Policymakers in the US and UK hiked by a quarter point while those in Switzerland opted for a half point. All three signaled more increases could be in store.

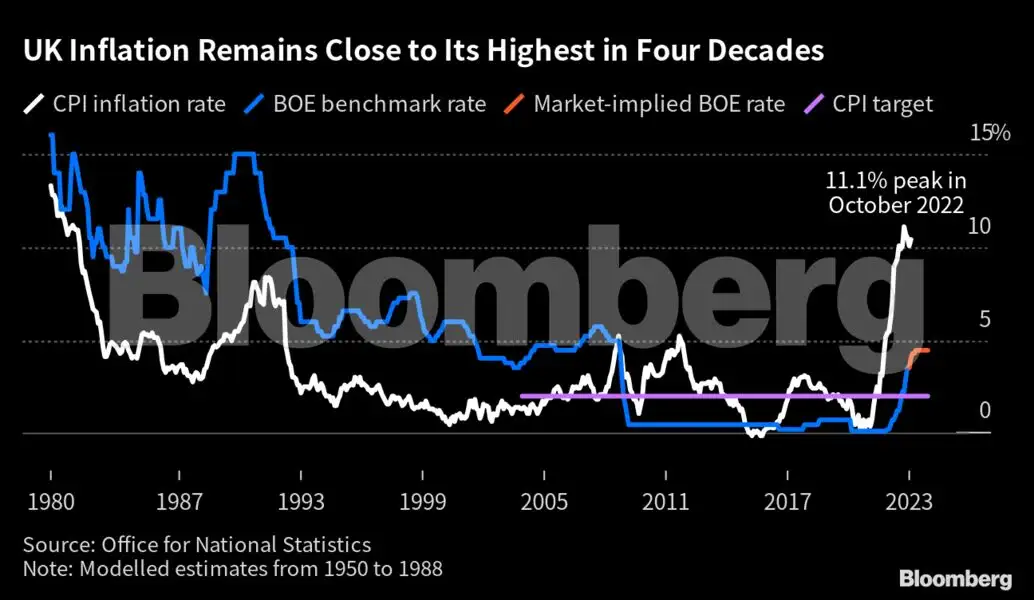

The UK was especially under pressure to tighten policy after a report earlier in the week showed consumer prices advanced 10.4% in February, surpassing all estimates in a Bloomberg survey and bucking economists’ expectation of a slowdown.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

Bloomberg

BloombergIceland’s central bank extended western Europe’s longest policy-tightening campaign with a full percentage-point increase, while the Philippine central bank shifted to a smaller hike. Norway, Taiwan and Nigeria also kept hiking. Officials in Turkey left rates unchanged, as did those in Brazil despite pressure from the government for looser policy.

Bloomberg

BloombergThe rush of layoffs that began late last year isn’t letting up, marking the worst start to a year since 2009, with nearly 52,000 jobs lost in one week in January alone. Since Oct. 1, executives across sectors have sacked almost half a million employees around the world, according to a comprehensive review of layoffs by Bloomberg News.

US

Bloomberg

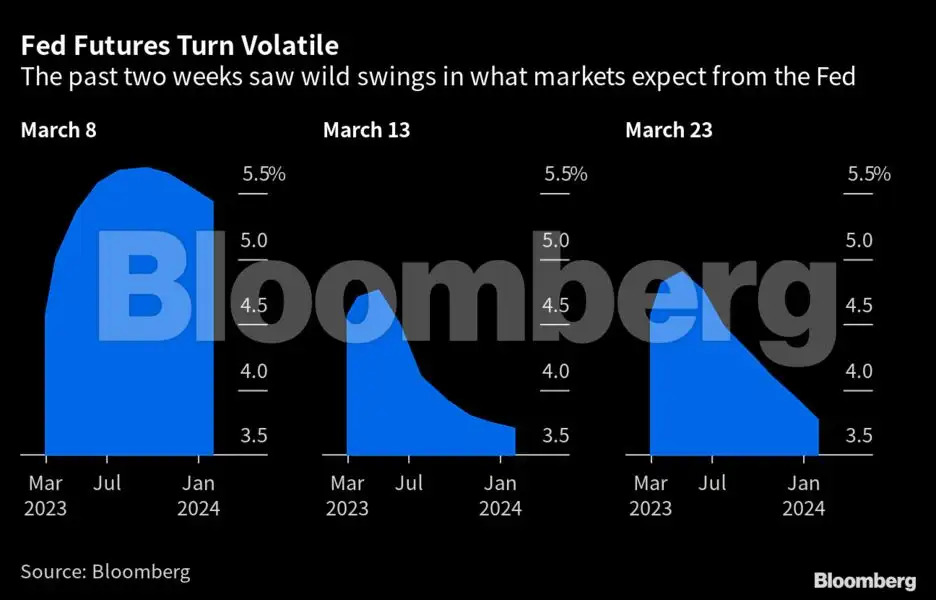

BloombergHistory remembers Paul Volcker as the slayer of inflation, and Ben Bernanke as the crisis firefighter. Jerome Powell is in danger of having to play both roles at once — or, what may be worse, to choose between them.

