The move would set the stage for unicorns and other entities to have easier access to a larger pool of foreign capital, they said, adding that it could also encourage a greater number of startups, with Indians at the helm, to incorporate within the country instead of jurisdictions like Singapore.

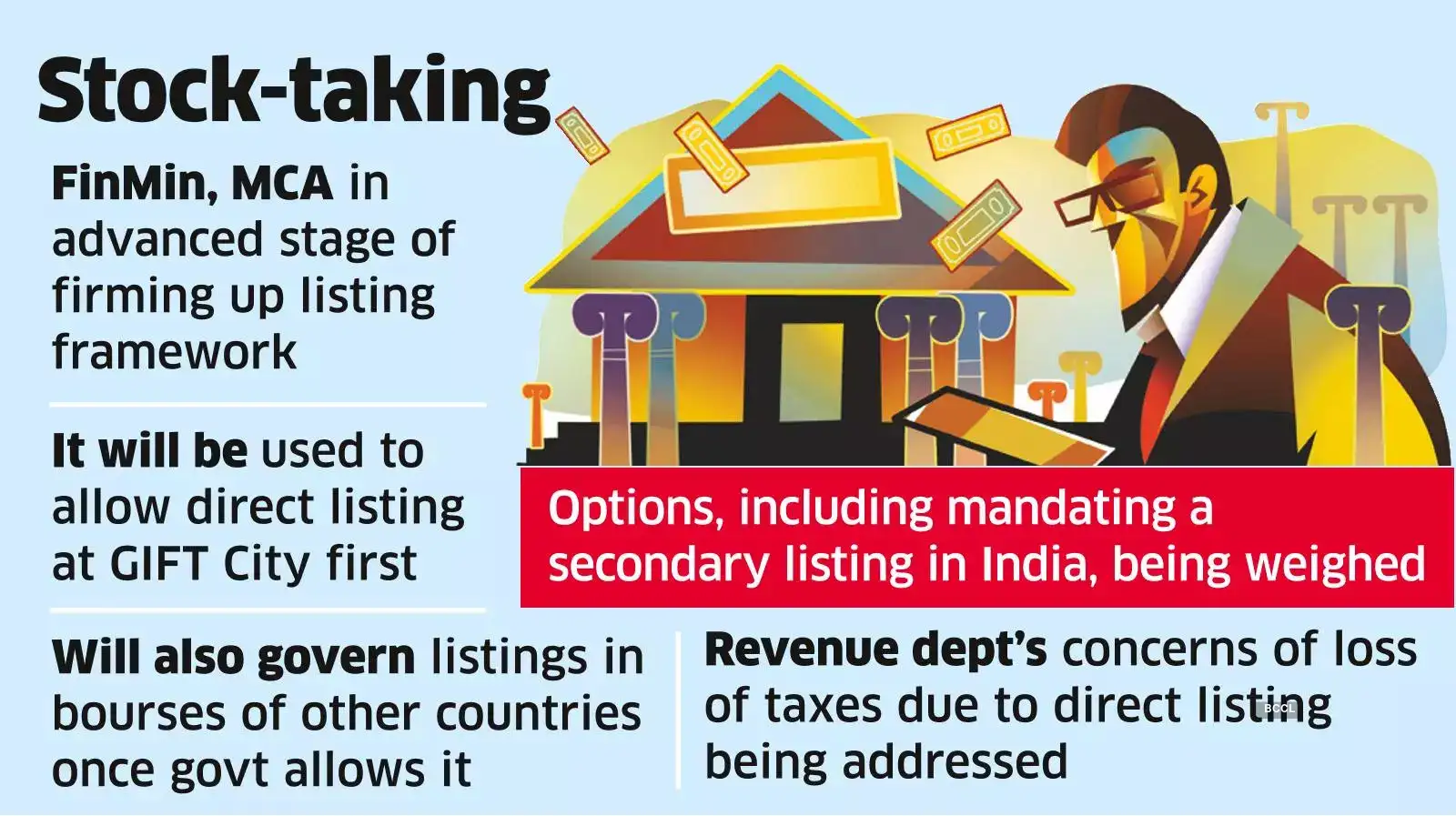

Initially, the framework will be used to allow direct listing at the International Financial Services Centre (IFSC) at Gujarat’s GIFT City. Subsequently, it will govern listings in other jurisdictions as and when the government decides to allow that, the people told ET.

“The capital markets division of the Department of Economic Affairs (DEA) and the Ministry of Corporate Affairs (MCA) are firming up rules that will act as an enabler of the direct listing process. The broad framework will govern future listings in all international jurisdictions and not just in the IFSC,” said one of the persons, who did not wish to be identified.

Several options, including mandating a secondary listing for domestic companies on Indian bourses within a stipulated time frame after they list abroad, are being considered as part of the framework, the person said. This would assuage fears of less oversight of such entities by Indian regulators, he added.Extant rules bar Indian firms from listing overseas directly. They are allowed to access overseas equity markets only through depository receipts, such as the American Depository Receipts and Global Depository Receipts, after they go public in India. They can also list their debt securities, including foreign currency convertible bonds and masala bonds, on foreign markets.”The direct listing framework is also being discussed with markets regulator Sebi, the revenue department and IFSC Authority. The revenue department has raised concerns about potential loss of revenue due to direct listings which are being addressed,” said another person. The revenue department is learnt to have flagged issues such as tax treatment involving big foreign investors in cases where they exit a domestic company listed on foreign exchanges.

In July, finance and corporate affairs minister Nirmala Sitharaman had announced that Indian companies would soon be able to list their shares directly on the exchanges at the Gujarat IFSC. “This is a major step forward. This will facilitate access to global capital and better valuation,” she said.

Moreover, both India and the UK agreed to consider a proposal to allow such listings in London in future, according to a joint statement after a meeting of finance ministers of the two countries in September.

In March 2020, the Union cabinet approved amendments to the Companies Act, 2013, paving the way for direct listing of Indian companies abroad once enabling provisions are hammered out and built into law.

Earlier, in December 2018, a Sebi committee had recommended the need for an appropriate framework for listing shares of domestic companies abroad and vice versa. It also proposed allowing listings on stock exchanges in ten permissible jurisdictions that had strong anti-money laundering regulations. These comprised specified stock exchanges in the US, Japan, South Korea, the UK, China, Hong Kong, France, Germany, Canada and Switzerland.