The interest from D2C brands to advertise on these fintech apps comes as these platforms have amassed a large captive user base and witness high daily user engagement rates with use-cases such as digital payments.

For instance, Paytm, which was one of the first payment financial-technology platforms to bring large-scale advertising revenue into its fold, claims to have 89 million monthly transacting users on its platform. Rival PhonePe claims that it has 440 million overall customers.

Other reasons for brands to continue running offers on these platforms include lesser cost per conversion as the price of advertisement increases on platforms like Google and Meta-owned Facebook with higher brand demand and limited ad inventory supply, at least three founders and executives in the D2C segment that ET spoke to said.

The average cost per mile, a marketing term used to denote the price spent for 1,000 ad impressions, for fintech apps including PhonePe and Paytm is in the Rs 70-150 range for clients on a daily basis, said an industry executive who works with these brands, requesting anonymity. Further, 60-65% of total advertising spends coming on platforms are through direct brand partnerships, with no media buying agencies involved.

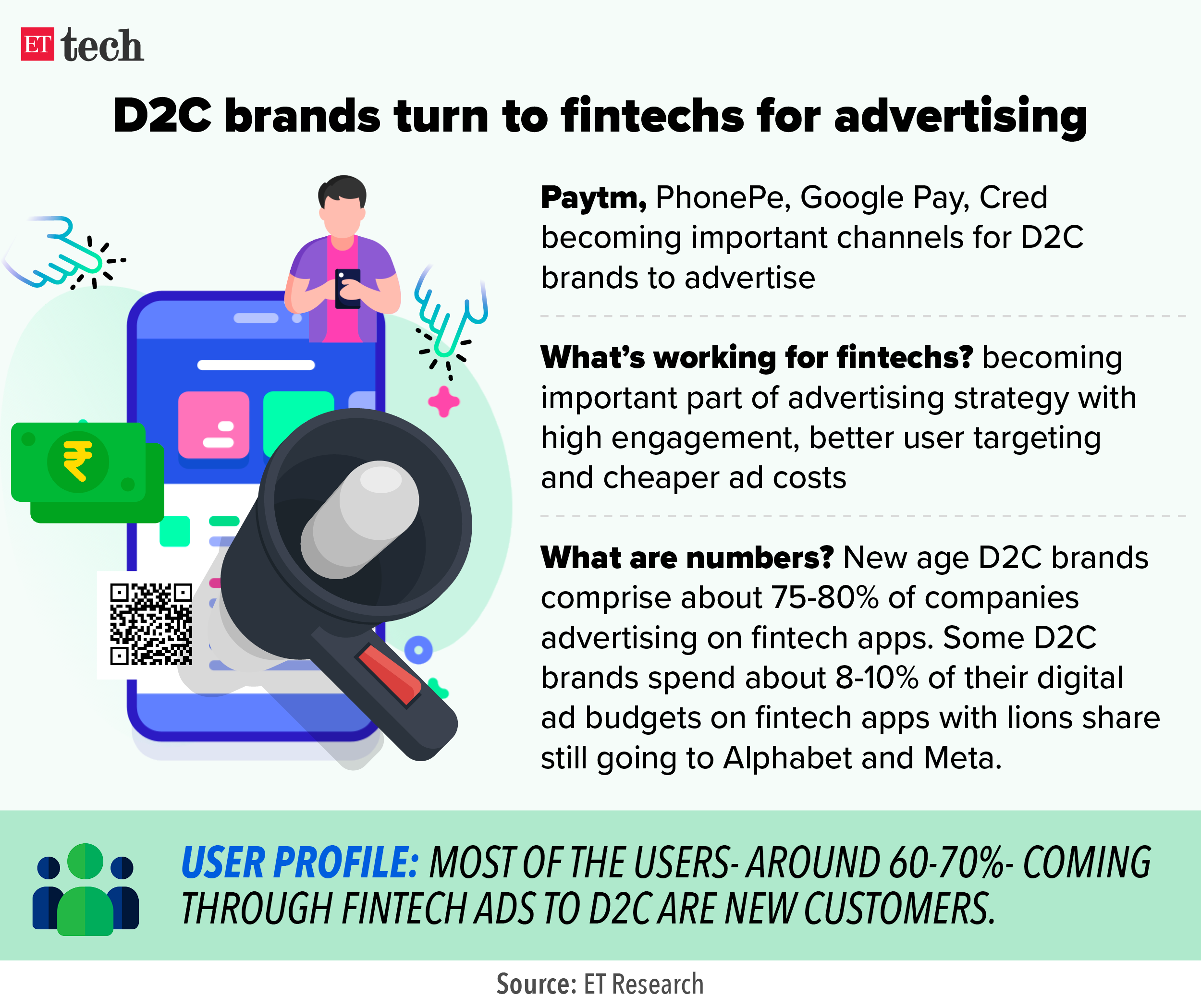

About 75-80% of advertisers on these payment platforms are new-age D2C brands, an executive working in the advertising division of these fintech brands told ET, requesting anonymity.

