Source: Ron Struthers 04/09/2024

There has been a lot of activity in the market. With Bitcoin (CRYPTO: BTC) soaring to old highs and gold breaking out into record hights, Ron Struthers of Struthers Resource Stock Report takes a look at what might be going on.

There has been a lot of activity in the market with Bitcoin soaring back to old highs and a bit more and gold breaking out to record highs.

What is going on?

The Basics

First a bit of level set and the basics of each. You hear cryptocurrency but it is not a currency not even close and never will be. Currency is a medium of exchange that can be transmitted between people and is generally accepted.

Only government-backed fiat currencies (dollars, yen, euros, etc.) and gold fit this description. They are Tier one assets that can be used as collateral, make loans against, etc. Central Banks own paper currencies, bonds, treasuries, and gold, not Bitcoin, silver, copper, or oil.

The world population is around 8.1 billion and anyone with a hand can use paper currencies or a gold coin. Bitcoin requires a third party and an internet connection to work. Moreover, both people require a crypto wallet. There were about 84 million crypto wallets in 2022, which is only about 1% of the population.

It is simply not widely used or popular enough. Even if the number of wallets doubles or triples, it is still very small. The Bitcoin market is also too small and not liquid enough. At today’s high prices, the market is about $1.3 trillion compared to about $6 trillion for gold, which is only physical gold. And it’s $10s of trillions for various government fiat currencies.

Silver will also work as a currency in times of turmoil and disaster because it has a long history as coinage and was only abandoned in coins in the late 1960s. Industrial consumption is about 65% of the annual market today, so this is pulled out of circulation where very little gold is pulled out of circulation and no fiat or bitcoin. The silver market is very small at $26 it is about $1.5 trillion for all the silver ever mined, but we know most of that went into industry, sitting in millions of circuit boards, silverware, dishes, solar panels, etc. Physical coins and bars etc. could be a value around 1/2 trillion today.

Gold is the premier currency and unique because it can’t be printed, or downgraded and is nobody’s liability.

“We have gold because we cannot trust governments” said President Herbert Hoover, but the U.S. was on a gold standard then. Most Western governments despise gold publicly, but their central banks still hoard it.

Of course, as we all know, the biggest negative with fiat currencies is they keep printing more of it out of thin air and debase its value. In the long run, every single fiat currency has evaporated. The US$ has been one of the longest-lasting ones, but out-of-control spending and printing are eroding its value at a faster and faster pace. Just the deficits and interest payments are around 74% of the U.S. budget now.

Bitcoin pundits will argue that the amount of bitcoin is limited, and it grows very slowly. That is true, but it is really like fiat currency because around 10,000 different cryptocurrencies have been created. Crypto.com lists the top 3,000 and if you add up the top five with Bitcoin you have about a $2 trillion market value. There are not 100s or 1,000s of different gold, just one and governments create more and new fiat currencies all the time.

What did the people of Ukraine and Russia do during the war and recently the Palestinians? They flocked to gold and US$, not Bitcoin. In Turkey where high inflation is collapsing the currency they are flocking to gold, not Bitcoin. About 350 kilograms have been seized at the Turkish border so far this year. The Turkish State Mint which has a monopoly on the production of standardized ‘Republic Gold’ coins, “is working double shifts through to 1 am seven days a week to meet citizens’ demand” said Mehmet Hekim, the Mint’s deputy general director. “It’s almost doubled its daily output in recent weeks to 700-800 kilograms as of Wednesday.”

To sum up, Bitcoin is best described as a new, unique financial instrument that is very volatile while fiat currency is best as a daily median of exchange for goods that continuously erodes in value, referred to as inflation. Gold is a store of wealth and holds its value long-term or, some would say increases in value as measured against fiat currencies. If you look at the past 20 years or 50 years, gold is the top-performing asset, over the stock markets, bonds, whatever.

I am not saying not to trade Bitcoin, it is even easier now with the ETFs, but it is just speculation. If you think Bitcoin is going to save you in times of turmoil, you are just fooling yourself. Its greatest weakness is that it is totally reliable on the power and communication grid. Another reason it was useless in much of Ukraine and Gaza. Fiat currency is also becoming totally reliable on the power and communication grid. You can still use physical paper cash but few retailers will accept it if their electronic systems don’t work and governments are determined to get rid of physical cash.

Investors, survivalist, family providers, etc., should have 1000 to 3000 worth of physical cash depending on your lifestyle and physical gold and silver. Once you have that, it is fine to speculate in Bitcoin and the Stock Market, what have you. When investing, your goal must be to beat inflation. Currently, inflation is running about 3.5% but in reality, it is about double at 7%. Therefore your portfolio has to make over 7% this year to be ahead.

