TAM Media has said from current 29% share of total digital ad spends, AVOD’s share will be almost 40% in the next 5 years.

“The biggest advantage that AVOD platforms enjoy over SVOD (subscription video-on-demand) is the sheer availability of content across genres for audiences criss-crossing all demographic segments on almost all devices,” said LV Krishnan, CEO, TAM Media.

The AVOD model’s strengths are now being recognised by Netflix and Prime Video, with the latter launching ad-supported miniTV in India, and Netflix offering an ad-supported tier in select markets for price-conscious customers, say experts.

Manish Kalra, chief business officer at ZEE5 India, said the AVOD model has enormous potential in a price-sensitive market like India.

“India is a price-sensitive market, where the hybrid model allows consumers to explore and experience the platform without paying any price. It enables the brand to reach a larger audience base and facilitate sampling to gauge consumer preferences and behaviour,” he said.

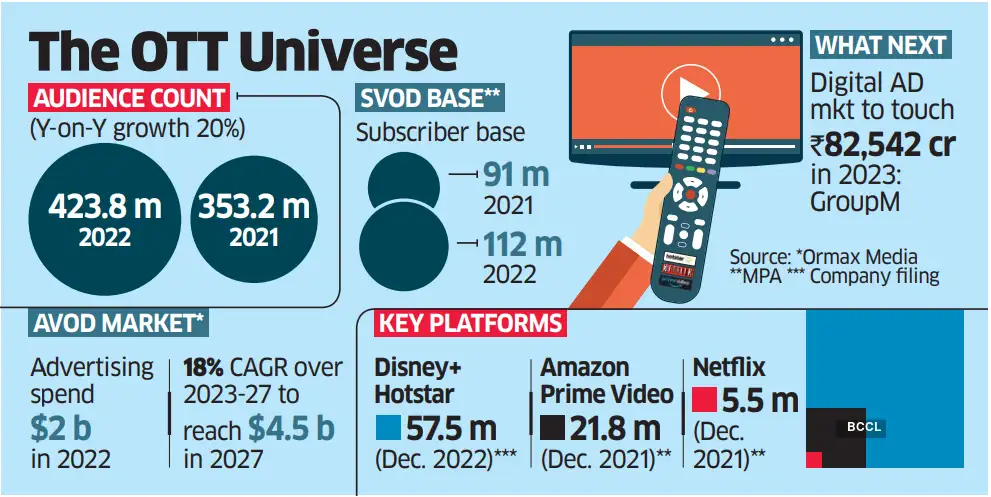

According to Media Partners Asia VP Mihir Shah, the Indian AVOD market is projected to grow at an 18% CAGR over 2023-2027 to reach $4.5 billion.”A large part of this incremental growth is expected to be fuelled by the supply of premium inventory from heavyweights like Jio Cinema, which has the IPL and other top sports, as well as SVOD powerhouses like Prime Video and Netflix adding AVOD tiers to go deeper,” he said.

According to a recent GroupM report, the size of the digital ad market is projected to jump by 20% to ₹82,542 crore in 2023 over the previous year.

Digital is expected to corner 56% of total ad spends this year.

Uday Sodhi, a senior partner at Kurate Digital Consulting, said digital video advertising, which is growing at a rate of 35% year-on-year, is expected to become the most important type of advertising in the next four to five years.

“India today has between 450 million and 500 million users with an internet connection. Almost all of them are AVODviewers. We have also seen the reach of AVOD-heavy platforms like YouTube and MX Player,” he stated.

Building a strong AVOD platform, according to Sodhi, can lead to lower customer acquisition costs and better monetisation for a future SVOD business.

Experts say most OTT platforms will have a blended AVOD plus SVOD strategy.

“Amazon is experimenting with miniTV, Netflix is launching an advertising-based service, Indian broadcast OTT platforms are all blended AVOD and SVOD businesses, and YouTube has recently begun pushing subscriptions,” Sodhi explained.

EY media & entertainment advisory leader Ashish Pherwani said the AVOD market size will reach Rs 25,000 crore to Rs 30,000 crore in the next five years if premium sports remain free.