It’s 2024, and the investment landscape is undeniably shifting – traditional safe havens like gold ETFs are experiencing notable outflows in contrast to Bitcoin ETFs, which have seen a substantial increase in interest since their debut at the beginning of the year. This change suggests investors are exploring new territories, possibly looking for alternatives that promise both security and growth in these uncertain times as we had highlighted in this article.

In this narrative, Galaxy Fox ($GFOX) is also heading to a lucrative road, soaking up liquidity and selling out over 2.7 billion tokens throughout the presale. Why is crypto leaning from gold to $BTC, and how is $GFOX surpassing some of the best altcoins?

Bitcoin vs Gold in 2024

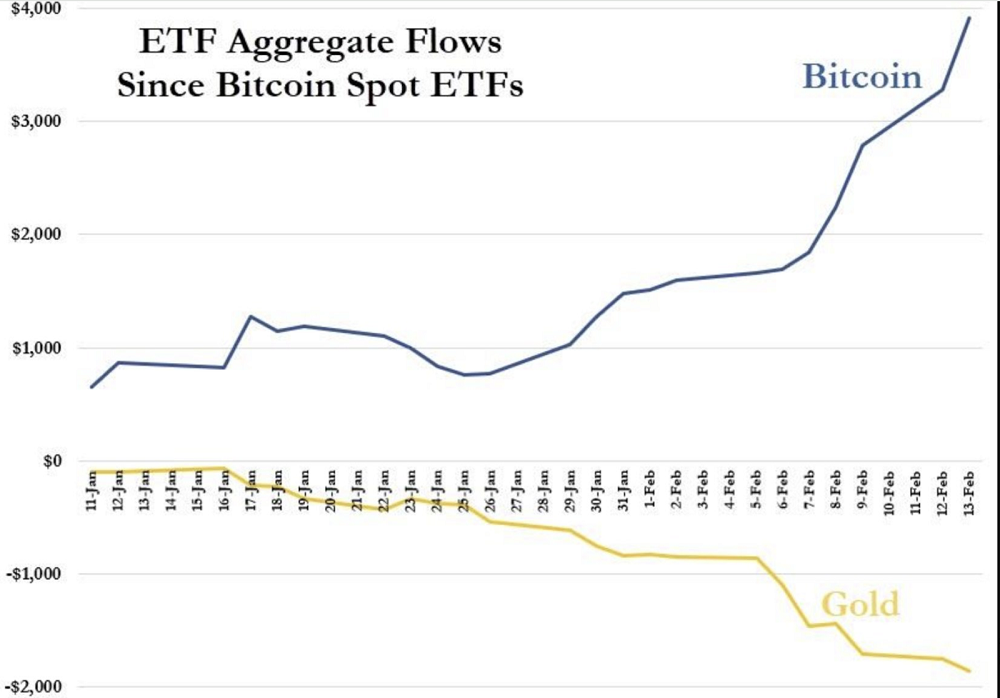

In the year 2024, the difference between investments in gold and Bitcoin has become much more obvious. A total of $2.4 billion has been pulled out of gold ETFs, with the biggest amounts being $230.4 million and $423.6 million from BlackRock’s iShares Gold Trust Micro and iShares Gold Trust, respectively.

In contrast, Bitcoin ETFs have seen an opposite trend. With record-breaking volumes and a noticeable move towards digital assets, the ten authorized spot Bitcoin ETFs have collected an incredible $3.89 billion in inflows since their inception in early January.

There has been an even more fundamental shift in investor attitude, and this change is reflected in the figures. Bitcoin has gained 23.5%, reaching a two-year high, while gold, which is usually a safe haven during uncertain times, has fallen 3.4% to a two-month low. The difference shows that investors are starting to see Bitcoin as a good substitute for gold, attracted by its high return potential in the present economic climate.

Bloomberg analyst Eric Balchunas is among many who think this trend might mean more diversification into US stocks and digital assets than a straight shift from gold to Bitcoin. It suggests that investors’ priorities are changing and that digital currencies may soon be considered as good as, or perhaps better than, conventional assets like gold as a store of value.

Investors troop to Galaxy Fox

Bitcoin’s success is directly reflected in the overall crypto market, and the current crypto stats are no exception. Among the top 10 altcoins, Galaxy Fox is a name you’ll often hear from analysts discussing the potential best altcoins.

Galaxy Fox, one of the best crypto ICOs so far, is split into ten separate stages, and at each stage, it gradually raises the value of the $GFOX tokens. This means early investors have the chance to see their deposits grow by 450%, a temptation hardly anyone should miss.

However, with such a lucrative opportunity, competition arises, and investors have been rushing to soak up the $GFOX tokens at their lowest rate. This has resulted in the presale stages selling out quickly, and currently, $GFOX is on the verge of closing its 8th stage.

However, the window to step in and buy $GFOX in the 8th stage is still there, though narrow, and if you make it, you secure yourself a 33% gain, as two more presale stages will naturally increase the price of $GFOX.

Notably, the charm of $GFOX is not only in its rewarding presale but also in its hybrid memecoin/P2E ecosystem, which is fully dedicated to community engagement and will reward you at multiple steps during your participation.

Bottom Line

As the latest market dynamics show, Bitcoin has become the new gold, which means cryptocurrencies as a whole are about to experience more adoption and trust.

In these directions, experts often suggest identifying low-cap gems with tangible utility and future potential, as those are the best altcoins that would pay off the most in the bull run.

Learn more about $GFOX, visit Galaxy Fox Presale or join the Community.