What’s happening Now?

Gold has been setting new record highs and has moved up strongly in two distinct waves as of this time. What is different this go around is there has been no big intervention to drive the price down, or one that worked. The Easter holiday weekend was the prefect opportunity and they usually use thin trading on Sundays to whack the price down and holiday weekends usually offer even thinner markets. That said, Comex gold has been weaker in late Sunday, early Monday morning trading yesterday, but it was only down $20 as of 7:30 AM and low volume. The futures, Comex was previous interventions have occurred, but as I mentioned in my March 26th newsletter, Central Banks have been draining the Comex and GLD etf and Comex open interest is much lower for a less effective manipulation tool. You would typically see abnormal high volume on a down move if it was intervention and there is no sign of that.

I believe and the evidence suggests that the U.S. and their allies have lost control over the gold market. Too much physical metal has moved to the East and many countries are on a buying binge of physical gold that I mention above. Vietnam is another with economic woes, inflation and having two Presidents resign in two years, people are flocking to gold. Vietnam’s gold imports were about 55.5 tonnes last year and a lot of that is being illegal imports. The rise in gold smuggling is fuelled by a combination of a lack of official supplies and flight-to-safety demands. China bolstered its gold reserves to 72.74 million ozs. in March, its 17th successive month of official purchases. And remember, China is the worlds top gold producer, around 370 tonnes/year. They keep all of it.

Although the Comex gold price is up over $250 since this run, it still does not reflect the higher price people will pay. Comex gold was $2,330 on Friday, but in Vietnam physical gold was priced almost $400 higher at $2,719. My low end target is between $4,000 and $5,000 in this run, not all for this year but $2,500 to $3,000 is quite possible for 2024.

Currently, there is not much higher volume in the various gold and gold stock ETFs than in the gold bugs index.

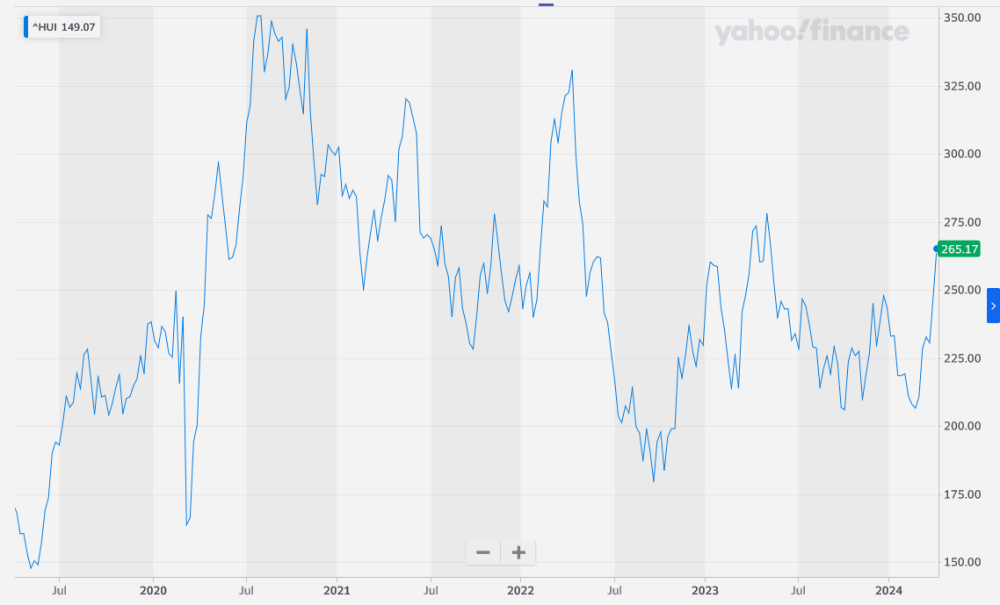

HUI made its first important hurdle, a higher high above 250, and is now up +28% from the February low. A break above 275, say 280, would be the next bullish signal, maybe this week.

