In Europe, inflation excluding food and energy costs hit a record last month, reinforcing calls from several European Central Bank officials that more interest-rate increases are needed. In the US, however, core price pressures eased in February by more than forecast, which may allow the Federal Reserve to pause rate hikes soon.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Asia

Bloomberg

BloombergChina’s economic recovery gathered pace in March, with gauges for manufacturing, services and construction activity remaining strong, boosting the outlook for growth this year.

Bloomberg

BloombergSouth Korea’s construction deals fell by a record margin in the fourth quarter as the property market cooled with rising interest rates weakening demand and inflation fuelling costs.

Bloomberg

BloombergSouth Korea is forecast to overtake China in spending on advanced chipmaking equipment next year in a sign of US export controls reshaping global supply chains for semiconductors.

Europe

Bloomberg

BloombergUnderlying inflation in the euro area hit a fresh high, handing ammunition to ECB officials who say interest-rate increases aren’t over yet. The rise to 5.7% in March’s core price reading, which strips out volatile items like fuel and food costs, came alongside a record plunge in headline inflation to 6.9% from 8.5% in February.

Bloomberg

BloombergWhile Sweden sits between France and Switzerland in a ranking of dollar billionaires, many poorer Swedes have seen the gap between the haves and the have-nots widen dramatically in recent times. At the heart of Sweden’s woes is a dysfunctional housing market, which has not only cemented social divides, but exacerbated them.US

Bloomberg

BloombergA key gauge of US inflation rose in February by less than expected and consumer spending stabilised, suggesting the Fed may be close to ending its most aggressive cycle of interest-rate hikes in decades. Excluding food and energy, the core personal consumption expenditures price index climbed 4.6%, matching the smallest annual increase since October 2021.

Bloomberg

BloombergBanks reduced their borrowings from two Fed backstop lending facilities in the most recent week, a sign that liquidity demand may be stabilising. US institutions had a combined $152.6 billion in outstanding borrowings in the week through March 29, compared with $163.9 billion the previous week.

Bloomberg

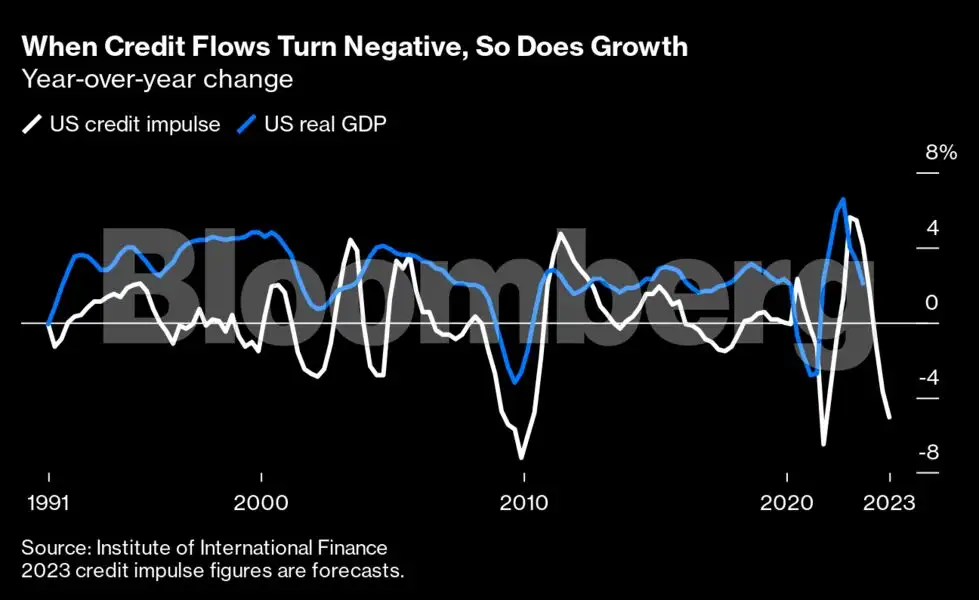

BloombergThe biggest banking scare since the 2008 financial crisis will ricochet through the economy for months as households and businesses find it harder to gain access to credit. That’s the scenario facing the US after the collapse of three regional lenders, and a giant global one, over an 11-day span, according to several economists.

World

Bloomberg

BloombergSouth Africa and Ghana each lifted rates by more than expected, and Thailand signalled more tightening is on the horizon. Mexico slowed its pace of hikes while Hungary’s resisted government pressure to start monetary easing. Colombia increased rates to a 24-year high and Egypt went ahead with a jumbo hike.

Bloomberg

BloombergBank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.

Emerging Markets

Bloomberg

BloombergPresident Vladimir Putin’s drive to expand Russia’s armed forces is adding to labor shortages as his war in Ukraine draws hundreds of thousands of workers into the military from other sectors of the economy. The total number taken into service is likely to have exceeded half a million, according to Bloomberg’s Russia economist Alexander Isakov.