The latest communication by Europe’s top financial markets regulator to the RBI, made earlier this month, comes amid a standoff between the Indian central bank and European authorities over the latter’s requirement of rights of audit and inspection of domestic clearing houses, including The Clearing Corporation of India Ltd (CCIL).

“Around two weeks ago, ESMA put forward the idea of continuing with the current MoU that is in place. The existing framework does have certain provisions for oversight but within a clearly defined understanding that nothing would be done bypassing the RBI,” a person aware of the development said.

“The root of the disagreement that broke out since last year is the EMIR (European Market Infrastructure Regulation) 2 which has far greater provisions of foreign oversight over domestic clearing houses. It is difficult for all the EU states to come together and change the language of the new proposals,” the person said.

Emails sent to the RBI and the ESMA did not elicit any response till press time.

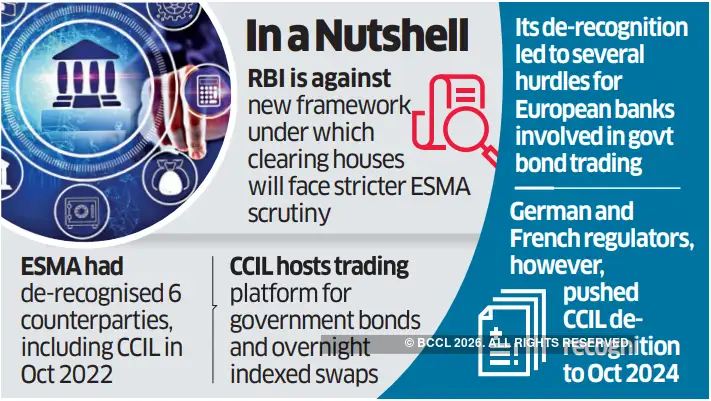

ESMA had in October 2022 announced the de-recognition of six Indian clearing houses, including the CCIL, which hosts the trading platform for government bonds and overnight indexed swaps. The CCIL is supervised by the RBI.

Earlier this year, however, German, and French financial supervisory authorities took a more relaxed view, providing their country’s banks with an extension of the deadline till October 2024 for de-recognition.

European banks with a presence in Indian bond and derivatives markets include Societe Generale, Credit Agricole, BNP Paribas and Deutsche Bank. Ahead of the October 2024 deadline, foreign banks have been exploring alternate strategies to ensure uninterrupted trade if the situation wasn’t resolved.

In an interview to ET earlier this month, Deutsche Bank Group, India, CEO Kaushik Shaparia said while he was hopeful of a resolution between the regulators, the German lender had a Plan B in place, which either directly or indirectly would offer all services to clients.

PREVIOUS MoU

An ESMA document signed in February 2017 shows the adoption of an MoU related to ESMA’s monitoring of the ongoing compliance with recognition conditions by central counterparties supervised by the RBI.

According to the document, the European Commission had adopted a decision made in December 2016 which said the legal and supervisory arrangements of the RBI ensured that central counterparties complied with legal requirements.

In June 2019, the EMIR Regulatory Fitness and Performance programme came into effect, with the purpose of bringing about changes that would alter legal liabilities between some counterparties.

After the Global Financial Crisis of 2008, developed markets took steps towards reducing risk in derivatives markets, in the process looking to maintain control of regulation and risk management practices in third countries.