Other data in the week like retail sales, new home construction and manufacturing came in softer than expected, adding to evidence that demand is cooling in the world’s largest economy. Stocks rallied to record highs.

Over in the world’s No. 2 economy, Xi Jinping’s government announced its most forceful attempt yet to rescue the beleaguered Chinese property market. The housing crisis threatens to destroy millions of jobs.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

Bloomberg

Bloomberg

The so-called core consumer price index — which excludes food and energy costs — climbed 0.3% from March, snapping a streak of three above-forecast readings which spurred concern that inflation was becoming entrenched. The year-over-year measure cooled to the slowest pace in three years.

iStock

iStockA string of reports this week illustrated a slow start for the economy in the second quarter, adding to evidence that demand is cooling which will help set the stage for the Fed to cut interest rates later this year.

Bloomberg

BloombergAmericans give Donald Trump the edge over Joe Biden on the economy in poll after poll. That’s even as the Biden years have been the best time to find work since the 1960s, and the US has bounced back from the pandemic with stronger growth than international peers and stronger growth overall than under President Trump. Instead, voters this year are focused on the steep jump in prices from the post-pandemic surge in inflation.

Bloomberg

BloombergPresident Biden is hiking tariffs on a wide range of Chinese imports — including semiconductors, batteries, solar cells, and critical minerals — in an election-year bid to bolster domestic manufacturing in critical industries. The US will also raise levies on port cranes and medical products, in addition to previously reported increases on steel, aluminum, and electric vehicles. The changes are projected to affect around $18 billion in current annual imports.

China

Bloomberg

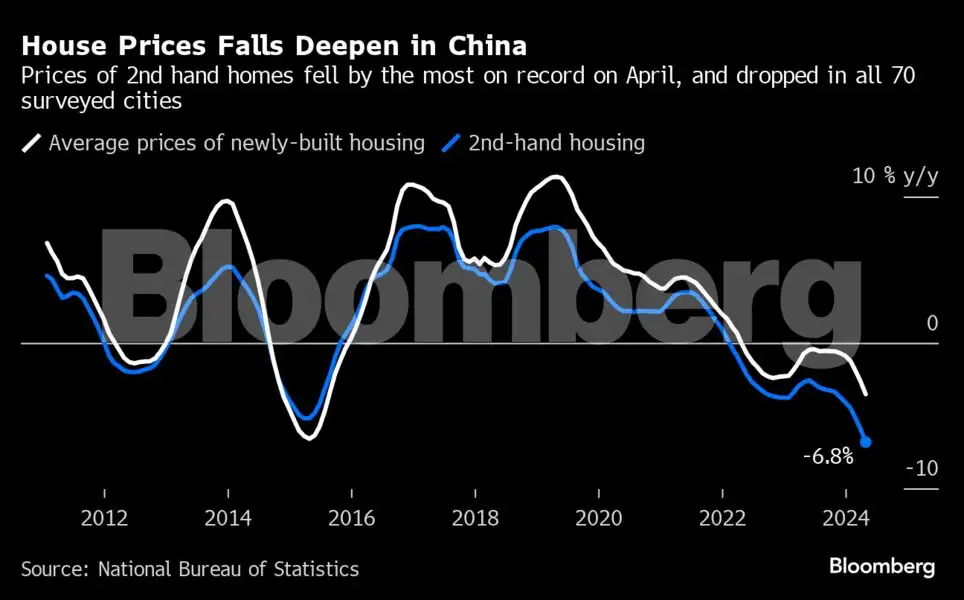

BloombergTo rescue the beleaguered Chinese property market, Xi Jinping’s government is relaxing mortgage rules and urging local governments to buy unsold homes as authorities become increasingly concerned about the sector’s drag on economic growth.

Bloomberg

BloombergThe housing sector’s economic heft may shrink to about 16% of China’s GDP by 2026, according to Bloomberg Economics. That possibility threatens to put about 5 million people — equal to the population of Ireland — at risk of unemployment or reduced incomes, the analysts wrote.

Bloomberg

BloombergChina’s economic recovery tilted even further toward manufacturing, leaving it more vulnerable to trade barriers and highlighting the stakes of a new bid to shore up domestic demand. Growth in consumer spending unexpectedly cooled to 2.3% in April, the slowest pace since 2022, while industrial output rose from a month ago to a faster-than-expected 6.7%, the National Bureau of Statistics said.

Emerging Markets

Bloomberg

BloombergIsrael’s economy rebounded at a pace seen only after the coronavirus pandemic, as investment and consumption powered an upswing that partly offset the shock of more than seven months of war. The worst of the economic fallout may be coming to an end, with consumer confidence approaching its pre-war levels and the labor market quick to stabilize after unemployment spiked in October.

Bloomberg

BloombergUnexplained outflows of capital from Turkey surged again during a month when voters went to the polls, a repeat of the money drain it suffered in the run-up to national elections a year ago.

Europe

Bloomberg

BloombergNorway plans to spend more of its $1.6 trillion sovereign wealth fund than planned earlier, helping the Nordic nation’s economy overcome a soft patch amid an expected delay in interest rate cuts. Labor Prime Minister Jonas Gahr Store’s cabinet is widening its so-called structural non-oil fiscal deficit for 2024 to 419 billion kroner ($39 billion), compared with 410 billion kroner seen in October, according to revised budget figures..

World

Bloomberg

BloombergSuperpowers led by the US and European Union have funneled nearly $81 billion toward cranking out the next generation of semiconductors, escalating a global showdown with China for chip supremacy. The surge has pushed the Washington-led rivalry with Beijing over cutting-edge technology to a critical turning point that will shape the future of the global economy.

Romania unexpectedly held borrowing costs steady, while Uruguay also left rates unchanged. Zambia and Angola hiked. The Philippine central bank kept its key interest rate at a 17-year high for a fifth meeting, but may lower it by a total of 50 basis points this year, its governor said.