Boot maker Dr Martens fell 29.4% as the group said it faced another tough year

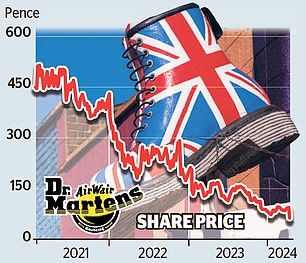

Dr Martens shares plunged to a record low after it issued its fifth profit warning in three years.

Shares in the FTSE 250 boot maker fell 29.4 per cent as the group said it faced another tough year in the US and revealed its chief executive was stepping down. The slump put Dr Martens at an all-time low of 67p – a far cry from its 370p float price in January 2021.

After a bumpy few months, Dr Martens yesterday issued its fifth profit warning since 2021 as it grapples with rising costs and fewer orders across the Atlantic.

‘The outlook is challenging, and the whole organisation is focused on our action plan to reignite boots demand, particularly in the USA, our largest market,’ a spokesman for the firm said.

‘The nature of USA wholesale is that when customers gain confidence in the market, we will see a significant improvement in our business performance, but we are not assuming that this occurs.’

Dr Martens said its autumn and winter order book is ‘significantly down year-on-year’ and is estimated to have a £20million impact on profits, whilst cost inflation is predicted to have a £35million hit.

Analysts at Peel Hunt said while the profit warning was not a surprise, it was ‘much worse’ than expected.

And Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: ‘The US had been seen as the key market for growth for the company, but instead of being a golden cash cow, it’s been looking like a cash hog, with supply chain snarl ups, operational problems, rising costs and plummeting demand.

‘While Dr Martens will always remain a British iconic fashion force, it’s clear that stomping into new fashion ground overseas is far from easy.’

Separately, boss Kenny Wilson will step down before the end of the financial year. He said ‘the time is right’ to hang up his boots. He will be replaced by chief brand officer Ije Nwokorie.