Those troubles risk spilling over to the rest of the continent, which for decades has relied on Germany to power growth. The country’s companies are also pessimistic, maintaining a prediction for no growth in 2023.

Inflation in the US and UK were both stronger than forecast in April, fueling bets in both regions that their central banks will keep raising interest rates.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

Bloomberg

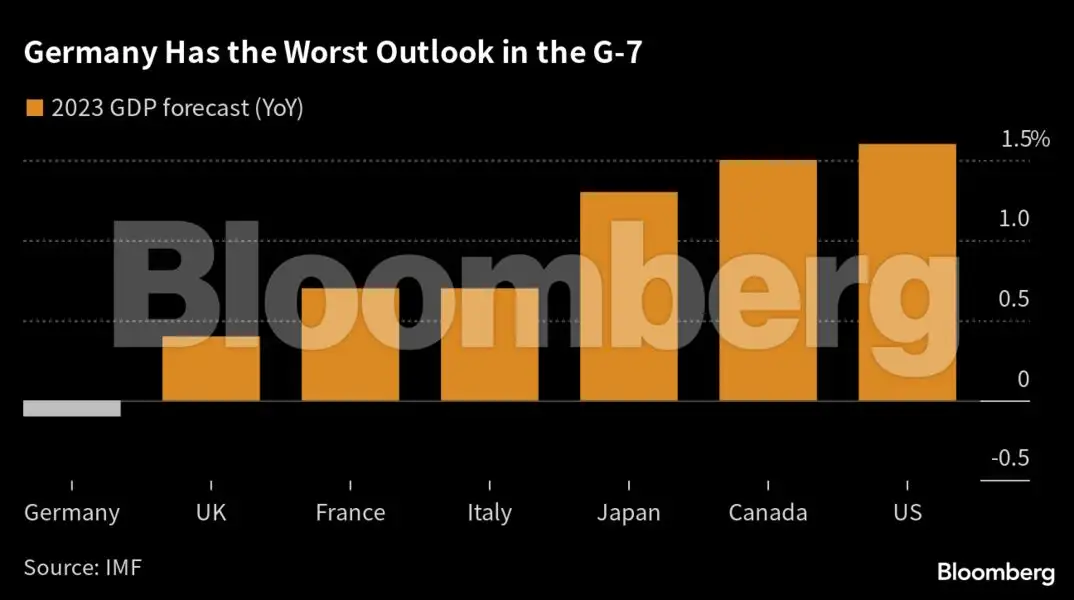

BloombergGermany has been Europe’s economic engine for decades, pulling the region through one crisis after another. But that resilience is breaking down, and it spells danger for the whole continent.

Bloomberg

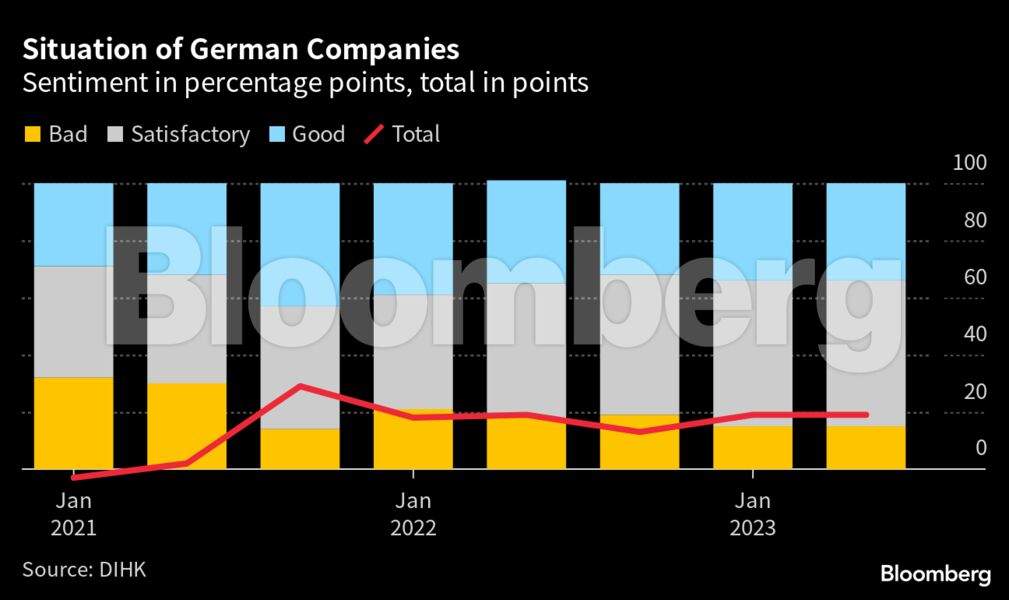

BloombergGerman companies aren’t seeing any evidence of a pickup taking hold in Europe’s biggest economy, according to a survey conducted by the DIHK business lobby. The group maintained a prediction for zero growth in 2023, an outlook that’s more pessimistic than the 0.2% expansion forecast by the European Commission.

Bloomberg

BloombergBritain’s inflation rate remained much stronger than expected, with the fastest increase in services and core prices in more than three decades fueling a flurry of bets on more Bank of England interest rate rises.

US

Bloomberg

BloombergInflation and consumer spending accelerated last month, highlighting steady price pressures and demand that will keep Federal Reserve policy makers tilted toward raising interest rates further. Combined with other Friday reports showing a surge in business equipment orders and a pickup in merchandise imports, the data indicate demand continues to power ahead.

Bloomberg

BloombergOn Friday, June 2, millions of Americans are due a total of $25 billion worth of Social Security payments. And more than anything else, that may prove a decisive element in forcing an end to the partisan standoff over raising the federal debt limit.

Asia

In 2021, a remote coal town in northeastern China was forced to undergo an unprecedented financial restructuring. Its struggles since are an ominous sign for President Xi Jinping as other heavily indebted municipalities look set to follow suit.

Bloomberg

BloombergSingapore is confident that a rebound in travel that’s boosting the services sector will help the island’s economy avoid a recession this year despite a darkening global outlook.

Emerging Markets

Bloomberg

BloombergBrazil’s central bank may have pushed up interest rates earlier and higher than others, but almost all of them — from the Federal Reserve to the Bank of England — have hiked to levels that are uncomfortably high for politicians. Calls for an end to rate hikes are mounting in capitols from Nairobi to Bogotá to New Delhi, threatening to undermine the autonomy that’s so critical to central banks’ fight against inflation.

Bloomberg

BloombergMexico’s economy expanded at a slightly slower pace in the first quarter than previously estimated, while still benefiting from strong remittance flows and record exports to the US. The economy has now posted six straight quarters of growth.

World

Israel delivered an unprecedented 10th consecutive interest-rate increase, New Zealand signaled this hike would likely be its last of the cycle, while Iceland and South Africa also tightened. Hungary cut the EU’s highest interest rate, while Vietnam and Belarus also eased. Ghana, Korea and Turkey stood pat.

Bloomberg

BloombergArgentina’s government is asking China for an expansion of its bilateral currency swap in yuan as it seeks to build up central bank reserves in a bid to contain another peso selloff with inflation already running above 100%, according to two people with direct knowledge. For China, it’s another opportunity — albeit risky lending more to a serial defaulter in Argentina — to expand the yuan’s global use in a bid to diminish dependence on the US dollar.