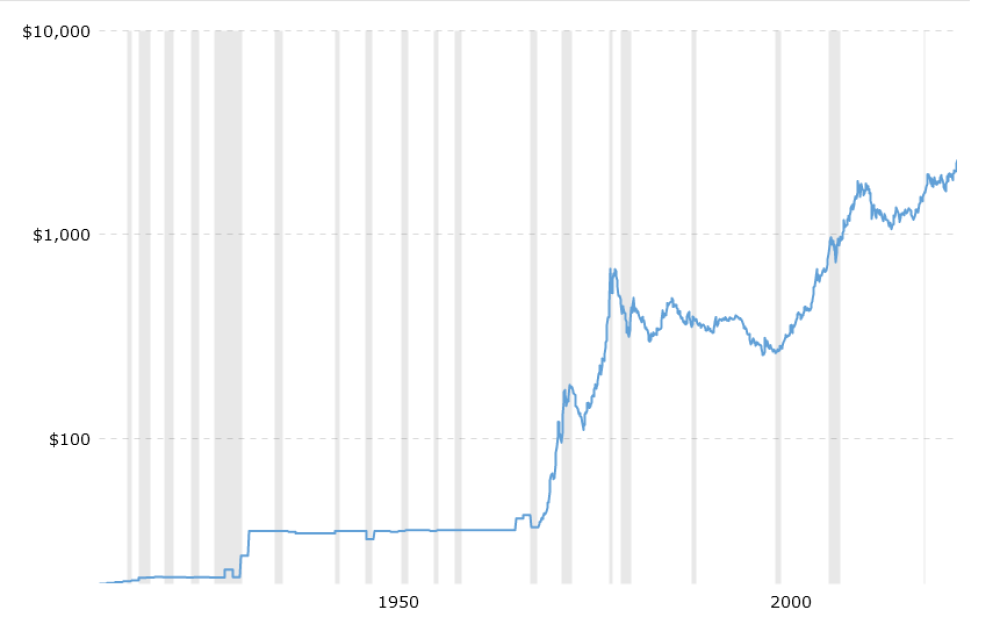

Here is a long-term chart of gold in US$ so you can see the devaluation of the US fiat dollar.

Since the U.S. went off the gold standard in the early 1970s, the US$ has lost about 98% of its value to gold in about 50 years.

Bitcoin – A Short History

Bitcoin has not been around very long to make any long term conclusions. However, since 2016, it is now on its third bullish wave up.

It could be close enough to call a double top on the ETF hype that has fuelled the current bull move. However, it has been going up the past week, and a solid close above $74,000 would break out a double top and a possible move to the $80,000 to $100,000 range.

The hype now is the halving event, but this only slows the production of about the last 1.5 million Bitcoins. Really not that important, but this market is totally driven by hype and speculation. There is only going to be 21 million bitcoin when it is all mined. However, about half of it does not trade, and estimates show that 6 or 7 million has been lost (another reason half does not trade). There are still about 1.5 million to be mined. Many Bitcoin pundits say it is better than gold because more cannot be created.

This is false because we know another 1.5 million Bitcoin will be created, which is a 7.7% increase. Currently, gold is mined each year, but it adds less than 1.5% to the supply each year. Also, as I have pointed out, around 10,000 cryptocurrencies have been created, and there is only one gold currency. Assuming there really is, say 6 million lost Bitcoin, then the increased supply of what is actually available to trade today will be about 11%.

Lost Bitcoin refers to Bitcoin that the current owner can’t locate, either because they forgot their private key or lost their hardware wallet device. It is much harder to lose gold or fiat currency unless you bury it and forget where. And this is an important point, you should always tell someone you trust where you hid your gold or cash. And in the same breath tell someone what your crypto wallet is, ID, and password.

If you lose your banking or social media ID and password, because it is centralized control it can be retrieved. On the other hand, a decentralized organization (Bitcoin) has no control over the information stored within the network. There is no centralized server or data center, so there is no one authority you can go to if something goes wrong. Data is spread across multiple nodes within the network, none of which have the authority to alter or delete data. The entire point of a decentralized network is to give control back to the users.

This is a true story from somebody I know. They worked as an electrician, and an old fellow passed away in his home/apartment. The landlord hired the electrician to inspect things before renting the place back out. The electrician noticed a noisy exhaust fan above the stove, and upon investigation, he found two gold bars stuffed up there. Some people have all the luck, but the old guy told nobody about his stash, so nobody knew. You never know when an accident might get you, and I bet you won’t find cash in an exhaust fan and never Bitcoin.

It looks like Western governments and the Banksters are going to focus on manipulating Bitcoin. I think they have given up, and lost control of gold, but are starting big time on Bitcoin. They are doing the same things they did with gold, where they created 100 or more ounces of paper gold for every ounce of physical gold. With silver, some estimate there are 300 paper ounces for every physical ounce.

Like gold, they started with future contracts, such as paper Bitcoin. There is the Bitcoin future, and they started the Bitcoin micro future contract about two years ago; it is just 0.1 Bitcoin per contract.