Discover the stories of your interest

“We spend about 8-10% of our overall digital advertising budgets on platforms like PhonePe and Paytm,” said Deepak Gupta, cofounder and chief operating officer of Bombay Shaving Company, a personal care D2C brand. “Facebook and Google form about 80% of the spends, followed by programmatic websites like Criteria and MiQ, which would be another 10-12% and then the fintech apps, which is 8-10%.”D2C and consumer brands have been actively advertising through the rewards and coupons offered by the fintech apps to users.

Within rewards and coupons, brands can either choose to have a distribution partnership, which includes total users the rewards are shown to, or a performance-based sale-conversion model. In the latter, fintechs take a small cut of the value of the transaction made by the user for these brands.

“The conversion rate for Google and Facebook would be around 2.0-2.5%, whereas for fintech platforms it would be about 4%,” Gupta said.

Paytm did not respond to ET’s queries until press time on Thursday. PhonePe and Cred declined to comment.

ETtech

ETtechCheaper customer acquisition cost

According to Ashutosh Valani, cofounder of Renee Cosmetics, about 15-20% of the total digital advertising budgets for a D2C brand today goes towards affiliate platforms which include fintech apps. Other platforms include Alphabet (including Google and YouTube), social media and content platforms, which take a major share of the budgets.

“Affiliate is now one of the biggest networks for D2C brands to sell in the market. It comes at a much cheaper cost, because the CAC (customer acquisition cost) from these networks is much lower than Meta and Alphabet,” said Valani. He previously founded men’s grooming startups Beardo and Villain Life, and sold them to Marico and Mensa Brands, respectively.

Valani said rewards and couponing on these affiliate fintech platforms contribute to a brand’s direct sales push to customers, which excludes revenues from marketplaces like Flipkart or Amazon India.

“Fintechs like Cred and Paytm would contribute 10-15% of the total direct sales which come from a D2C’s website or apps and affiliates. Almost 60-70% of sales for a D2C still comes from marketplaces (like Amazon or Flipkart) with the rest from direct or affiliate channels. But 60-70% D2C customers coming from fintech platforms are also first-time buyers,” said Valani.

What further helps brands in advertising on fintech platforms is the right targeting of digital users based on user payments and consumption data, multiple executives at D2C brands told ET.

“It’s not just the captive audience, but the right filtration in terms of age, spending habits and spend potential which these fintech platforms are offering,” said Girish Dwibhashyam, chief operating officer at DocuBay, a documentary screening platform.

Rewards just content for fintechs?

As brands look to gain, for fintechs, advertising is a value-added service to brands and merchants. This comes at a time when both Paytm and PhonePe for whom advertising was once a major source of revenue, are now pushing the pedal on payments and financial services distribution.

As a result, contribution from advertising revenue comes after payment and financial services, such as lending and insurance, for these fintechs.

“For fintechs, these brand offers (and launches) can be perceived as fresh content to keep users engaged and coming back on the platform and not as the biggest revenue generation engines in the long term,” said a fintech executive aware of the strategy of these firms.

This can be seen in strategies of new-age fintechs like Cred, which has focused on discovery of new D2C launches for users and waived commissions or listing fee last year for brands listing on its commerce platform.

Ambarish Kenghe, VP, product, Google Pay, said merchant vouchers, which appear as rewards when users make transactions, are one of the ways the platform brings novelty besides also opening up additional discovery and trial opportunities for merchant products and offers. “These vouchers have not only helped emerging D2C brands find new paying customers but also helped existing category-leading brands to re-engage their customers and build loyalty,” he said.

Small scale

However, while advertising on fintech platforms may catch advertisers’ attention, D2C brands warn that it works only as an engine to add incremental sales and that scalability remains a challenge.

“Advertisements through these fintech apps are cheaper, but it does not give you scale. You can get a certain percentage of business from these platforms, you cannot entirely rely on them,” Gupta of Bombay Shaving Company said.

Valani from Renee Cosmetics concurred: “You cannot totally rely on these because they cannot fulfil the entire sales target. They may add a percentage of it.”

Sujata Dwibedy, chief investment officer, Amplifi, Dentsu International, said there is a huge demand for affiliate platforms now compared to about two years back. “Nonetheless, ad expenditure on fintechs will still be 1-2% of total affiliate marketing spends for the industry. But these channels may pick up in the future,” she said.