The sources did not indicate what specific provisions of the Foreign Exchange Management Act (FEMA), which covers individual and corporate transfers overseas, were the subject of the investigation by the Enforcement Directorate.

One of the sources added that the investigators were not yet in contact with Paytm.

The sources declined to be named because they were not authorised to speak to the media.

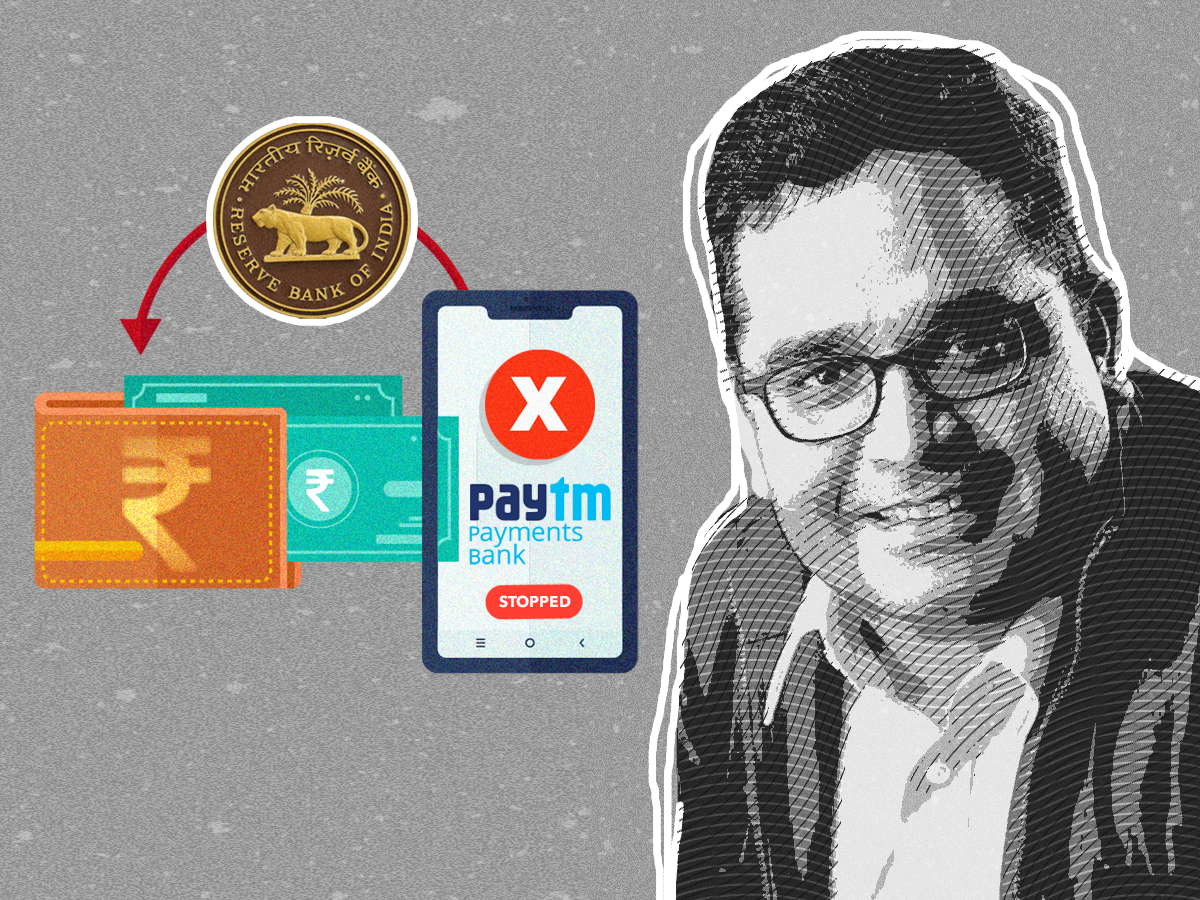

The Enforcement Directorate and the Ministry of Finance, which oversees the agency, did not immediately respond to requests for comment. A spokesperson for Paytm said that allegations regarding FEMA violations were “unfounded and factually incorrect”. The Reserve Bank of India on Wednesday ordered Paytm Payments Bank, an affiliate of Paytm, to wind down most of its businesses, including deposits, credit products and its popular digital wallets, by Feb. 29.

There had previously been no reports, however, of a government investigation of possible foreign exchange rule violations involving the platforms of the bank or its parent company.

ALSO READ: Ambanis eyeing Paytm wallet? Jio Financial shares jump 13% on report saying so

The Paytm spokesperson said no overseas remittances of any kind could be initiated from bank accounts or wallet accounts at Paytm Payments Bank.

“We vehemently deny any speculations on alleged FEMA violations by One 97 Communications or its associate Paytm Payments Bank,” the spokesperson said via email.

“The licence for payments banks restricts them from conducting operations related to outward remittances, which are exclusively permitted for large commercial banks in India.”

(You can now subscribe to our Economic Times WhatsApp channel)