Keeping this situation at the centre, a World Economic Forum (WEF)’s report, Chief Economists Outlook, outlines the emerging contours of the current economic conditions and pinpoints priorities for further action by policymakers and businesses globally. The report states that the regions most likely to benefit from the global supply chain changes are South Asia, East Asia and the Pacific, Latin America and the Caribbean, and the US.

The report specifically states that economies that are likely to benefit from these changes are India, Vietnam, Thailand, Indonesia, Mexico, Turkey, and Poland. These assertions are backed by the fact that many of these countries have managed to attract substantial foreign direct investment (FDI) in the last few years. For instance, the financial year 2021-22 recorded the highest FDI into India at $83.6 billion. Similarly, in 2021, Vietnam attracted more than $31.15 billion in FDI pledges, 9% higher than the previous year.

China’s prospects to take a hit

The WEF outlook also notes that amid this shift in supply chains, China is expected to be particularly affected. Most of the chief economists surveyed by the WEF say they expect supply-chain restructuring to have a negative impact on China’s economic prospects.

A classic example is the American tech firm Apple, which has plans to diversify its supply chains to other countries with an aim to reduce its heavy dependence on China. The iPhone-maker has been assembling its products in both India and Vietnam for a few years and aims to leverage its presence in these countries and increase its volume of production.

A 2022 forecast by JP Morgan states that the percentage of Apple products made in China will fall to 75% from 95% by 2025. Apple may manufacture one out of four iPhones in India by 2025.

The WEF survey states, “The twin pressures of deepening geopolitical tensions and intensifying industrial policy mean that further adjustments in the global supply chain are almost inevitable in the coming years.”

Arun Singh, Chief Economist, Dun & Bradsheet, says that the geopolitical and economic uncertainties have highlighted that a large part of the global economy was relying on just a few suppliers.

“We have seen China getting impacted with issues such as slowdown and closures in the recent past. It disrupted the global supply chain and hit the pricing and whatever demand we had at that time. We failed to meet even small demands at that time. Soon we realised the mistake of relying on just one supplier. Now you have the Russia-Ukraine crisis. There have been several regional developments in the near past which exposed countries to the supply chain risks. Now, companies are looking at diversification so that their supply chains are not impacted in such scenarios. In this new setting, we will see a supply chain approach shift,” says Singh.

Many companies are shifting from China towards safer locations or nearshoring or even moving towards their local markets. “What’s worse for China is that its domestic market is also saturating, implying it will only have majorly relied on the exports market – which itself is subdued due to the global slowdown,” he says.

Singh dismisses the idea that China may re-emerge strongly and get back the full mojo once it completely beats Covid-19. “China was practically never shut. Even when the entire world was seeing a shutdown, Chinese factories were operational. Saying now that China’s performance would get back to its pre-pandemic days is too far-fetched. We should understand that Covid-19 is history now.”

Supply chain diversification is here to stay

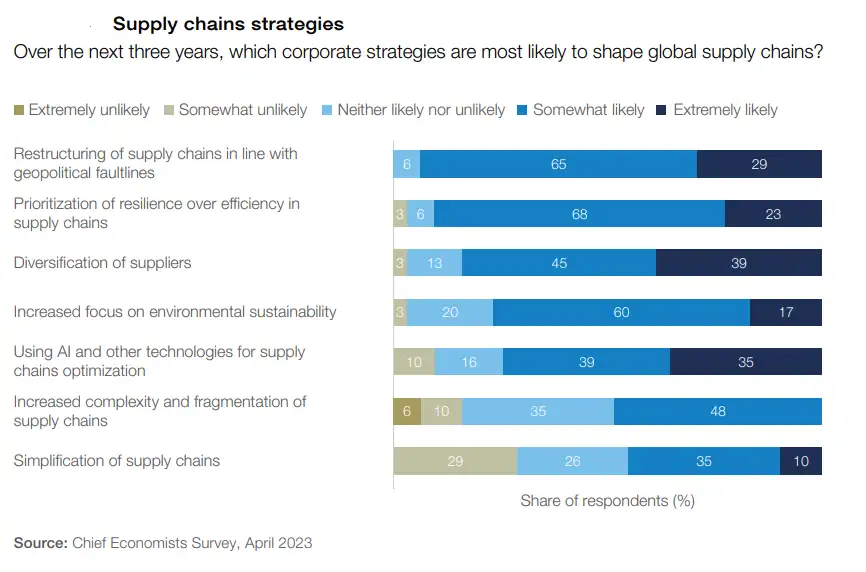

The chief economists in the WEF report are unanimous in anticipating further changes in the structure of global supply chains. The business strategies they expect to contribute to this reconfiguration include adaptation to geopolitical fault lines, the prioritisation of resilience over efficiency, diversification of suppliers and an increased focus on environmental sustainability.

On a sectoral basis, the WEF outlook highlights a range of industries where they expect supply chain changes to be most pronounced, including semiconductors, green energy, automotive, pharmaceuticals, food, energy and the broad technology category.

Potential for India

India may have huge potential but Vietnam has done relatively well in attracting big names in the past few years. Other than Apple, Samsung has also opted for Vietnam. The country has also attracted Google for producing Pixel phones, as well as Nike and Adidas.

“We expect Vietnam to remain a key beneficiary for re-location or co-location of production, supported by its already well-known and favourable factors. These include competitive costs for a relatively skilled workforce, extensive free trade agreements (FTA), and proximity to China, beyond its bright medium-term growth prospects of 6%-7%. Vietnam’s growing electronics ecosystem will also be another advantage,” says DBS in its report released in April 2023.

So, convincing big firms for relocation would not be a cake walk for India.

Singh says India is working to attract FDI but a lot still needs to be done. “But I think there is a constant nudge from the government asking global manufacturers to settle their facilities in the country. We should not forget that India is equivalent to China and the US both from the market and cost-effectiveness perspective. Big efforts are still required and that is why we see the government pitching up with schemes such as PLI. Every country now is trying to get the benefit of this supply chain relocation. This is going to have an impact,” he adds.