Any euphoria over the size of its win, though, will be quickly overshadowed by the scale of the economic challenges facing the next government.

Among economic data this week, inflation cooled last month in the euro zone, the US labor market showed further signs of moderating and Japan’s household spending retreated.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Bloomberg

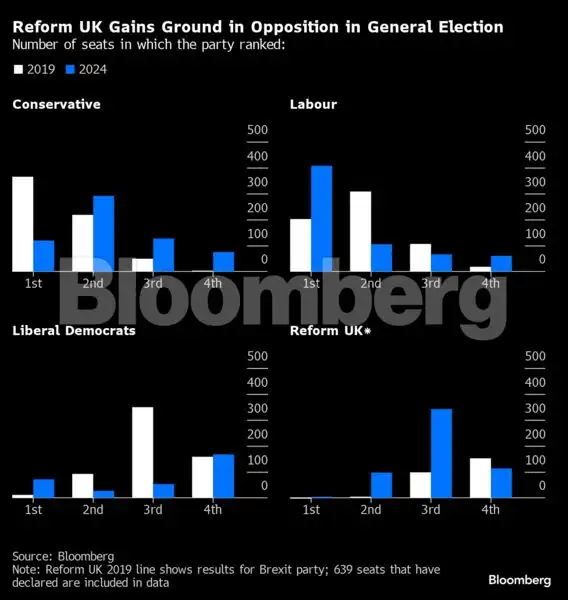

BloombergNew British Prime Minister Keir Starmer’s Labour Party took 412 of the 650 seats in the House of Commons, the most since Tony Blair’s 1997 triumph and a remarkable turnaround less than five years since being trounced at the last election. The Tories garnered 121 seats, their worst-ever performance. The pound strengthened.

Bloomberg

BloombergEuro-zone inflation slowed in June — adding to evidence that price pressures are gradually moving toward the European Central Bank’s 2% target. Consumer prices rose an annualised 2.5% after rising at a 2.6% pace a month earlier.

US

Bloomberg

BloombergHiring and wage growth stepped down in June while the jobless rate rose to the highest since late 2021, bolstering prospects that the Federal Reserve will begin cutting interest rates in coming months. Average employment growth over the last three months slowed to the least since the start of 2021, reflecting a labor market that cooled more in the second quarter than previously estimated.

Bloomberg

BloombergThe services sector contracted in June at the fastest pace in four years due to a sharp pullback in business activity and declining orders.Asia

Bloomberg

BloombergJapan’s household spending unexpectedly fell in May, raising the likelihood that consumption won’t be a key driver for the economy in the second quarter, and complicating the prospects for the central bank’s next interest rate hike.

Bloomberg

BloombergA surge of Chinese plastic supply is threatening to overflow in the face of weak domestic demand, morphing into a fresh trade challenge for the rest of the world. Parts of the country’s sprawling petrochemicals sector are running at as little as half capacity as producers cut back. But with the industry still expanding, that restraint is becoming harder to sustain.

Bloomberg

BloombergJapan’s tax revenues reached another record in the fiscal year ended in March, a positive outcome partly driven by the weak yen and sticky inflation. Even with the revenue gains, Japan’s fiscal plight is severe. It shoulders the heaviest public debt burden among developed nations

Emerging Markets

Bloomberg

BloombergPeru’s annual inflation accelerated moderately in June in line with economists’ expectations while remaining within the central bank’s target range. Inflation in Peru remains the lowest among Latin America’s major economies and central bank President Julio Velarde has said he expects price increases to close 2024 at 2.2%.

Bloomberg

BloombergFor the past three years, one of the hottest investment plays in Brazil has been the emerging industry for agriculture financing. No longer. The market for the so-called Fiagros, investment funds focused on agricultural receivables such as interest, dividends and land-lease payments, is set to stall this year after a wave of farmer defaults sparked uncertainty.

Bloomberg

BloombergTurkish inflation eased for the first time in eight months, a faster-than-estimated slowdown from a peak reached in May that puts consumer prices on course for a steep deceleration during the summer months. Turkey is starting to turn the page on two years of a severe cost-of-living squeeze caused by one of the world’s fastest rates of price growth

World

Bloomberg

BloombergIsrael’s war with Hamas and its drain on public finances led to the sharpest decline in sovereign-risk score in emerging markets during the first six months of 2024, while fiscal pressures in Saudi Arabia were the biggest among neighbouring Gulf countries, according to Goldman Sachs Group Inc.

Bloomberg

BloombergNorway is building a grain stockpile to prepare for a potential crisis. The move resonates beyond domestic politics, pointing to a deeper anxiety over food. Governments around the world are fretting over securing supplies for growing populations. In recent years, supply chains have been hit by shocks such as the Covid pandemic, Russia’s war in Ukraine, crop-export bans, shipping disruptions and erratic weather.