The gains were extended amid reports that China may cut interest rates by 50 bps on $5 trillion mortgages to boost demand in real estate and commodity markets. The decline in global crude oil prices further contributed to the market upside, according to a release by ICRA Analytics.

In the domestic debt market, bond yields fell after the U.S. Federal Reserve kicked off its interest rate cut cycle, with a significant reduction of 50 bps. Yields fell further driven by global interest rate changes and increased demand due to government bonds being added to the global index. However, gains were capped after the central government upheld its borrowing plan as budgeted, defying the market participants’ expectations of a reduction.

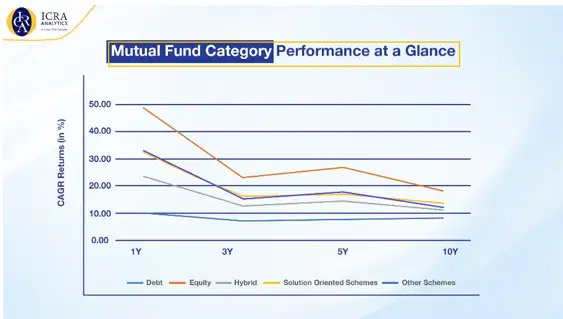

According to the release, the following trends were spotted in different mutual fund categories in September 2024.

Equity mutual funds

- In the past seven days, as of September 30, 2024, all categories witnessed negative returns, barring the Dividend Yield fund, which managed to give some positive returns that stood at an average of 0.42%.

- Small cap funds gave maximum returns over an investment horizon of 6-months, 3-years, 5-years and 10-years.

- Mid-cap funds gave maximum returns over an investment horizon of 1-year that stood at an average of more than 50.11%.

- Sectoral/Thematic funds gave maximum returns over an investment horizon of 1-month and 3-months.

- Large-cap funds were the laggards, as they gave the minimum returns across the time periods of 3 months, 6 months, 1 year, 3 years, 5 years, and 10 years.

Debt Mutual Funds

- All categories witnessed positive returns across all time periods

- Long-Duration funds gave maximum returns across an investment horizon of 1-month, 3-month, 6-months, 1-year and 5-years

- Credit risk funds gave maximum returns over the 3-year period.

- Gilt Fund with a 10-year constant duration gave maximum returns over the 10-year period. However, over the past 3-years it gave the minimum returns.

Hybrid Mutual Funds

- Aggressive hybrid funds gave the maximum return in 6 months, 1 year, 3 years, and 10 years

- Arbitrage funds gave lowest return across all horizons.

- Multi asset allocation funds gave the highest return in 3 year, 5 year, and 10 year horizons.

- In one week period, aggressive hybrid funds lost the most of around 0.56%

ETMarkets.com

ETMarkets.comOther categories

- In one year horizon, other ETFs gave the highest return of 35.69% followed by Gold ETF which gave 29.17%

- In five years, index funds gave the highest return of around 19.77%

- In 10-years, index funds and other ETFs gave 13.17% and 13.07% returns respectively.