Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Hedge funds have torn up their bets against the dollar after the US economy’s unexpected resilience sparked a rebound for the greenback in the first six weeks of the year.

Citibank, one of the world’s largest foreign exchange trading banks, said that hedge funds had switched from positioning for a decline to betting on the dollar’s appreciation.

Funds have “closed all of their short US dollar exposure in aggregate”, with their long positions now equal to more than 80 per cent of their maximum exposure over the past year, according to Citi. Late last year, they had smaller negative wagers as investors prepared for a rapid series of interest rate cuts by the Federal Reserve.

“The consensus view of dollar weakness coming into the year was wrong and people have flipped their positions,” said Sam Hewson, head of FX sales at Citi, adding that a lot of hedge funds had been forced to cover their shorts as “the early 2024 playbook was adjusted”.

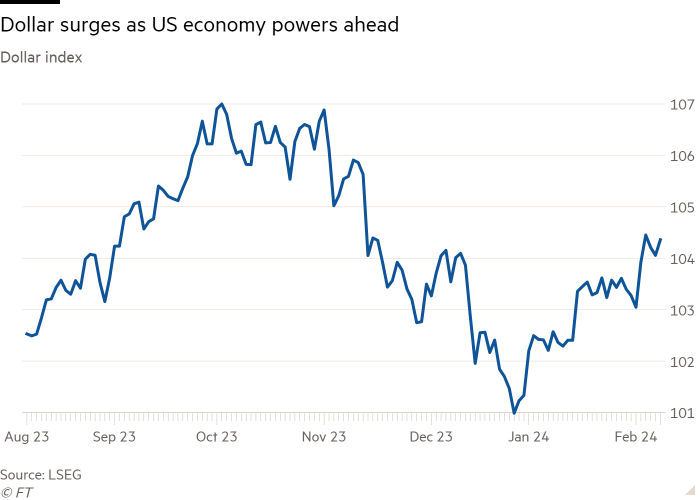

The dollar has climbed nearly 3 per cent so far this year, boosted by strong economic data, including blockbuster jobs figures last week that punctured hopes of a sharp fall in borrowing costs in the world’s largest economy.

Federal Reserve officials have also been pushing back against a slew of rate cuts priced by markets this year. On CBS’s 60 Minutes, aired on Sunday, Fed chair Jay Powell said that he expected about three quarter-point rate cuts this year. Markets are pricing in four or five rate reductions, down from six or seven late last year.

FX strategists at JPMorgan, another big foreign exchange trading bank, said that in futures markets, short positions on the dollar had now “neutralised”.

JPMorgan expects the dollar index — a gauge of the currency’s strength against a basket off rivals — will rise from its current level of 104 to between 106 and 108 by the end of June, driven by the relative strength of the US economy.

The IMF last week raised its US growth projection for 2024 to 2.1 per cent, up from a previous forecast in October of 1.5 per cent. For the euro area, it cut its growth projection to 0.9 per cent from 1.2 per cent.

“There’s a substantial amount of US growth exceptionalism relative to China and Europe and that just isn’t going away,” said Meera Chandan, co-head of global FX strategy at JPMorgan, adding that she thought the euro could fall to parity with the dollar this year, from its current level of $1.077.

JPMorgan economists predict that the Fed will lower rates for the first time in June, later than more than half of central banks globally. “If the Fed was the only game in town that’s when the dollar would be weakening quite a bit but that’s not the case,” Chandan said.

The possibility of a Donald Trump victory in this year’s presidential election — in particular the former president’s pledge to impose tariffs on imports to the US — could also become a tailwind for the dollar.

Chandan said tariffs would be likely to hurt the economic growth of US trading partners, weakening their currencies against the greenback.

The predictions of a rising dollar come after investors were stunned last week when official figures showed the US economy had added 353,000 jobs in January, almost twice as many as forecast.

“The market [previously] had a tendency to shrug off some of the better economic data as being an anomaly,” said Jane Foley, head of FX strategy at Rabobank. “The payrolls data last week was so strong [that it] was impossible to shrug off. The market couldn’t avoid the assumption that the US economy is going to be stronger for longer.”

Other investors have followed hedge funds in buying dollars in recent weeks, according to Michael Metcalfe, head of macro strategy at State Street, which is custodian to $40tn of assets. He said asset managers had been “heavy sellers” of the currency between October’s payroll report and the middle of January, but since then flows into dollar assets had resumed.

In contrast, he said asset managers had been consistently underweight euro-denominated assets in recent months “suggesting the gloomy outlook for the euro remains more entrenched and somewhat independent of fluctuations in US rate expectations”.

Despite the recent shift in positioning, some analysts think a fall in the dollar has merely been delayed. Investors were “jumping the gun” by predicting aggressive Fed cuts late last year, and this year’s rally has been driven by a correction of that view, according to Athanasios Vamvakidis, global head of G10 FX strategy at Bank of America.

“We continue to believe that we’re gonna see some weakness in the dollar this year, but we believe it’s now basically a story for the second half of the year,” Vamvakidis said.