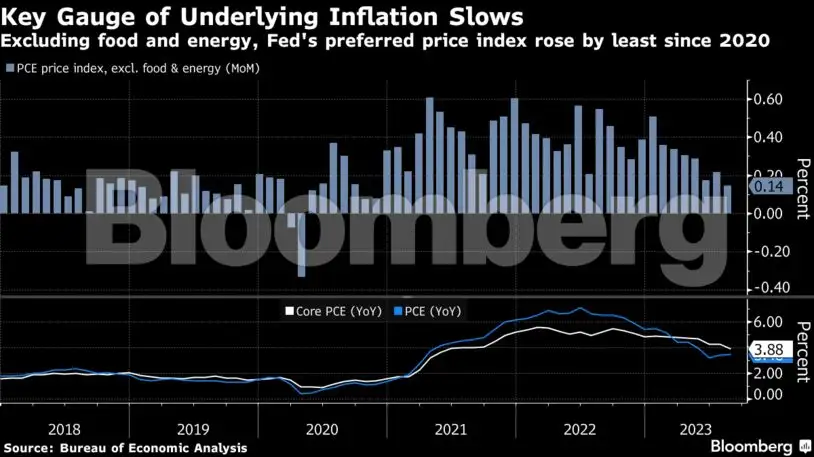

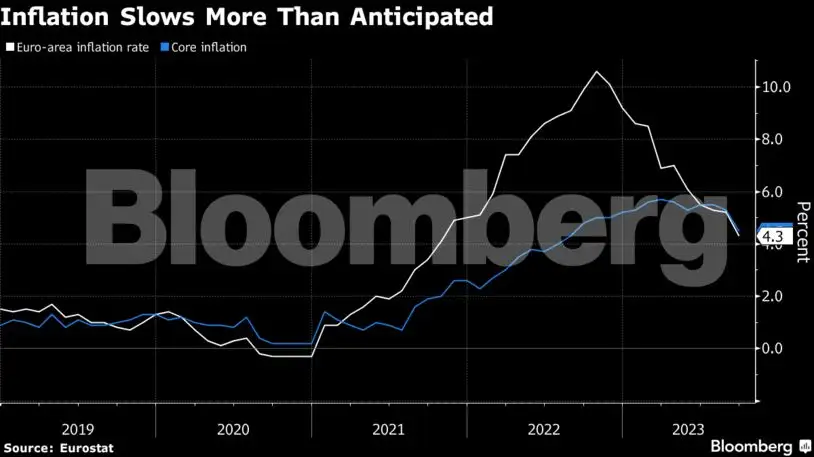

The US core personal consumption expenditures price index, which strips out the volatile food and energy components, edged up just 0.1% in August, the smallest advance since late 2020. A similar metric in the euro zone showed the smallest annual increase in a year.

The PCE report is likely the last major release from the US government ahead of an expected shutdown on Oct. 1. The closure could last weeks or more and will put private-sector indicators in the spotlight.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

Bloomberg

BloombergThe Federal Reserve’s preferred measure of underlying inflation rose at the slowest monthly pace since late 2020, helping to lay the groundwork for policymakers to forgo an interest-rate hike at their next meeting.

Bloomberg

BloombergThe imminent US government shutdown that threatens to delay the publication of key economic data will test policymakers’ and investors’ trust in a range of less-regarded third-party indicators. Yet when any policy missteps could be enough to tip the world’s largest economy into recession, the Fed’s emphasis on decisions as “data dependent” becomes more precarious.

Bloomberg

BloombergAmericans outside the wealthiest 20% of the country have run out of extra savings and now have less cash on hand than they did when the pandemic began, according to the latest Fed study of household finances.

Europe

Bloomberg

BloombergAnnual euro-area core inflation eased to 4.5% in September, marking the slowest pace in a year and supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

Bloomberg

BloombergGerman companies are thinking twice about hiring staff amid an increasingly uncertain economic environment, according to a study by the Ifo Institute. A gauge measuring firms’ willingness to take on employees fell to its lowest level since February 2021.

Bloomberg

BloombergInflation in Tokyo slowed more than expected in September, offering support for the Bank of Japan’s view that prices are set to cool further, and thus ultra-easy policy needs to stay in place. Behind the steady slowdown is the impact from government subsidies.

Bloomberg

BloombergRising debt payments are eroding the spending power of Indian households and threatening to choke off the funds that fuel the fastest-growing major economy. Net financial savings eased to 5.1% of gross domestic product in the fiscal year ended March, which one economist says is the lowest since 2007.

Bloomberg

BloombergLabor markets in Brazil and Mexico are extending their hot streaks into the third quarter in an unexpected performance that has underpinned the strength of Latin America’s two largest economies.

Bloomberg

BloombergMexico’s central bank kept interest rates unchanged for a fourth straight meeting and increased its inflation projections for next year, a sign that borrowing costs could stay higher for longer.

Bloomberg

BloombergVietnam’s economy accelerated for a second straight quarter on the back of stronger performances by its key growth drivers — manufacturing and exports. The numbers raise hopes that growth could further accelerate amid early signs of China’s recovery stabilizing.

World

Bloomberg

BloombergIn addition to Banxico, Ghana, Zimbabwe, Czech Republic, Guatemala and Colombia also left rates unchanged. Morocco held pat as the kingdom contends with the hefty cost of rebuilding after its strongest earthquake in over a century. Hungary cut and Thailand signaled it’s time to pause.

–With assistance from Maya Averbuch, Maria Eloisa Capurro, Max de Haldevang, Nguyen Dieu Tu Uyen, Yoshiaki Nohara, Reade Pickert, Jana Randow, Andrew Rosati, Anup Roy, Augusta Saraiva, Zoe Schneeweiss, Alex Tanzi, Alexander Weber and Erica Yokoyama.