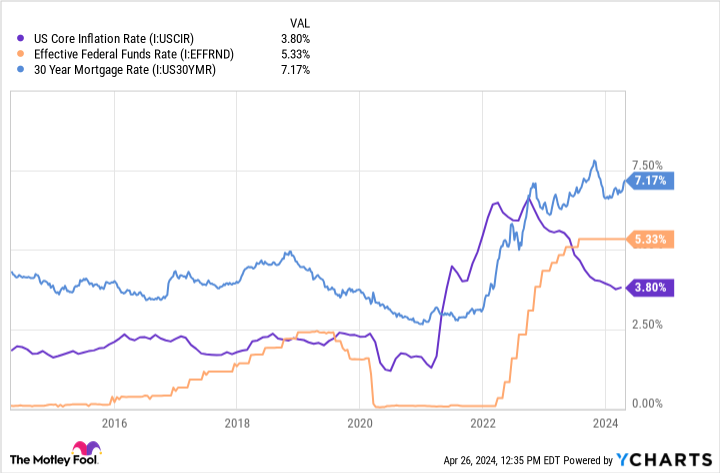

Consider this chart.

As you can see, the inflation rate in the U.S. is still somewhat elevated relative to its long-term norm of around 2% annually. In its efforts to bring inflation back down from its post-pandemic surge, the Federal Reserve rapidly hiked the benchmark federal funds rate, which determines the interest rates that banks can lend at. It’s now at a relatively high level compared to where it has been ever since the 2008 financial crisis and the Great Recession, when the Fed slashed it in an effort to hit the accelerator on the U.S. economy.

Today’s markedly higher federal funds rate has pushed the interest rates that lenders offer to would-be borrowers for mortgages upward as well. So from the consumer’s perspective, there are several problems with the current state of affairs.

First, even though the current rate of inflation has dropped significantly from last summer’s multidecade highs, those prior price increases are still baked into the prices people are paying today. This makes everyday purchases like food feel inordinately expensive, and for those whose wages have not kept pace, it may be harder to save funds for a down payment on a home. More importantly, even for those who have successfully saved up a down payment (or who already own homes with equity in them), with interest rates on mortgages significantly higher than they were up until the past couple of years, the monthly payment on a loan of any given size will be noticeably higher than it would have been.

That makes it much harder for homeowners to justify selling their homes to upgrade to a larger dwelling, for example, as their monthly payments will almost certainly skyrocket if they took out their current mortgage at any time prior to 2022. Because people are loathe to sell if they can avoid it, the number of homes on the market is unusually low.

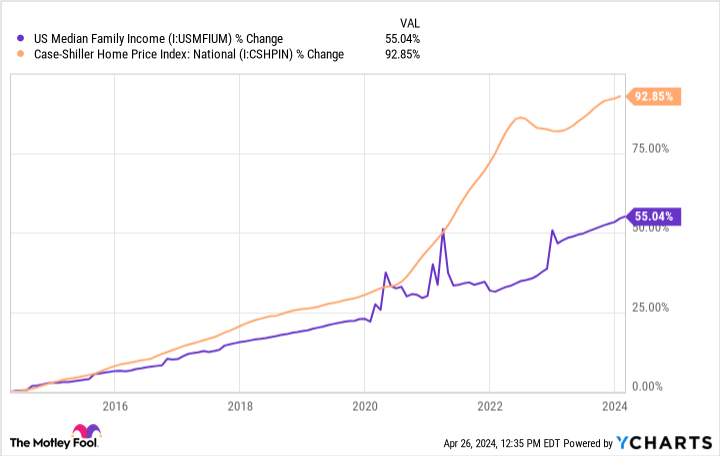

Now consider this chart.

Home prices have risen dramatically faster than the median family’s income in recent years. Today, to afford the median home at its current price, a family would need to earn at least $113,500. But the median household income today is roughly $84,000. So the median buyer can’t afford the median house, and it’ll take more than a raise or two to change that, as house prices are still rising, and inflation is still marching upward at a faster rate than the Fed would prefer.

It’s easy to see why this situation is causing a sense of gloom on Main Street. Widespread homeownership is one of the pillars of the U.S. economy. When it doesn’t appear achievable, many feel as though the American Dream is out of reach. And with the national shortage of homes estimated to be between 4 million and 7 million dwellings, the issue will not be solved anytime soon.

Even assuming that the Fed begins cutting its benchmark rate eventually and market interest rates fall, that will likely bring many aspiring homebuyers off the sidelines, creating another hot market where fierce competition between buyers causes home sales to close at prices dramatically higher than their initial listing prices.

Furthermore, people who lack access to a safe-haven investment in real estate are missing out on the asset that has been the single best financial instrument for forced saving and long-term wealth building. And it is precisely this scenario that has left so much capital free to flood into the cryptocurrency market.

Crypto is a one-stop-shop for taking risks

What’s an investor to do with excess capital if their income is not sufficient to swing the cost of a high mortgage payment?

The most obvious answer would be to invest in stocks and pursue a strategy of wealth building for the medium term by accepting a higher level of risk, perhaps by focusing on growth stocks. However, that approach, while fully reasonable, today seems too slow and unreliable to many people. The stock market historically has grown by an average of around 10% per year. Those who choose a significantly riskier mix of stocks but who are lucky enough to make excellent picks might see their portfolios compound in value by an average of 25% annually.

But growth of that magnitude — which is very rapid, and far higher than what most world-class investors are able to sustain over time — still doesn’t feel like it’s enough to secure homeownership for many people, in part because of the small amounts of capital they can allocate. In pursuit of their financial goals, they may therefore move further out toward the edge of the risk curve. And cryptocurrencies, especially the riskiest of meme coins, are an obvious market to enter in that context.

Bitcoin, with its growth of more than 1,130% over the last five years alone, is just a starting point for returns of the desired scale. Dogecoin, up more than 5,940% in the same period, may look like just the ticket for these relatively desperate investors.

Smaller and riskier cryptocurrencies can promise even higher returns in shorter periods — assuming that they don’t drop to zero or near zero, which most of them do. Many of those smaller cryptos are listed on the Solana blockchain, which is currently experiencing a flurry of meme coin investing activity.

Taking massive financial risks can backfire spectacularly, especially for those who have not diversified their portfolios beforehand. Diligent and long-term investing in stocks or blue chip cryptocurrencies like Bitcoin can almost certainly do more to support a person’s wealth-building objectives than many of these new crypto investors assume.

Still, people continue to flock to the most casino-like corners of the cryptocurrency markets, and they aren’t going to stop as long as they feel like their key financial objectives are impossible to attain with a combination of hard work and a more conservative investing approach.

So remember: As long as housing supply in the U.S. is tightly constrained and mortgages are expensive, it will be game on for crypto.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Alex Carchidi has positions in Bitcoin and Solana. The Motley Fool has positions in and recommends Bitcoin and Solana. The Motley Fool has a disclosure policy.

Here’s How the Housing Market Is Driving Cryptocurrencies in 2024 was originally published by The Motley Fool