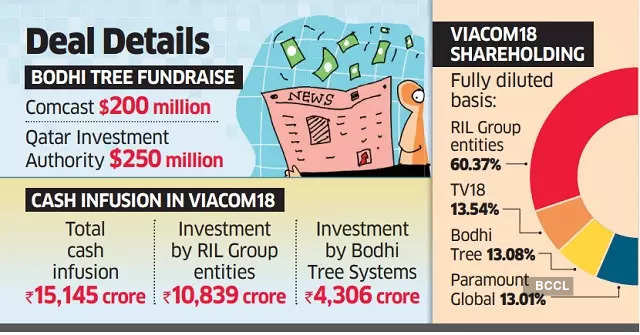

On Wednesday, the Competition Commission of India cleared NBC Universal’s acquisition of a stake in BTS Investment 1 Pte Ltd and Bodhi Tree Systems VCC, which are owned by Asia Initiatives Pte Ltd. Asia Initiatives is a joint venture between James Murdoch‘s Lupa Systems and former Star India chief executive Uday Shankar. Bodhi Tree is a minority shareholder in Reliance Industries-controlled Viacom18, which owns a bouquet of entertainment channels.

According to industry experts, Comcast’s investment in Bodhi Tree is a preliminary step towards the conglomerate’s larger ambitions in the Indian market.

“Investment in Bodhi Tree will open the doors for Comcast in a fast-growing entertainment market like India. Comcast is entering India through Bodhi Tree since India is an unfamiliar territory for them,” said a person close to the development.

“Right now, they are just testing the waters,” a veteran media professional said, adding that the company will increase its investments once it sees the value creation that happens in the Viacom18 business.

A portion of the funds from NBC Universal’s investment in BTS Investment and Bodhi Tree Systems will be used for additional investment in Viacom18.

NBC Universal, which is owned by Comcast, currently has a subsidiary in India named NBC Universal Media Distribution Services Pvt Ltd.

In 2021, the company introduced DreamWorks and E! channels on the Jio TV app. It also operates an ad-free OTT platform called Hayu in India.

Much before it was acquired by Comcast, NBC Universal had acquired a 26% equity stake in NDTV for $150 million in 2008. Later, NDTV bought back the stake. NDTV Networks housed the entertainment and lifestyle channels of NDTV.

Comcast has been looking to gain a toehold in the Indian market.

Comcast had reportedly evaluated both Zee Entertainment Enterprises and Star India as potential targets at one point.

Comcast, in partnership with private equity heavyweight Blackstone Group and Lupa Systems CEO James Murdoch, had tried to acquire a stake in Zee when the media conglomerate was seeking a strategic investor to sell a portion of its stake to pay off debts owed by its promoters. However, the bid was unsuccessful.

The company was vying for Star India when 21st Century Fox put a large chunk of its entertainment assets on sale. Eventually, Disney walked away with the 21st Century Fox assets, including Star India.

Comcast had to remain content with the acquisition of British media and telecommunications company Sky.

Industry sources said Comcast had looked at assets in the TV distribution space too before it evaluated Zee and Star.

“Initially, it had looked at assets in the cable TV business, but it didn’t proceed further due to a lack of last-mile ownership. They also evaluated DTH assets, but that also didn’t yield any results,” a TV broadcast executive aware of the discussions said.

As per a person familiar with the matter, Viacom18 has achieved a valuation of ₹33,000 crore following the injection of funds by Bodhi Tree Systems.