Bloomberg

BloombergPowell and his colleagues are expecting a sharp dropoff in economic activity through the rest of 2023 — at least, that’s the implication from new economic projections they published this week.

Bloomberg

BloombergRent increases for US single-family homes eased for a ninth straight month in January, pushing the annual rate to the lowest since the spring of 2021, according to CoreLogic. All 20 major metro areas tracked by CoreLogic posted single-digit annual rent increases, for the first time since late 2020.

Europe

Bloomberg

BloombergUK inflation accelerated unexpectedly in February for the first time in four months, keeping the BOE on course to raise interest rates. Food and non-alcoholic drink prices soared 18%, the fastest pace in 45 years, while core and services inflation also picked up.

Bloomberg

BloombergEuro-zone economic growth continued to pick up in March, driven exclusively by the service sector as concerns over energy supplies recede. The overall rate of expansion rose to the highest level in 10 months, according to business surveys by S&P Global.

Asia

Bloomberg

BloombergChina’s population is emerging from a massive virus wave unleashed by the rapid reversal of Covid Zero in mid-December. People are planning trips, dining out and returning to shopping malls. Still, residents of the world’s second-biggest economy aren’t splashing out like they used to.

Bloomberg

BloombergSouth Korea’s early trade data showed a deepening slump in exports as global demand for semiconductors remains weak and China’s reopening is yet to generate any boost.

Bloomberg

BloombergSingapore’s core inflation, a key barometer for the central bank, kept its 14-year-high pace in February as officials weigh fresh threats to the global economy amid the Federal Reserve’s resolve to stay the course on tightening.

Emerging Markets

Bloomberg

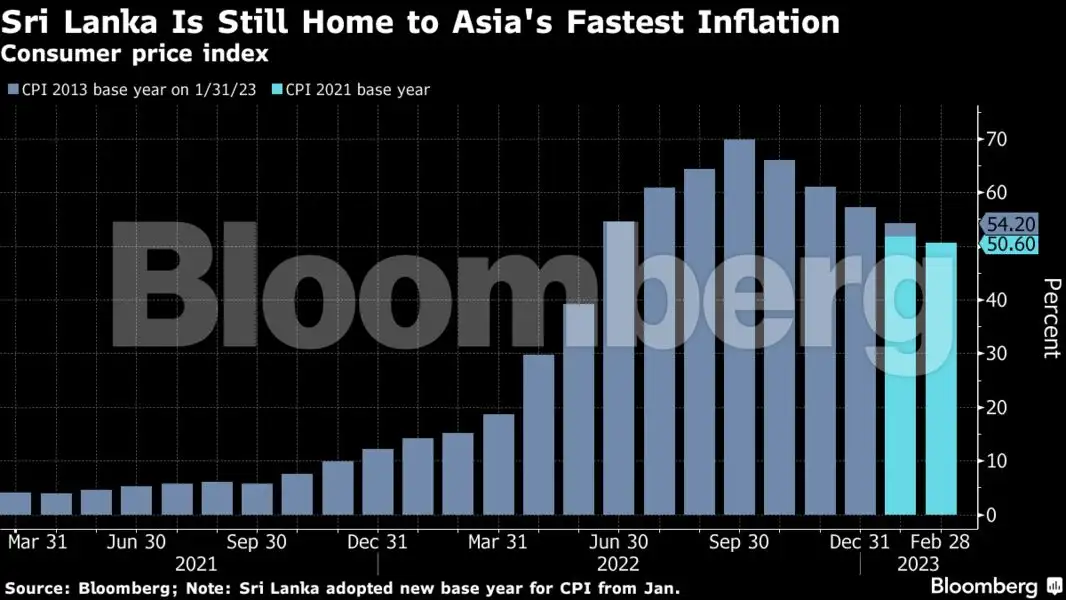

BloombergSri Lanka clinched a $3 billion bailout loan from the International Monetary Fund after six months of negotiations. Now comes the harder part: getting a debt restructuring agreement and seeing through monetary policy and tax reforms.