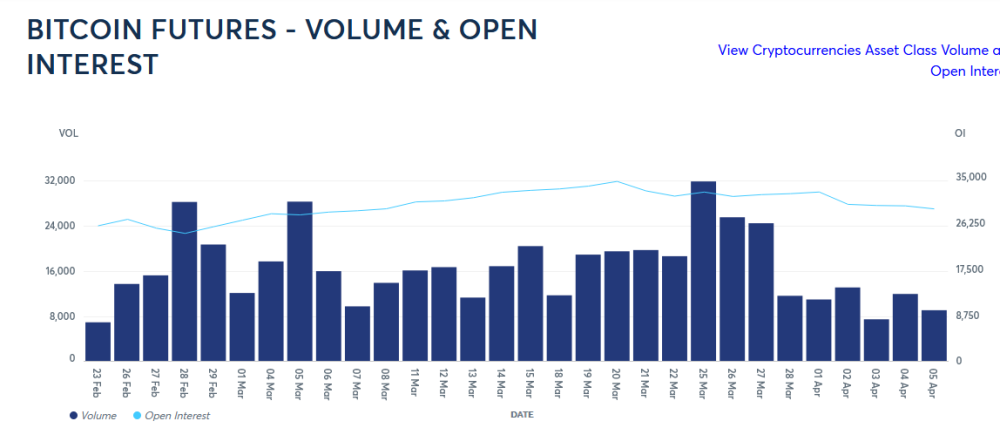

There are five Bitcoin in a regular futures contract, and they are trading 7 days a week, around 15,000 contracts per day or 75,000 Bitcoin equivalent per day. You cannot take delivery of Bitcoin; trades are settled in cash only.

The trading of actual bitcoin has averaged 500,000 per day in 2024. Therefore, the futures market is about 15% of that, not very much, and I believe that indicates low institutional trading. For 2024 in $ value, about $25 billion per day, but since March, about $45 billion, reflecting the price increase from around $50k to $69k. This is about the same value that Nvidia trades, just one stock in one day. Just another indicator of how small the Bitcoin market is.

Because Bitcoin is mostly retail trading, I expect the ETFs will have a more diluting effect on the price. I know most people think these ETFs will buy physical Bitcoin, but I have doubts about them based on all the past ETFs. We should get the first financial statements on these ETFs soon, and Coinbase financials will be out in the middle of May. Coinbase is the custodian for 8 of the ETFs, so we will see how much more Bitcoin they have added. I expect little, and they will just borrow the Bitcoin from somewhere. The ETFs may simply use swap agreements between Banksters or they all may lay claim to the same Bitcoins held at Coinbase. I don’t trust these Banksters any further than seeing a Bitcoin with my own eyes. Of course, you can’t; they only exist in cyberspace.

The most popular of the new ETFs is the iSahres Bitcoin Trust – IBIT. As of April 5th, the ETF had a value of $17.58 billion. There are 22.78 Bitcoin in a basket, and a basket was valued at $1,544,083. This equates to 11,385 baskets, so 295,350 Bitcoin is not a huge amount, but come financial reporting time, let’s see what they really have.

Since March, the ETF has been trading around 50M shares per day, or $2 billion per day.

Europe launched its Bitcoin ETF in 2020, and this one is backed by physical Bitcoin, and you can redeem shares for Bitcoin. I don’t know what the restrictions are or how redemption works, but they currently list 22,032 Bitcoin as their held assets. It trades on a number of European exchanges but primarily in Germany. It trades about 200,000 to 500,000 shares per day. Interestingly, Europe also launched a Futures contract on this physical ETF in September 2021. I will have much more on the Bitcoin ETFs when financial statements come out. The precious metal ETFs have not seen much volume yet, except silver, the SLV ETF.

This pick-up in volume is decent and a better volume increase than the gold GLD ETF, but both are not near higher volume levels seen in 2020 and 2021. I think the best way to describe the gold and silver rally is a stealth rally. Not many see it or believe it yet.

That said, managed money gold contracts on Comex are now up to 147,080. They have gone well over 200,000 before, and this will probably happen. At that point, it could be time for correction. What is interesting is open interest is still comparably low. It peaked March 13 at 540,654 and has been declining as gold continues to rise, with the last report on April 8 at 504,408 contracts. It indicates that a lot of the rally has been driven by short covering.

Interesting times, stay tuned for my next update.

Important Disclosures:

- Ron Struthers: I or members of my immediate household or family, own securities of: Silver SLV and Gold GLD. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.