Growth is losing momentum in many countries and won’t edge up until 2025, when real incomes recover from the inflation shock and central banks will have begun cutting borrowing costs, according to the organization.

Inflation eased in Europe, Brazil and Australia in recent readings but remains too high for central bankers’ comfort. Meantime, price pressures accelerated in Japan’s service sector, as well as in Zimbabwe, where officials recently adopted a new inflation metric.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

The Organization for Economic Cooperation and Development forecasts global gross domestic product to expand only 2.7% next year after an already weak 2.9% in 2023. The pace will only pick up to 3% in 2025, according to the assessment.

Europe

Euro-zone inflation cooled more than expected, putting the 2% target in sight as investors step up bets that the European Central Bank will cut interest rates sooner than officials suggest. ECB officials are adamant, however, that monetary policy must remain tight to ensure inflation makes it all the way back to 2%. Sweden’s economy fell into a recession in the third quarter as inventories declined and households cut back spending amid increasing borrowing costs and rising prices. Most forecasters now expect the largest Nordic country to see its output contract for two consecutive years, and the European Commission forecasts that Sweden will be the only member state that will see its output decline next year.

Bloomberg

BloombergAsia

Bloomberg

BloombergJapan’s business service prices increased by the most in over three decades when ignoring sales tax hikes over the years, throwing some doubt over the Bank of Japan’s assertions that inflation will decelerate in the short term. Such gains in prices put the central bank in a difficult position, as the country is still struggling to speed up wage growth.

Bloomberg

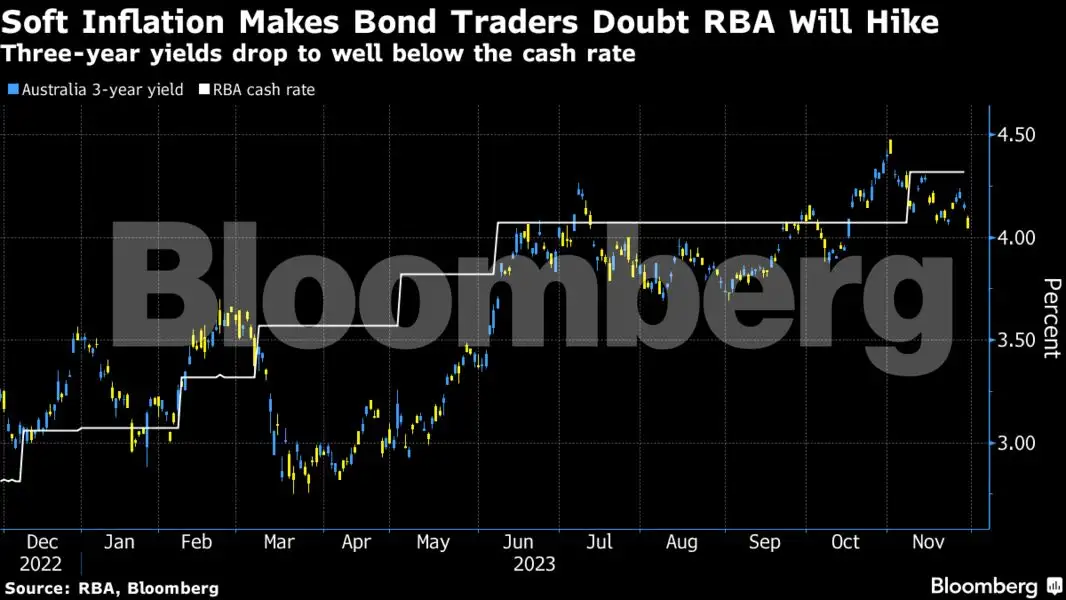

BloombergSoft Inflation Makes Bond Traders Doubt RBA Will Hike | Three-year yields drop to well below the cash rate

Australia’s monthly inflation gauge snapped two months of acceleration in October, bolstering the case for the Reserve Bank to resume pausing interest rates next week.

Emerging Markets

Bloomberg

BloombergBrazil Mid-Month Inflation Decelerates Toward Target | IPCA-15 CPI hits 4.84%, above central bank’s 3.25% target

Brazil’s annual inflation slowed roughly in line with expectations in early November, approaching the target range as central bankers forge ahead with plans for more monetary easing.

Bloomberg

BloombergZimbabwe’s annual inflation rate climbed for the first time since the recent adoption of a new price measure that reflects the widespread use of US dollars for transactions in the economy. A 2 US cents per kilowatt hour increase in power tariffs likely contributed.

iStock

iStockWorld Relies on West Africa for Much of Its Cocoa | Ivory Coast and Ghana are responsible for about 60% of output

There’s a climate crisis playing out across Ivory Coast and Ghana, the heavyweights of cocoa, with consequences for global food inflation and the cost-of-living squeeze. Too much rain is lowering output and delaying harvests, with the resulting shortfall catapulting wholesale prices in New York to their highest in 46 years.

Bloomberg

BloombergUS

US consumer spending, inflation and the labor market all cooled in recent weeks, adding to evidence that the economy is slowing. The figures are consistent with expectations that the economy will moderate in the fourth quarter following the strongest growth pace in nearly two years.